🎯Today's Global Economy Pulse

Updated 2h agoWhat's happening: US growth stalls to 1.4% annualized in Q4 2025 amid fiscal gridlock

The U.S. economy expanded at a 1.4% annualized rate in the fourth quarter of 2025, roughly half of analysts' expectations and the slowest pace since early 2024. The deceleration follows a 4.4% surge in the prior quarter and coincides with heightened legislative gridlock over fiscal policy and the debt ceiling.

News•Feb 17, 2026

Thai Banks’ Bad Loans Dip Slightly

Thai banks’ non‑performing loan ratio slipped to 2.84% at December, down from 2.94% in September. Bank lending fell 1.1% in Q4 2025, marking the sixth straight quarter of contraction, driven by tighter credit to SMEs and consumers. Household debt remains high at 86.8% of GDP, while overall economic growth slowed to 2.4% for the year. The Bank of Thailand signaled readiness to extend relaxed mortgage LTV rules to aid the property market.

By Bangkok Post – Investment (subset within Business)

Social•Feb 17, 2026

Foreign Investment Steady, US Stocks Slightly Lagging

Balanced take from Bob. While the headline may be different than my "get out" thesis. The meat says the same. Flows suggest marginally weaker dollar and relative underperformance of U.S. stocks vs ROW. Don't panic out...

By Andy Constan

Social•Feb 17, 2026

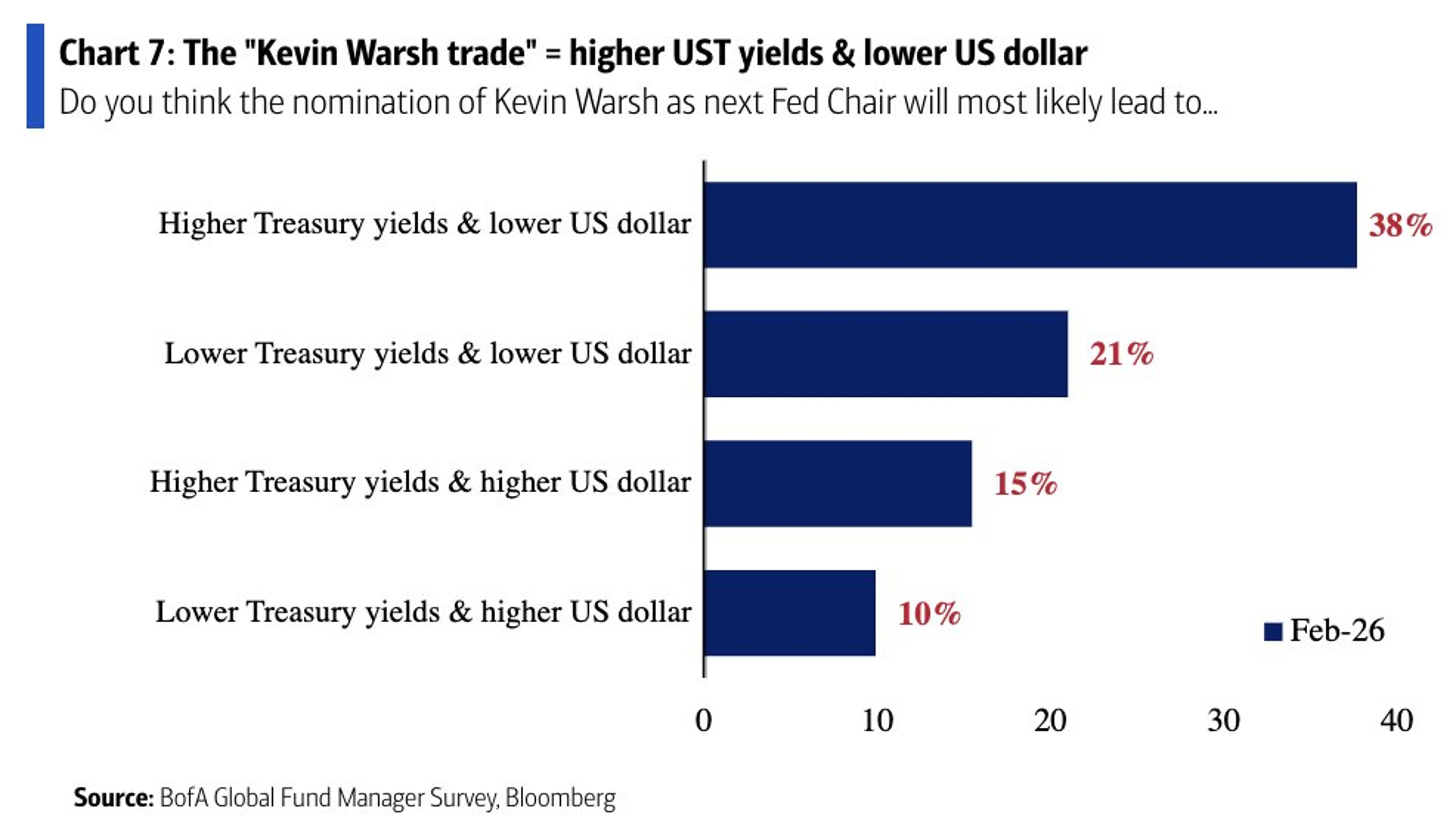

38% Expect Warsh Chair to Push Yields Higher, Dollar Lower

"38% of FMS investors believe that, all else equal, the nomination of Kevin Warsh as the next Fed Chair will likely lead to higher US Treasury yields and a lower US dollar." - BofA Global Fund Manager Survey https://t.co/5m0L3ZjRg1

By Sam Ro

News•Feb 17, 2026

Ongoing War Stifles Ukraine’s Grain Exports

Ukraine’s grain exports have slumped dramatically as Russian shelling intensifies attacks on Black Sea ports and energy infrastructure, cutting monthly shipments from 3.6 Mt to 2.5 Mt. Year‑to‑date volumes are 28.5% lower and export value down 18%, eroding billions of foreign‑currency earnings...

By Grain Central

News•Feb 17, 2026

Almi Marine Back in Newbuild Arena with Ultramax Pair

Greek dry‑bulk carrier Almi Marine has re‑entered the new‑building market after a four‑year hiatus, signing a contract for two next‑generation 64,000 dwt ultramax vessels with Nantong Cosco KHI Ship Engineering (NACKS). The ships, slated for delivery in the second quarter of...

By Splash 247

News•Feb 17, 2026

Philip R Lane: Bulgaria and the Euro

Philip R. Lane praised Bulgaria’s smooth euro cash changeover, noting that euros now represent 70 percent of cash in circulation as the dual‑lev/euro period ends on 31 January 2026. The speech highlighted Bulgaria’s new seat at the ECB Governing Council, giving the country a...

By BIS — Press Releases

News•Feb 17, 2026

Christine Lagarde: Preparing for Geoeconomic Fragmentation

European Central Bank President Christine Lagarde warned that deepening supply‑chain interdependence now poses a security risk, prompting Europe to shift toward strategic autonomy. She outlined three policy levers—diversification, indispensability and independence—to reduce reliance on distant suppliers, especially in electronics, chemicals...

By BIS — Press Releases

News•Feb 17, 2026

Indian Veg Oil Buyers Await Clarity on US Trade Deal

Indian vegetable‑oil importers are waiting for concrete details on the pending U.S.–India trade pact that could lower tariffs on U.S. soybean oil. The framework hints at a 0‑15% duty cut and a tariff‑rate quota of roughly 200,000‑250,000 tonnes, but exact...

By Fastmarkets – Insights

News•Feb 17, 2026

Will Indonesia’s US$762 Million Ramadan Stimulus Be a ‘Positive’ Boost for the Economy?

Indonesia has unveiled a US$762 million, 12.83 trillion‑rupiah stimulus aimed at bolstering Ramadan consumption. The package includes transport fare discounts of up to 30%, full‑fare ferry rides, and food parcels for low‑income families. Officials hope the measures will sustain mobility and purchasing...

By South China Morning Post – Asia

News•Feb 17, 2026

Trump’s New Arms Rules Will Hit Southeast Asia

President Trump issued an executive order establishing an “America First” arms export strategy that rewards allies who invest in self‑defense, occupy critical geography, or contribute to U.S. economic security. The rubric pushes the Philippines, Singapore and Cambodia toward priority status...

By Foreign Policy

News•Feb 17, 2026

BofA Survey Flags Dollar Bearish Bets at over a Decade High. Here's What It Means for Bitcoin

Bank of America’s February survey shows investor exposure to the U.S. dollar is at its most bearish since early 2012, marking a record underweight stance. Historically, a weaker dollar has acted as a bullish tailwind for bitcoin, but since early...

By CoinDesk

Social•Feb 17, 2026

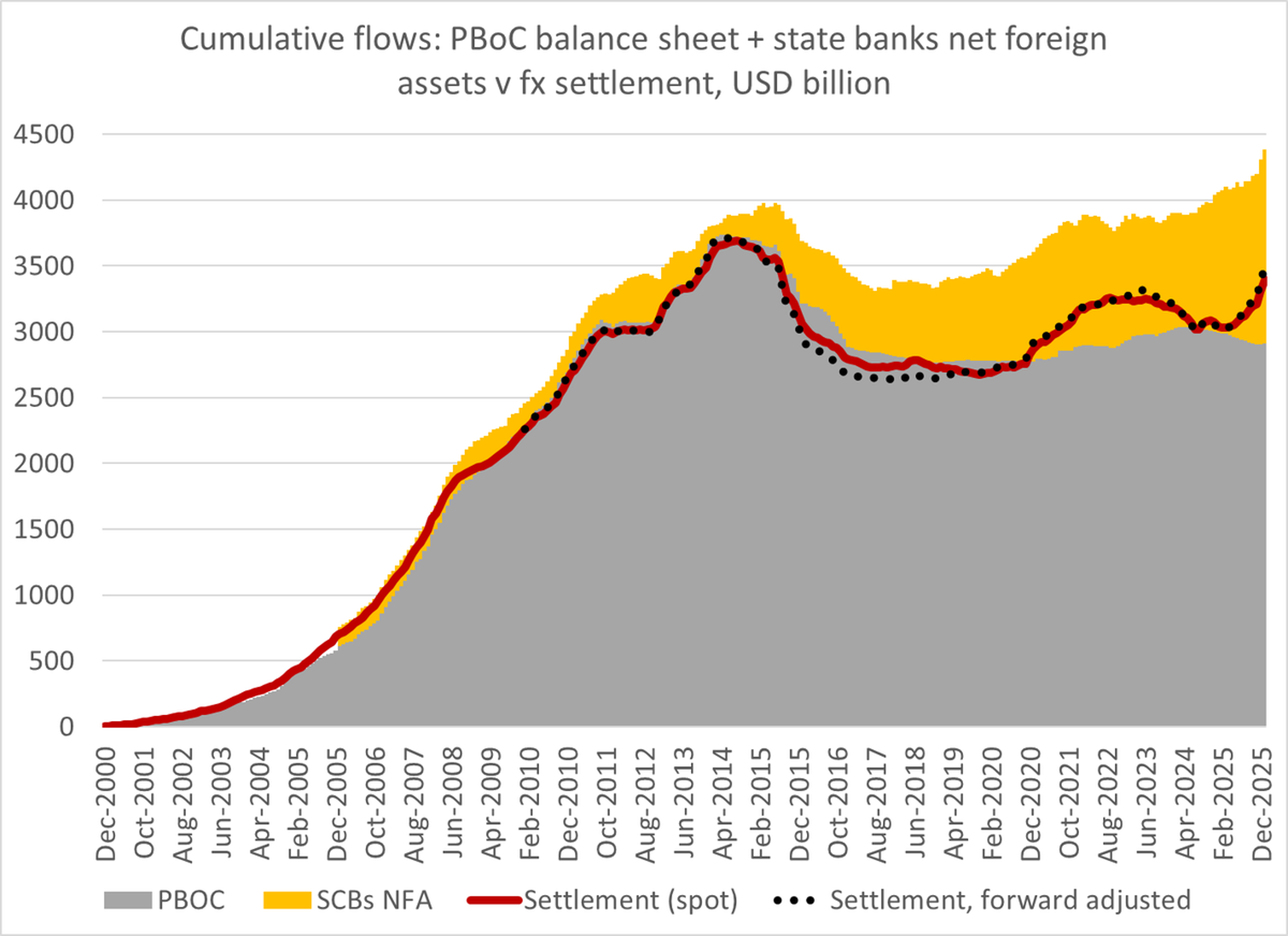

China Shifts Reserves to State Banks, Boosts Returns

Beijing really just outsourced its reserves to its state banks, and shifted out of US custodians High return on investment tho. Tons of folks swallow the fall in reported Treasury holdings hook, line and sinker https://t.co/MKw3EJlSuR

By Brad Setser

News•Feb 17, 2026

Walmart’s Sam’s Club Cracks China Market Formula Even as Foreign Retailers Shut Shop

Walmart‑owned Sam’s Club is expanding in China by deepening localisation, offering China‑specific products such as ginseng, copper‑gourd ornaments, and right‑sized private‑label packs. The chain opened ten new stores in 2025, bringing its footprint to 63 locations and shifting focus to...

By South China Morning Post — Business

News•Feb 17, 2026

JICA Mulls Resuming ODA Loans to Pakistan After Decadelong Hiatus

Japan International Cooperation Agency (JICA) is weighing a restart of official development assistance (ODA) loans to Pakistan after a ten‑year hiatus. The move reflects improving macro‑economic indicators, including steadier growth and reduced fiscal stress. JICA’s decision will be coordinated with...

By Nikkei Asia – Economy

Social•Feb 17, 2026

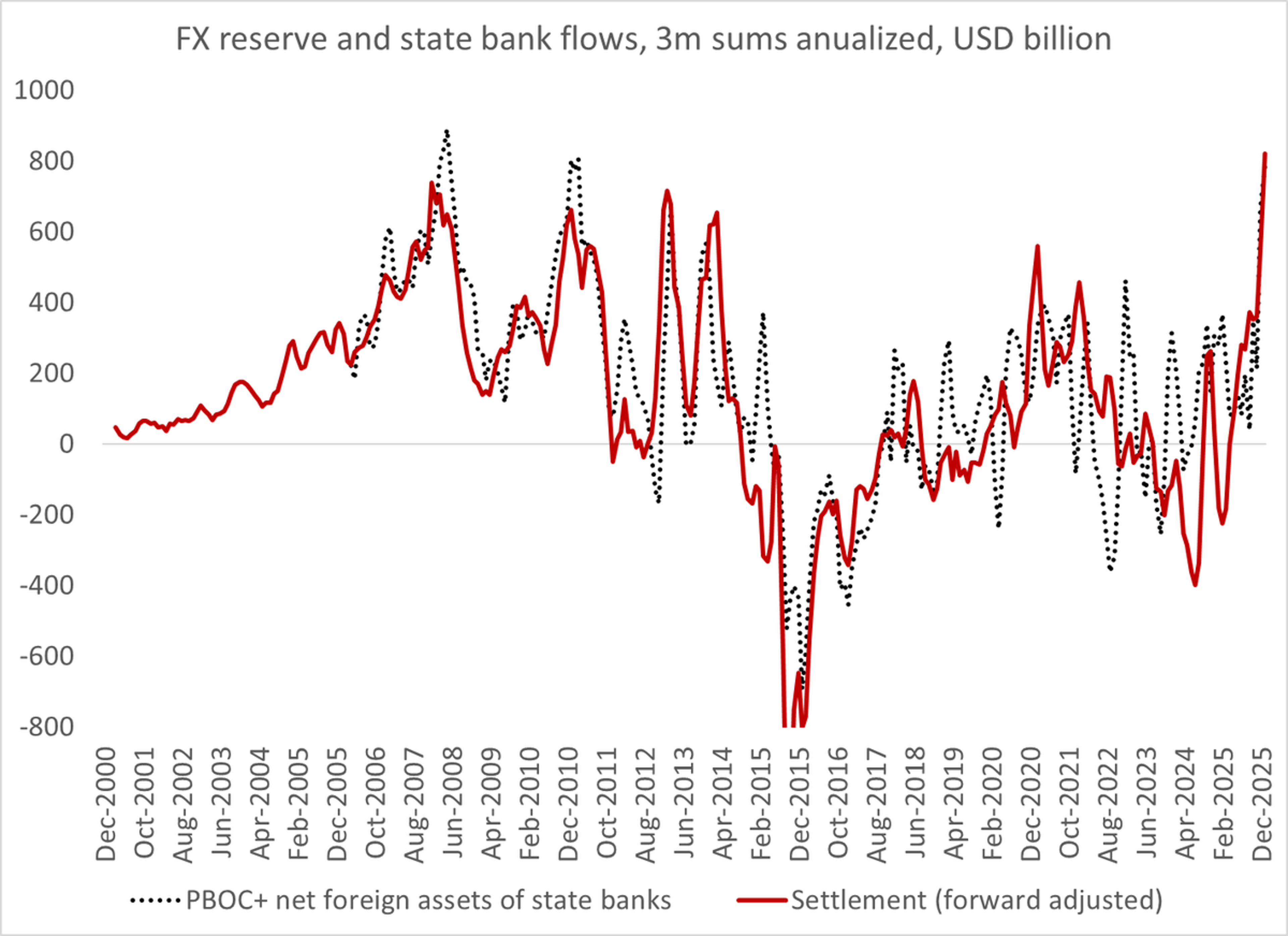

China's Hidden Bank Interventions Hit $800B Annual Record

The annualized measures of Chinese intervention over the last 3ms that capture backdoor intervention by the state banks are at all time highs in dollar terms -- over $200b a quarter/ over $800b annualized https://t.co/7vlh3tf4CX

By Brad Setser

Social•Feb 17, 2026

Sinokor's 120‑tanker Dominance Spikes Freight, Rattles Oil Markets

South Korean Sinokor now controls 120 oil tankers When one buyer controls the tradable fleet, charterers panic-book, freight spikes, and shocks bleeds into physical oil prices and spreads. https://t.co/Z2GsMyfbtl #oil #tankers #VLCC #shipping #freight #supplychain #sanctions #geopolitics #markets #energy

By Art Berman Blog

Blog•Feb 17, 2026

The Housing Inflection Point

The episode examines the current U.S. housing market inflection point, highlighting softened builder confidence, persistently tight resale inventory, and the potential impact of a credible rate‑cut cycle on margins and incentives. It discusses policy initiatives aimed at streamlining permitting and...

By The Lead‑Lag Report – Blog

News•Feb 17, 2026

Real vs Technical Inflation: Which Should Guide Monetary Policy in Nigeria?

Nigeria’s National Bureau of Statistics rebased its Consumer Price Index to a 2024 base year, pulling headline inflation down from 24.48% in January 2025 to 15.15% by December 2025. Critics argue the technical decline masks persistent real inflation, with food prices still...

By BusinessDay (Nigeria)

News•Feb 17, 2026

What Nigeria’s Economy Optimises for — Without Admitting It

Nigeria’s economy is structured to reward navigating bureaucratic friction rather than boosting productivity, efficiency, or innovation. World Bank data shows firms spend over 40% more time on regulations than the regional average, creating a thriving informal ecosystem of brokers, fixers...

By BusinessDay (Nigeria)

News•Feb 17, 2026

India's Textile and Apparel Exports Down by 3.75% in January, Outlook Improves Now with India US Interim Deal

India's textile and apparel exports fell 3.75% in January 2026, dropping to $3.27 billion from $3.40 billion a year earlier, primarily due to U.S. tariffs that remained until February 7. Cotton yarn, fabrics and handloom products declined over 4%, while carpet and jute...

By The Economic Times (India) – Economy

News•Feb 17, 2026

Stocks to Buy in 2026 for Long Term: IGL, Siemens Energy Among 5 Stocks that Could Give 10-40% Return

Brokerage houses have highlighted five Indian equities that could deliver 10‑40% returns by 2026. Motilal Oswal sees Indraprastha Gas (IGL) rising 41% to ₹235 and Siemens Energy up 31% to ₹3,600. Citi maintains a Buy on Lupin with a 15% upside,...

By The Economic Times (India) – RSS hub

News•Feb 17, 2026

US Dollar Positioning Hits Record Underweight in Bank of America Survey

Bank of America’s FX sentiment survey shows net US dollar exposure at a record underweight, the most negative level since the survey began in January 2012. Short positions have surged to extreme levels, surpassing the lows recorded in April 2023....

By ForexLive — Feed

News•Feb 17, 2026

Market Quote of the Day by Sir John Templeton | “The Time of Maximum Pessimism Is the Best Time to...

Sir John Templeton’s adage that the best buying opportunities arise at peak pessimism is highlighted as a timeless investing principle. The article notes that widespread fear compresses valuations, allowing strong companies to be bought at discounts, while emphasizing the need...

By The Economic Times (India) – RSS hub

Social•Feb 17, 2026

Iranian Rial Plummets, Becomes World's Second Worst Currency

On this week's Hanke's #CurrencyWatchlist, the Iranian rial ranks as the WORLD'S 2ND WORST currency. The rial has depreciated by 44% against the USD over the past year. RIAL = THE GREAT DESTABILIZER. https://t.co/06OiclsaSq

By Steve Hanke

News•Feb 17, 2026

BOJ Likely to Raise Rates 25bp April, Former Board Member Says. Gradual Move Toward 1.25%

Former Bank of Japan board member Seiji Adachi says the central bank is most likely to raise rates in April rather than March, waiting for clearer wage and inflation data. The BOJ’s December hike to 0.75% marked the first move...

By ForexLive — Feed

News•Feb 17, 2026

China Hits Renewable Milestone, But Coal Isn’t Going Anywhere

China’s operating power capacity from non‑fossil sources surpassed fossil‑fuel capacity for the first time, reaching 52 % of the total in February 2026. The achievement reflects a decade of aggressive solar and wind deployment, backed by the world’s largest clean‑energy supply chain....

By OilPrice.com – Main

News•Feb 16, 2026

ICYMI: China to Remove Tariffs on Imports From 53 African Nations From May 1

China will eliminate tariffs on imports from 53 African nations starting May 1, 2026, expanding the preferential regime beyond the continent’s least‑developed economies. The zero‑tariff policy applies to every African country that maintains diplomatic ties with Beijing and is paired with a...

By ForexLive — Feed

News•Feb 16, 2026

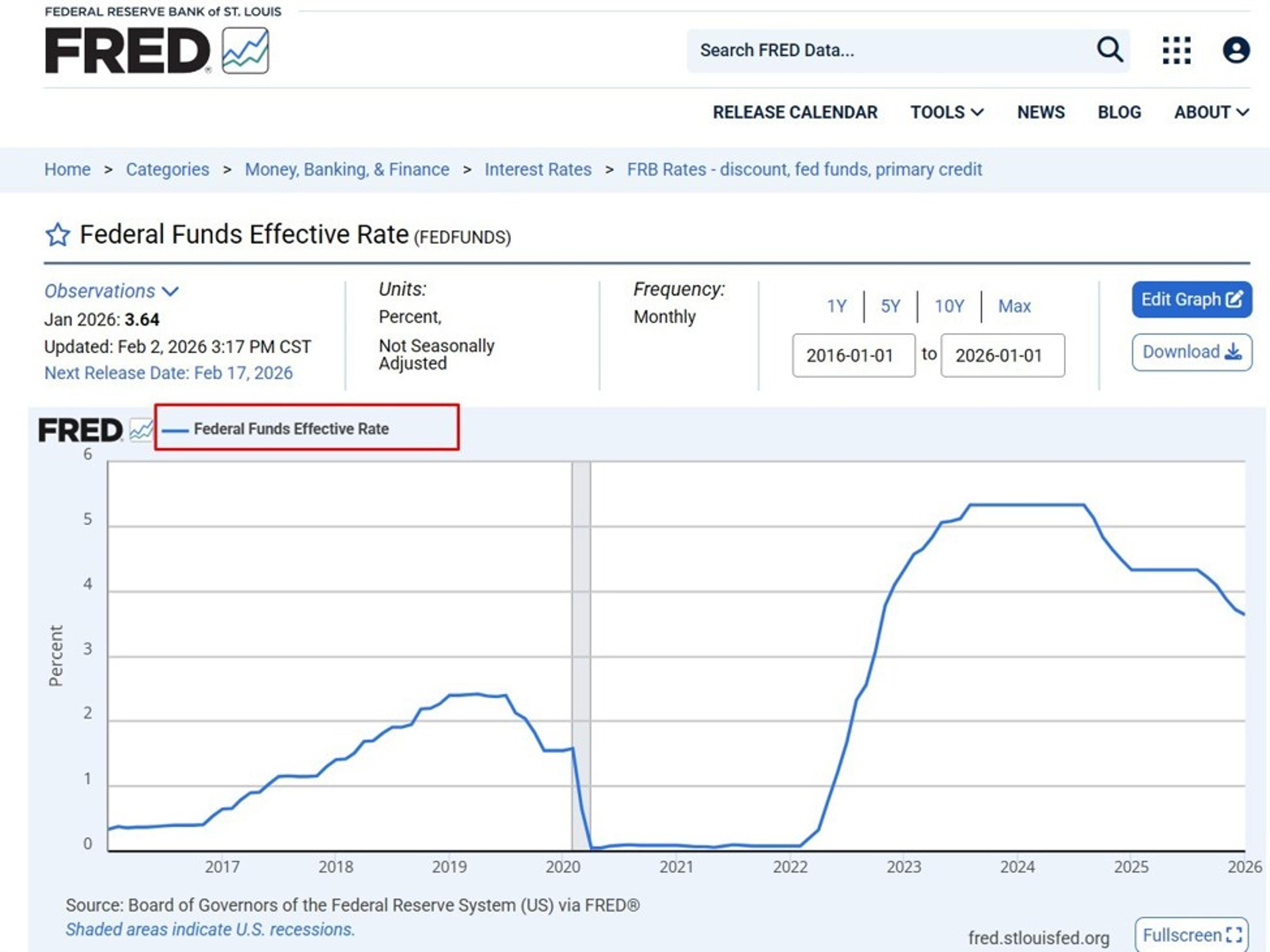

Soft Landing Looks More Plausible, but the Fed Isn’t Ready to Call It Done.

U.S. macro data are aligning for a potential soft landing, with core CPI easing to 2.5% year‑over‑year and unemployment slipping to 4.3% in January. While inflation is moving toward the Federal Reserve’s 2% goal, the Fed’s preferred gauge remains near...

By ForexLive — Feed

News•Feb 16, 2026

Asia Stocks Seen Muted on Holiday Trade, Oil Gains: Markets Wrap

Asian equities opened muted on Tuesday as holiday‑thin trading reduced volumes across the region. Futures indicated a slight rise for Australia and a modest dip for Japan, while the Euro Stoxx 600 remained flat. The yen slipped to around 153 per...

By Bloomberg – Markets

News•Feb 16, 2026

Suriname's Oil Boom Faces Economic Headwinds Despite Major Discovery

Suriname’s GranMorgu project, a $10.5 billion offshore development by TotalEnergies and APA, targets 760 million barrels and is projected to generate $26 billion in revenue. The field is slated for commissioning in 2028, roughly twice the timeline Guyana achieved for its Stabroek Block....

By OilPrice.com – Main

/file/dailymaverick/wp-content/uploads/2024/10/ISS-DRC-peace-mission.jpg)

News•Feb 16, 2026

CYRIL’S ARMY: Ramaphosa’s Decision to Deploy the SANDF Is Deeply Flawed. Here’s Why

President Cyril Ramaphosa announced the withdrawal of roughly 700 South African soldiers from the MONUSCO mission in the Democratic Republic of Congo, ending a 27‑year peace‑keeping presence. He simultaneously ordered the South African National Defence Force to support the police...

By Daily Maverick – Business

/file/dailymaverick/wp-content/uploads/2025/08/GettyImages-1952436000.jpg)

News•Feb 16, 2026

MONETARY POLICY: Sarb Proposes Major Reform — Ditching Prime Lending Rate for Repo Rate

The South African Reserve Bank (Sarb) has released a consultation paper proposing to scrap the prime lending rate (PLR) and use the repo rate, known as the SARB policy rate (SPR), as the benchmark for loan pricing. The PLR currently...

By Daily Maverick – Business

News•Feb 16, 2026

Russia Rattled by America’s Nuclear Move in Armenia

The United States and Armenia signed a nuclear cooperation agreement on February 9, committing to American modular reactor technology for Armenia's next plant. Moscow responded with a public backlash, accusing the U.S. of untested designs and offering lucrative financial and infrastructure...

By OilPrice.com – Main

News•Feb 16, 2026

Unemployment Rate up a Tad to 5% in January, Higher Rise for Females

India’s unemployment rate ticked up to 5 % in January, a modest rise from 4.8 % in December. The increase was driven primarily by a sharper jump in female joblessness, which reached 5.6 % versus 4.8 % for men. Urban unemployment climbed to 7 %...

By The Economic Times (India) – Economy

News•Feb 16, 2026

Govt Plans ‘Champion CPSEs’ for Viksit Bharat by 2047, NITI Aayog Roadmap Soon

India is preparing a roadmap to create ‘champion’ central public sector enterprises (CPSEs) that will drive economic growth and technological advancement toward a developed nation status by 2047. The plan, drafted by NITI Aayog in coordination with the finance ministry,...

By Economic Times — Markets

News•Feb 16, 2026

Ireland Leads Charge Against Biggest EU Economies Forming Elite Club

Ireland’s finance minister warned that the newly‑formed “E6” club of Europe’s six biggest economies could sideline smaller states as it pushes ahead on financial‑market integration, euro promotion and defence spending. The E6 – Germany, France, Italy, Spain, the Netherlands and...

By Politico Europe – All News

News•Feb 16, 2026

Hungary Seeks Croatian Help As Russian Oil Flows Via Ukraine Halted

Hungary and Slovakia have formally asked Croatia to permit Russian crude to flow through the Adria pipeline after the Ukrainian segment of the Druzhba pipeline was shut down following Russian strikes. The two countries cite an EU sanctions exemption that...

By OilPrice.com – Main

Social•Feb 16, 2026

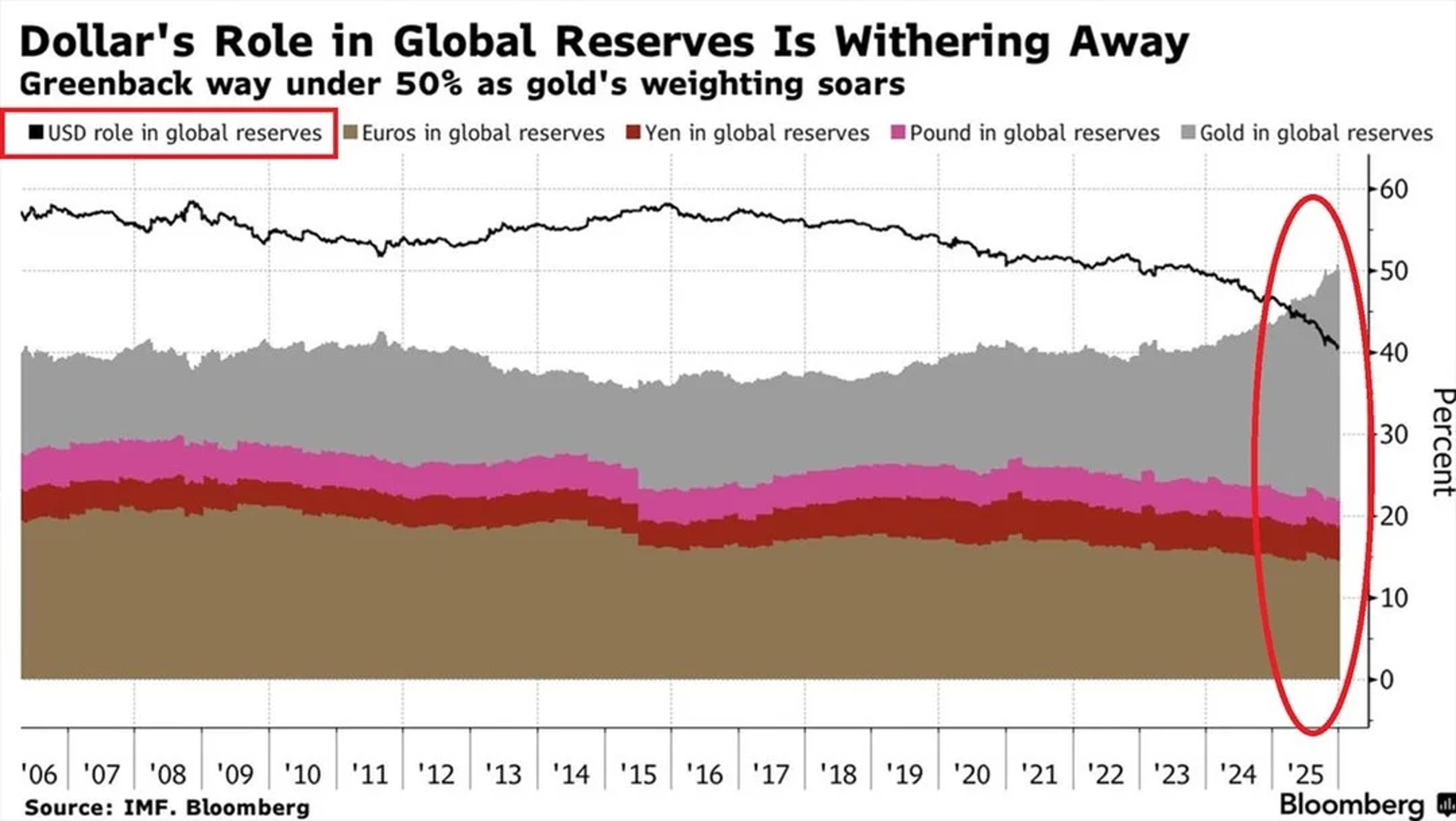

Gold Overtakes Major Currencies as Dollar Reserve Share Plummets

⚠️The US Dollar's role in global reserves is FALLING: USD share in global currency reserves dropped to ~40%, the lowest in at least 25 years. This is down from ~58% a decade ago. During the same period, gold’s share has risen from 16%...

By Global Markets Investor (newsletter author)

Social•Feb 16, 2026

2025 Profitability Snapshot: Sector Returns & Excess Gains

In my sixth data update, I look at business profitability in 2025, across sectors, industries and regions, scaled to revenues (profit margins) and to invested capital (accounting returns). I use the latter to compute and compare excess returns. https://t.co/L3PDmph4VA

By Aswath Damodaran

News•Feb 16, 2026

Economy Has 'Left ICU', Says Finance Chief

Thailand’s economy posted a surprising 2.5% GDP expansion in Q4 2025, outpacing the finance ministry’s 1.8% forecast and the NESDC’s 0.3% estimate. The stronger performance lifted full‑year 2025 growth to 2.4%, above the 2% target, and the finance chief now aims...

By Bangkok Post – Investment (subset within Business)

Social•Feb 16, 2026

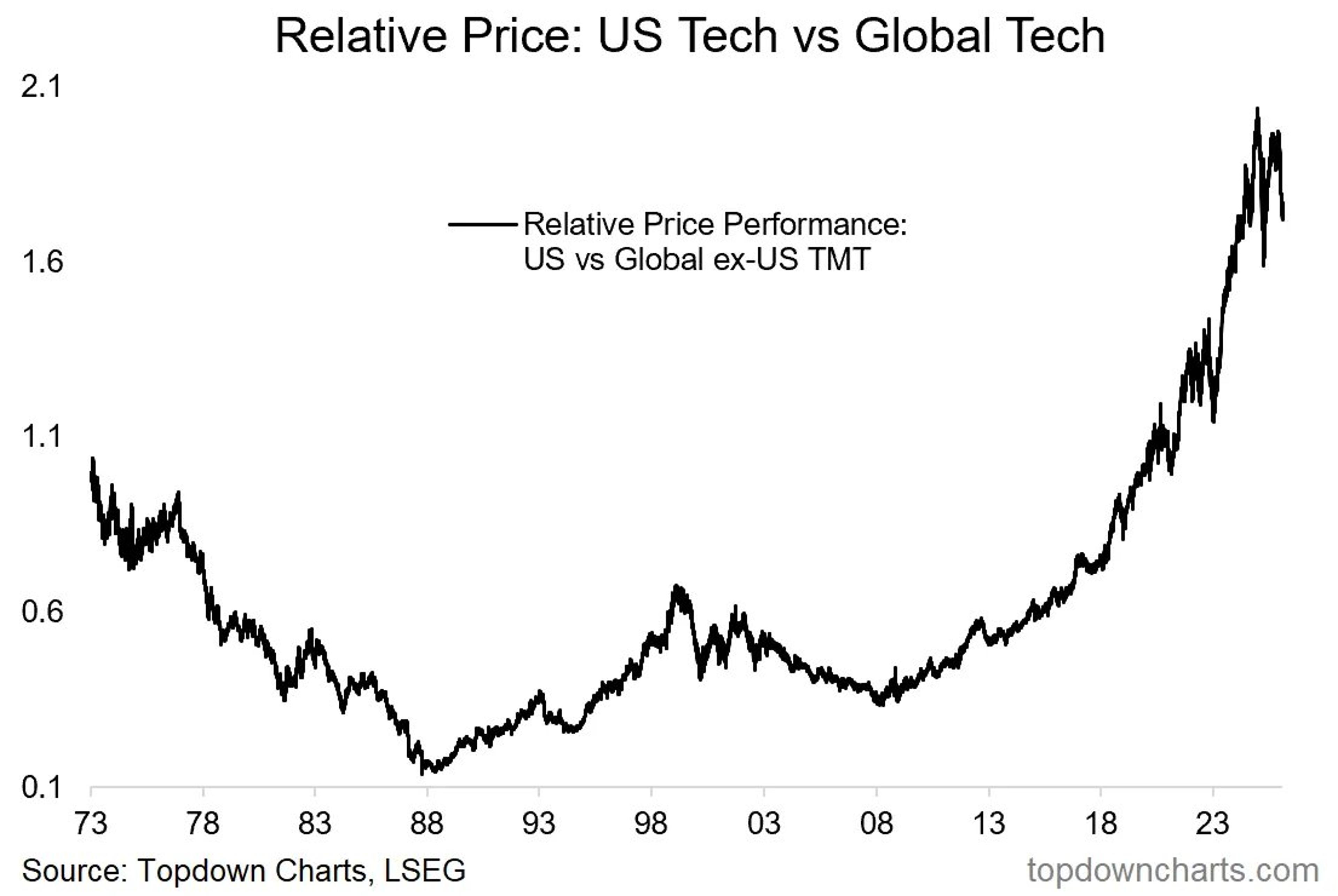

US Tech Dominance Fades as Global Rotation Shifts

This chart captures the 2 most important themes in the Stockmarket right now. 1. Global vs US rotation 2. Top in tech stocks For the past 17-years US Tech stocks have dominated global markets, but that is starting to change... https://t.co/6DhUXusR6C

By Callum Thomas

Social•Feb 16, 2026

Investors Shift From S&P 500 to Alternatives, Gains Accelerate

Rotation away from S&P500 (flat on the year) into other assets like foreign stocks, US value, etc up 10-15% seems to be accelerating...

By Meb Faber

News•Feb 16, 2026

State Firms Told to Avoid Borrowing when Investing

Thailand's finance ministry has instructed state‑owned enterprises to fund new investments primarily from internal revenues, limiting reliance on borrowing that is classified as public debt. The policy follows a backdrop where public debt stands at 66.1% of GDP, close to...

By Bangkok Post – Investment (subset within Business)

Social•Feb 16, 2026

Venezuelan Bolivar Plummets 87%, Becomes World’s Worst Currency

On this week's Hanke's #CurrencyWatchlist, the Venezuelan bolivar ranks as the WORLD'S WORST currency. The bolivar has depreciated by over 87% against the USD in the past year. IT’S TIME TO DUMP THE BOLIVAR AND REPLACE IT WITH THE US DOLLAR. https://t.co/dHtPzNew81

By Steve Hanke

Social•Feb 16, 2026

Trump's Presidency Keeps Oil Prices Higher, OPEC+ Cuts Production

The best—only?—argument that Trump is bearish for oil prices is that OPEC+ wouldn't have hiked crude production as aggressively last year in a world in which Harris was sitting in the White House.

By Rory Johnston

News•Feb 16, 2026

AUD/USD Flat Amid US Dollar Strength, RBA Minutes Eyed

The Australian dollar held near 0.7072 against the U.S. dollar on Monday as a firmer greenback limited upside. The pair slipped from three‑year highs of 0.7147 after U.S. CPI showed inflation easing to 2.4% and unemployment edging down to 4.3%,...

By FXStreet — News

Social•Feb 16, 2026

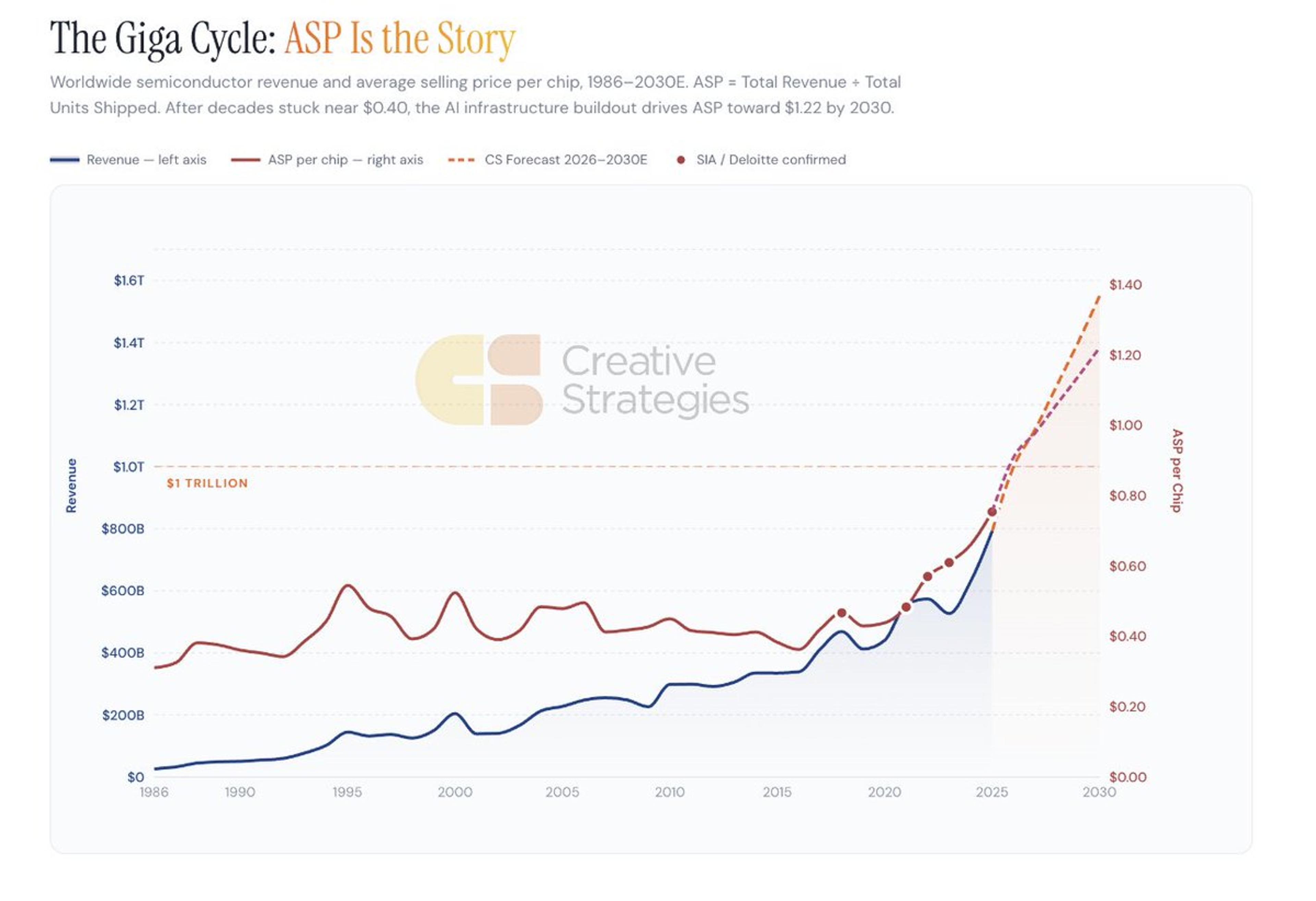

Semiconductors Shift From Volume to ASP‑Driven Value

Modeled a range of scenarios, but showing mid-bull to make a key point. For the first time in semiconductor industry history, value creation is primarily an ASP story not a volume story. https://t.co/IoHFb65Gmq

By Ben Bajarin

News•Feb 16, 2026

India’s Rooftop Solar Goals Slowed by Loan Delays

India’s PM Surya Ghar rooftop solar scheme, launched in February 2024 with up to 40% subsidies, has installed only 2.36 million panels, far short of the 4 million target for March. Loan approvals are delayed or rejected for roughly 60% of applications, and many...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 16, 2026

Dangote Drives Nigeria’s Domestic Fuel Supply Above 57% as Imports Retreat

Nigeria’s Dangote Refinery reached full 650,000 bpd capacity in January 2026, processing a record 40.1 million litres of crude per day and supplying 57 % of the nation’s fuel. Domestic output now provides 62 % of premium motor spirit, overtaking imports for the first...

By OilPrice.com – Main

News•Feb 16, 2026

The Promise and Peril of Trump’s Board of Peace

President Donald Trump’s newly created Board of Peace will hold its inaugural meeting on Feb. 19, promising to release $5 billion in humanitarian and reconstruction aid for Gaza. The board, established under UN Security Council Resolution 2803, will operate as a donor‑led, international...

By Atlantic Council – All Content