🎯Today's Global Economy Pulse

Updated 2h agoWhat's happening: US growth stalls to 1.4% annualized in Q4 2025 amid fiscal gridlock

The U.S. economy expanded at a 1.4% annualized rate in the fourth quarter of 2025, roughly half of analysts' expectations and the slowest pace since early 2024. The deceleration follows a 4.4% surge in the prior quarter and coincides with heightened legislative gridlock over fiscal policy and the debt ceiling.

News•Feb 17, 2026

Ukrainian Defense Tech Companies Must Prepare for Export Opportunities

Ukraine granted its first defense export permits in February 2026, allowing domestic defense‑tech firms to sell abroad as the government prepares ten export centers across Europe. The sector, proven in combat with rapid development cycles, now faces the need to align with complex international export controls such as ITAR, EAR and EU dual‑use regulations. Companies must build compliance programs, supply‑chain transparency and institutional maturity to capture market opportunities and avoid regulatory pitfalls. Early investor focus on governance will differentiate firms and drive valuation.

By Atlantic Council – All Content

News•Feb 17, 2026

Trump Crackdown Drives 80% Plunge in Immigrant Employment, Reshaping Labor Market, Goldman Says

Goldman Sachs reports an 80% plunge in net immigration to the United States, falling from roughly one million annually in the 2010s to an estimated 200,000 arrivals in 2026. The decline is attributed to heightened deportations, a visa processing pause...

By Fortune – Markets

News•Feb 17, 2026

Analysis-US Envoys Juggle Two Crisis Talks, Raising Questions About Prospects for Success

U.S. special envoy Steve Witkoff and Jared Kushner held back‑to‑back talks in Geneva on Iran’s nuclear program and the Russia‑Ukraine war, a move that has puzzled diplomatic circles. The two‑hour Iran session, mediated by Oman, yielded modest progress but no...

By Al-Monitor – All

News•Feb 17, 2026

Quantum Computing Can Solve the Hardest Port Scheduling Problems

Quantum computing is emerging as a complementary tool for the most complex optimization challenges in maritime logistics. While classical platforms handle data and routine analytics, hybrid workflows off‑load dense, constraint‑heavy subproblems—such as berth allocation, crane sequencing, and drayage routing—to quantum...

By The Maritime Executive

News•Feb 17, 2026

A Bad Ukraine Peace Could Ignite New Wars in Russia’s Former Empire

U.S.‑brokered peace talks aim to end the Ukraine war by early summer, but analysts warn that a deal lacking robust security guarantees could free Russian forces to pursue expansion in the South Caucasus and Central Asia. Recent recordings and leaked...

By Atlantic Council – All Content

News•Feb 17, 2026

US Treasuries Slip as Rally Loses Steam on Steady Labor Data

U.S. Treasury yields edged higher on Tuesday, halting a recent rally as steady private‑payroll data reinforced expectations of a still‑robust labor market. The benchmark 10‑year yield closed at 4.06%, while the two‑year rose to 3.43%, reflecting market pricing of two...

By Asset Securitization Report

News•Feb 17, 2026

Qatar PM Arrives in Venezuela on First Trip Since Maduro’s Ouster: What to Know

Qatari Prime Minister and Foreign Minister Sheikh Mohammed bin Abdulrahman Al Thani arrived in Caracas, marking his first visit since the U.S. raid that ousted President Nicolás Maduro. The trip focuses on strengthening bilateral ties, including agriculture and investment, while Qatar positions...

By Al-Monitor – All

News•Feb 17, 2026

Why Coal May Outlast Natural Gas in the Electricity Market

The article argues that as renewables displace fossil generation, coal may outlast natural gas in U.S. electricity markets. Coal’s proximity to mines allows on‑site storage and reduces logistical complexity compared with gas pipelines. Winter reliability concerns for gas, such as...

By OilPrice.com – Main

Blog•Feb 17, 2026

Coffee Break: Armed Madhouse – Requiem for Nuclear Arms Control

With the New START treaty lapsing on Feb. 5, 2026, the United States and Russia lost the last binding caps on their strategic nuclear forces. The article warns that the primary instability stems not from overt arsenal growth but from three...

By Naked Capitalism

/file/attachments/orphans/Image4_240865.jpg)

News•Feb 17, 2026

WATTS UP: Inside the Paarl Solar Panel Plant Trading on Local Agility to Challenge Imported Panels

Ener‑G‑Africa inaugurated a solar‑panel assembly plant in Paarl, Western Cape, with an annual capacity of about 150 MW, capable of producing panels from 5 W to 620 W. The facility differentiates itself through a locally trained, all‑female workforce and a focus on the...

By Daily Maverick – Business

News•Feb 17, 2026

Iciest Baltic in 15 Years Threatens to Cut Russian Exports

Russia’s Baltic Sea ports are encased in the thickest ice in 15 years, forcing non‑ice‑class vessels to wait for ice‑breaker escorts. The ice surge has already cut oil exports from Primorsk by roughly one‑third, and waiting times for convoys have...

By gCaptain

News•Feb 17, 2026

France Releases Oil Tanker GRINCH After ‘Several Million Euro’ Penalty for Sanctions Evasion

French authorities released the oil tanker GRINCH after its owner paid a multi‑million‑euro penalty for sanctions evasion. The vessel, seized in the Alboran Sea in January, was suspected of operating under a false Comoros flag as part of Russia’s shadow...

By gCaptain

News•Feb 17, 2026

Consumer Pressures General Mills Amid Price Cuts

General Mills is feeling the squeeze as consumers trade down to cheaper private‑label cereals and pet foods. Recent price cuts lifted unit volumes, but the gains were insufficient to offset margin erosion. The shift reflects broader post‑pandemic tightening of discretionary...

By Bloomberg – Markets

Social•Feb 17, 2026

Iran Shuts Hormuz for Drills Amid US Nuclear Talks

"Iran says it temporarily closed the Strait of Hormuz as it held more indirect talks with the US." https://t.co/Ek0ckZEw6N Iran announced the temporary closure of the Strait of Hormuzon Tuesday for live fire drills in a rare show of force as its...

By John Spencer

News•Feb 17, 2026

PPR 13: The Quiet IMO Meeting That Could Change How Ships Are Actually Run

The IMO Pollution Prevention and Response Sub‑Committee (PPR 13) in London signaled a shift from static emissions limits to performance‑based metrics that evaluate how ships are operated throughout their lifecycle. Discussions highlighted tighter scrutiny of biofouling, Arctic black‑carbon emissions, scrubber wash‑water...

By gCaptain

News•Feb 17, 2026

Warning Shots Off Yemen Underscore Ongoing Gulf of Aden Security Risks

A merchant vessel near Aden, Yemen, encountered armed skiffs that fired warning shots, later identified as a local militia rather than Houthi forces or pirates. The UK Maritime Trade Operations downgraded the event to suspicious activity after confirming no direct...

By gCaptain

Social•Feb 17, 2026

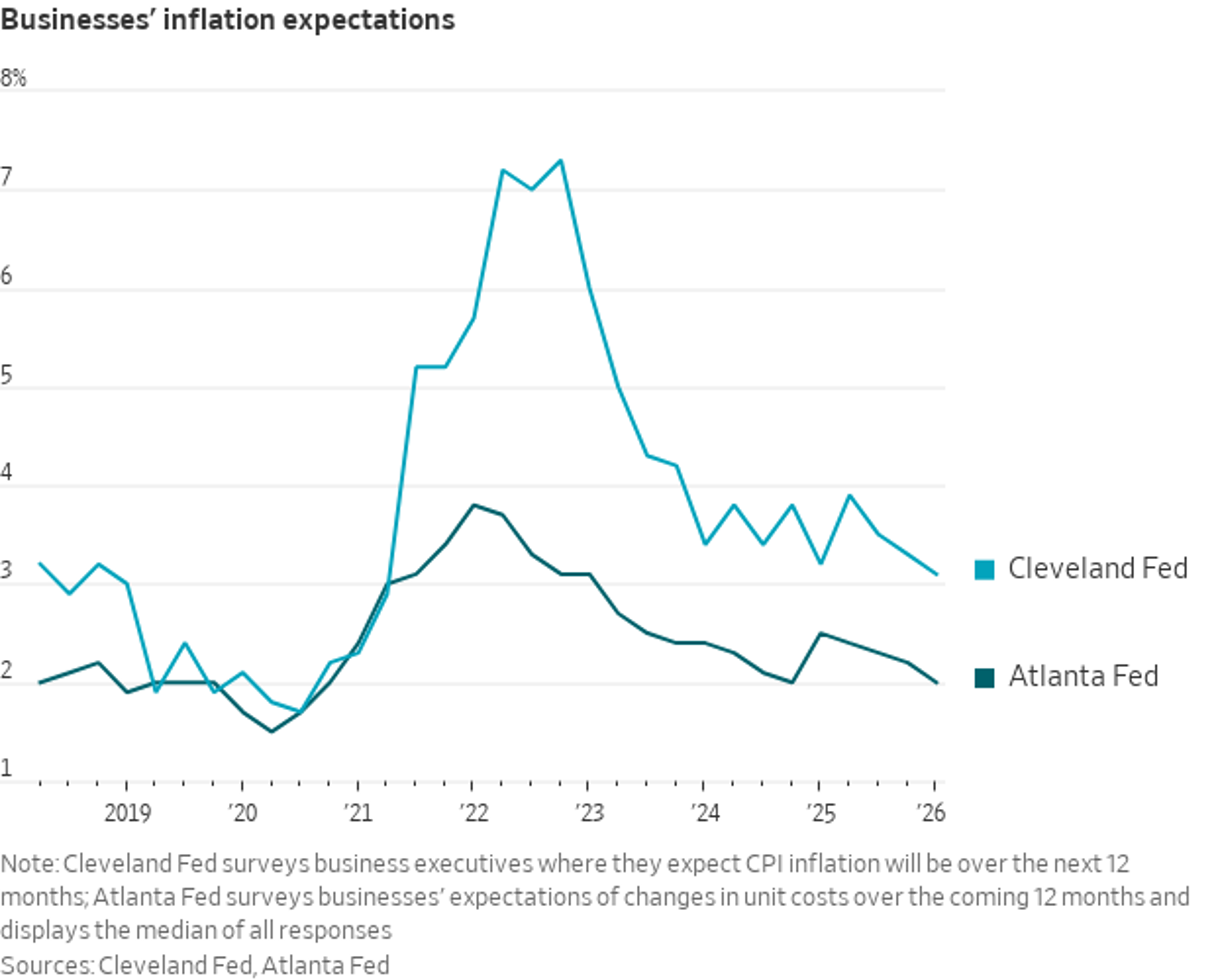

Business Inflation Expectations Return to Pre‑Pandemic Levels

Two different measures of business inflation expectations have essentially returned to pre-pandemic levels. The Atlanta Fed survey (dark line), which asks businesses how much they expect their own unit costs to change, is back at 2%—right where it was in 2019....

By Nick Timiraos

Social•Feb 17, 2026

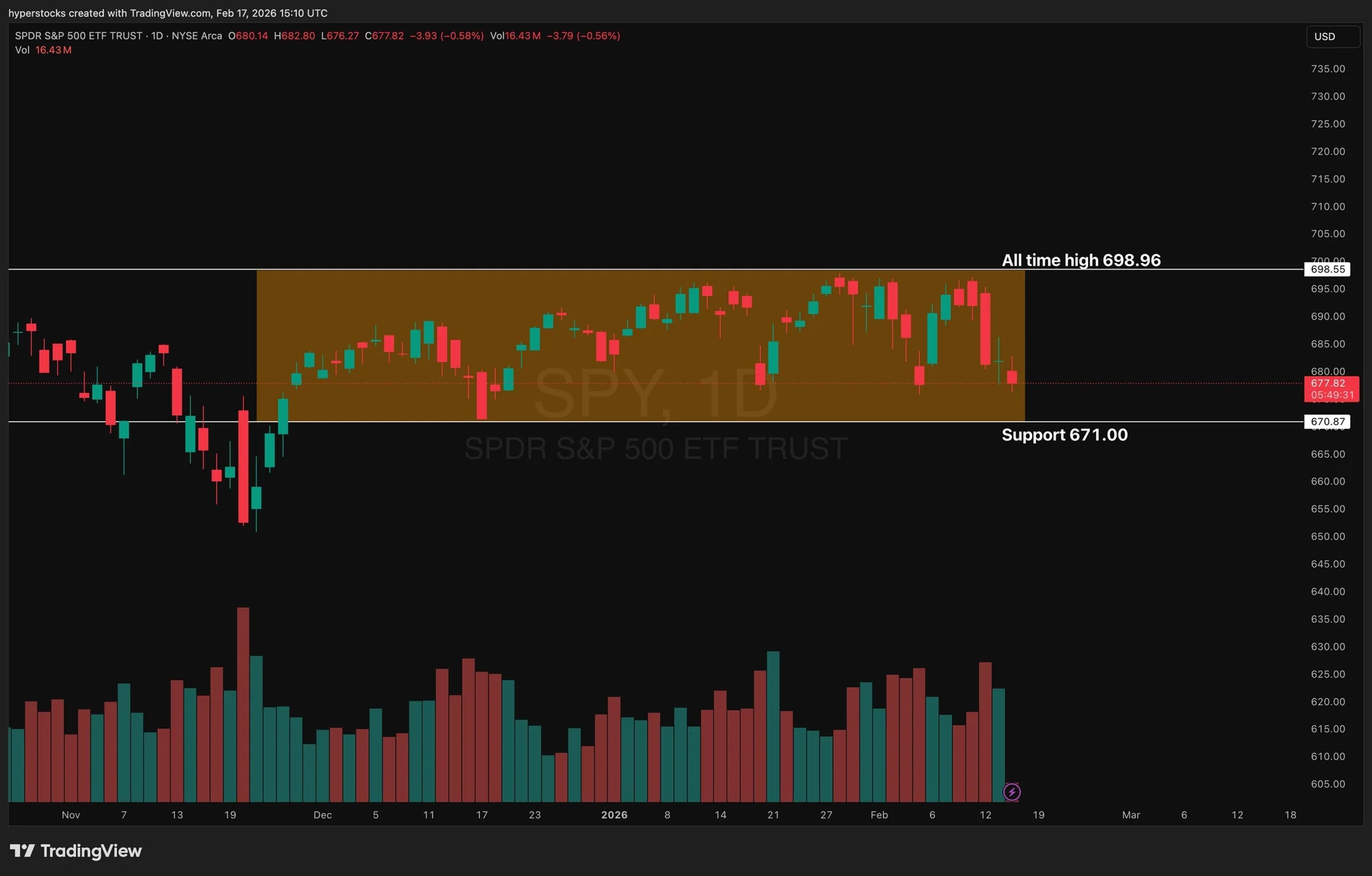

SPY Poised to Break November Range Amid Key Data

Is it finally the week $SPY breaks this range? Stuck here since November. Reports scheduled this week: - U.S. Trade Deficit Report (Thu) - GDP (Fri) - Inflation Report (Fri) - Consumer Sentiment (Fri)

By Hyperstocks

News•Feb 17, 2026

French Urea Imports Surge in 2H 2025

France’s urea imports surged to 1.15 million tonnes in the July‑December 2025 period, up from 842,000 tonnes a year earlier, as buyers rushed to stock ahead of the EU’s Carbon Border Adjustment Mechanism (CBAM). December shipments more than doubled the three‑year monthly...

By Argus Media – News & analysis

Social•Feb 17, 2026

UK Unemployment Peaks Since COVID, Youth Jobless at 16%

#UKWatch🇬🇧: UK unemployment levels have reached their HIGHEST LEVEL since COVID. Youth unemployment ROSE TO 16.1%. RUSSOPHOBE STARMER’S GOVERNMENT IS FLOUNDERING. https://t.co/4jk4KQ1Q5I

By Steve Hanke

Social•Feb 17, 2026

Iranian Rial Crashes as US‑Iran Nuclear Talks Begin

Today, US-Iran nuclear talks began in Geneva. As the talks start, the Iranian rial is in the tank. It has depreciated by over 43% against the dollar in the past year, making it THE SECOND WORST CURRENCY IN THE WORLD. https://t.co/PORIO6lGtc

By Steve Hanke

News•Feb 17, 2026

World Briefs | Putin Ally Warns European Powers over Seizure of Russian Vessels

Russia’s navy chief warned European powers of retaliation if Russian vessels are seized, underscoring heightened maritime tensions amid over 30,000 sanctions. Rosatom announced it has freed Siemens from the Hungarian Paks II nuclear contract and is scouting replacement equipment. Despite U.S....

By BusinessLIVE (South Africa) – RSS hub

Social•Feb 17, 2026

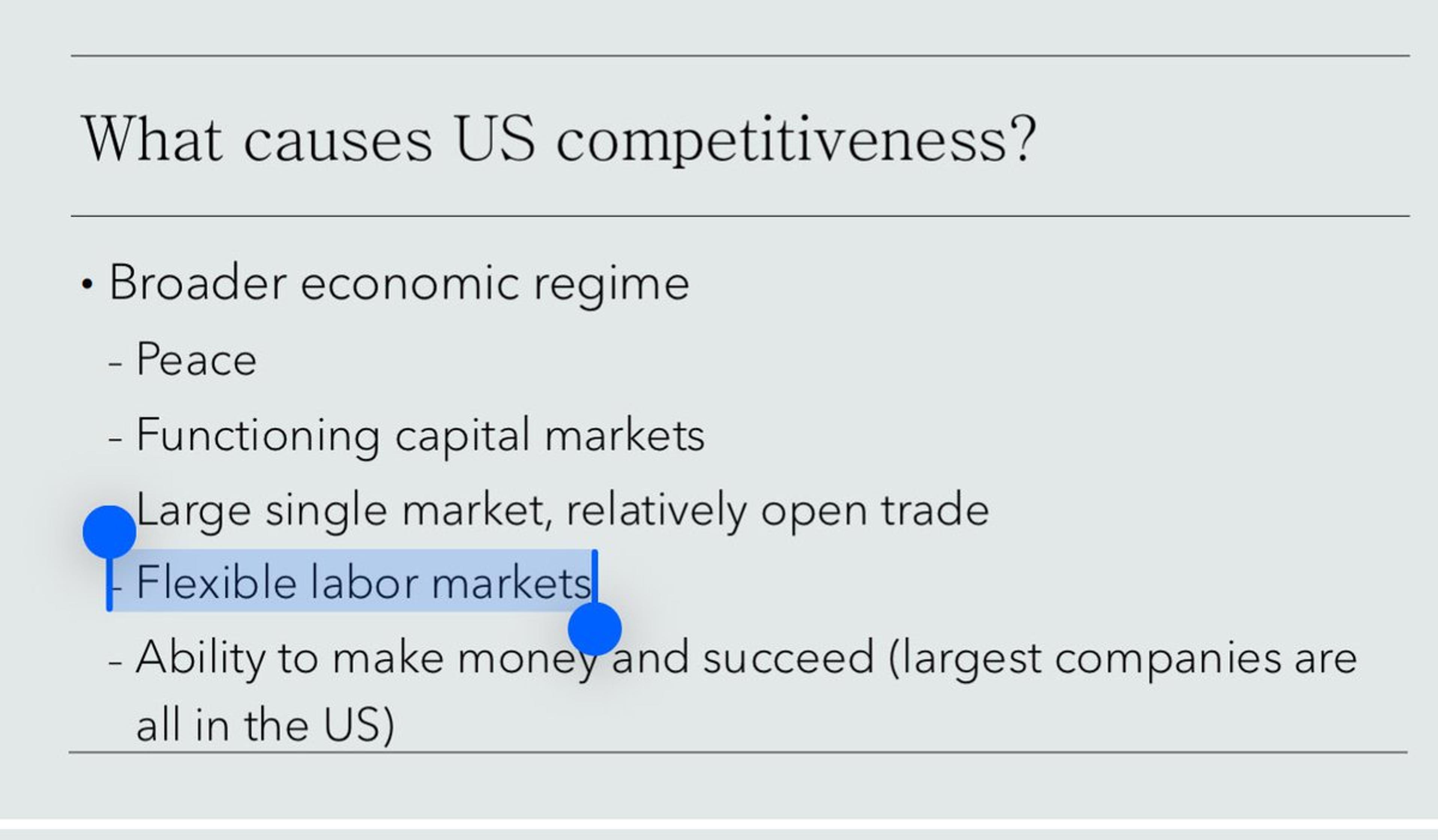

Labor Market Dynamism Drives Real Competitive Advantage

Labor market dynamism is the real differentiator. I make sure to stress it in my public talks https://t.co/jO6lNyPm8W

By Brian Albrecht

Social•Feb 17, 2026

Sanctions Spawn Shadow Fleet, Aging Tankers Scrapped in India

US sanctions squeezed Russian and Venezuelan oil shipping out of mainstream markets. A shadow fleet emerged. Now aging dark fleet tankers are arriving at Indian scrapyards at a record pace. SANCTIONS = WORKAROUNDS = UNINTENDED CONSEQUENCES. https://t.co/GddyWzZwZd

By Steve Hanke

News•Feb 17, 2026

International Business Briefs | Kennedy Wilson to Go Private in $1.5bn CEO-Led Deal

Kennedy Wilson agreed to a $1.5 bn CEO‑led buyout, offering a 10.2% premium and targeting a Q2 2026 close. Genuine Parts announced a split into two publicly traded entities—Automotive Parts Group and Industrial Parts Group—set to finalize in Q1 2027 after an activist‑driven settlement. Blackstone‑backed...

By BusinessLIVE (South Africa) – RSS hub

Social•Feb 17, 2026

Wheat Export Inspections Outpace USDA Target by 59M Bushels

Marketing year to date #wheat export inspections exceed the seasonal pace needed to hit USDA's target by 59 million bushels, versus 61 million the previous week. #oatt

By Arlan Suderman

Social•Feb 17, 2026

Oil Markets See Trump’s Hawkish Talk as Theater

Iran says it has “understanding on principles” with the US That was always the most likely outcome. Trump won't risk higher oil prices into an election cycle, writes @Ole_S_Hansen The oil market correctly judges his hawkish rhetoric as theater. #oil #Brent #Iran #geopolitics...

By Art Berman Blog

News•Feb 17, 2026

Breaking News: Canadian CPI Eases From 3-Month High, USD/CAD Extends Gain...

Canada’s annual CPI slipped to 2.3% in January 2026, easing from a three‑month peak of 2.4% and landing just below market forecasts. The trimmed‑mean core rate fell to 2.4%, the lowest level since April 2021, indicating waning underlying price pressure....

By Myfxbook — Latest Forex News

Social•Feb 17, 2026

Third-Generation Auto Bailouts: How Long Until They're Considered?

How many years away are we from the third generation of auto bailouts being on the table?

By Adam Ozimek

Social•Feb 17, 2026

Guyana Gains as Venezuela's Maduro Falls, Boosting Investment

Guyana is the biggest winner from Maduro's ouster in Venezuela. "It removes the biggest barrier for foreign investment," said CSIS's Henry Ziemer Lower risk premium, faster development, higher upside. https://t.co/1Tpj1OK8dp #oil #Guyana #Exxon #geopolitics #energy

By Art Berman Blog

News•Feb 17, 2026

GBP/JPY Price Forecast: Short-Term Trend Turns Negative Below 210.00 Handle

GBP/JPY slipped below the 210.00 psychological level, trading around 207.28 and marking a near two‑month low. The decline follows weaker UK labour‑market data that has pushed market consensus toward two Bank of England rate cuts this year, with the first...

By FXStreet — News

Social•Feb 17, 2026

TLT Seen as Lower High, Still Hating Treasuries

I think I might be the only person in the world who still hates US Treasuries here. $TLT is just another lower high imo until proven wrong.

By Quinn Thompson

Social•Feb 17, 2026

U.S. Corn Inspections Surpass Expectations, Soy Exports to China Strong

🇺🇸Last week's U.S. corn inspections easily beat all trade expectations (though they weren't a weekly record). FYI the previous week's corn volume was hiked significantly. Soy inspections were near the top end of estimates - 57% of the beans were...

By Karen Braun

News•Feb 17, 2026

Holiday Inn Owner IHG Hopes World Cup Can Kickstart US Recovery

InterContinental Hotels Group (IHG) is counting on the 2026 FIFA World Cup to revive U.S. travel after three consecutive quarters of declining room revenues. U.S. RevPAR fell 2% in Q4, lagging rivals Hilton and Marriott, while growth in Europe, the...

By BusinessLIVE (South Africa) – RSS hub

Social•Feb 17, 2026

Mistaking Short‑Term Labor Shortage for Full Employment Undermines Jobs

I disagree, but I don't think David is alone in this. To me, the biggest risk of confusing a temporary labor supply shortage that drives up inflation with full employment was that it would undermine actual full employment. We are...

By Adam Ozimek

Social•Feb 17, 2026

IEA Paris Meeting Tests Net‑Zero Shift Against US Oil Priorities

For energy policy making, a key week in Paris as @IEA energy officials gather Feb 18-19 for a biennial ministerial meeting. The IEA’s drift toward net-zero advocacy and overtures to China will be tested as US officials push to a return...

By Javier Blas

News•Feb 17, 2026

Antofagasta Profit Rockets 52% as Record Copper Prices Offset Weaker Output

Chilean miner Antofagasta reported a 52% surge in 2025 core profit to $5.2 bn, driven by record copper prices that rose over 40% last year. Despite slightly lower output, the company lifted capital spending to $3.7 bn, mainly for the Centinela concentrator...

By BusinessLIVE (South Africa) – RSS hub

Social•Feb 17, 2026

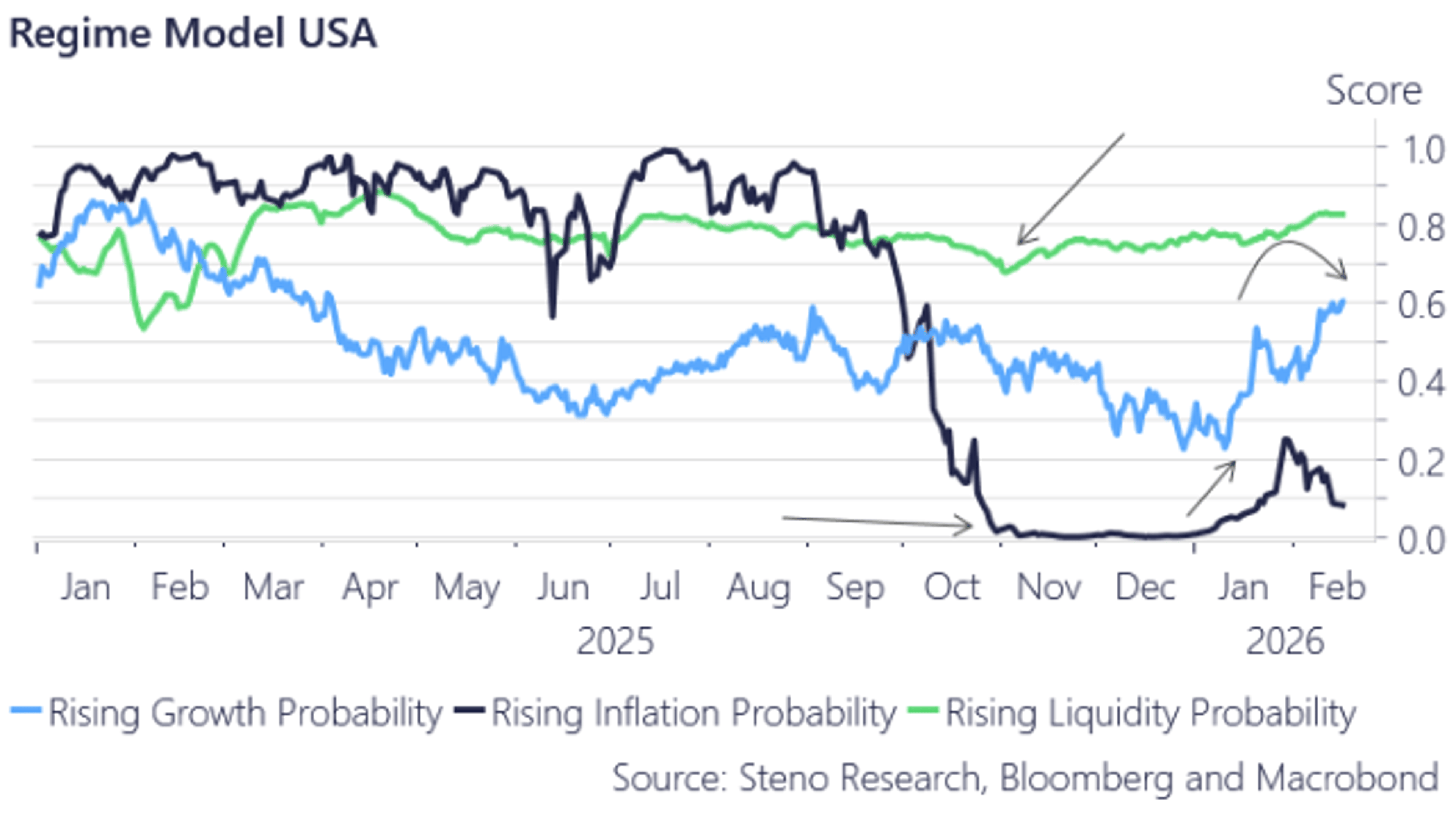

Nowcast IQ Predicts US Growth Despite Market Pessimism

A few of our weekly inputs have come in for US growth. We continue to rebound hard cyclically. EURUSD down, US assets (soon) up, and ISM PMI towards 60 by summer. Our Nowcast IQ is telling a VERY contrarian story to...

By Andreas Steno Larsen

Social•Feb 17, 2026

EURUSD Retreats to Fib Level as Longs Surge

$EURUSD has pulled back from its failed run on 1.20 a few weeks back - aligned to a 38.2% Fib of the 2008 to 2022 bear wave. Meanwhile, net speculative futures positioning has jumped this past week to its heaviest net-long...

By John Kicklighter

News•Feb 17, 2026

Conflicting Policies, Confused Investors, and the Weak Dollar

The United States continues to dominate global growth, driven by an AI-fueled expansion, yet its flagship currency is unusually weak. Markets are now pricing U.S. policy uncertainty on par with economies that lack a reserve currency. Conflicting fiscal and monetary...

By Project Syndicate — Economics

Social•Feb 17, 2026

Fed Rarely Cuts Rates During >8% Nominal Growth

"The Federal Reserve has cut rates only a handful of times when nominal growth was greater than 8 per cent and most of those instances were in the 1970s." Richard Bernstein @RBAdvisors in the FT https://t.co/vzNnkKmGpY

By Greg Ip

Social•Feb 17, 2026

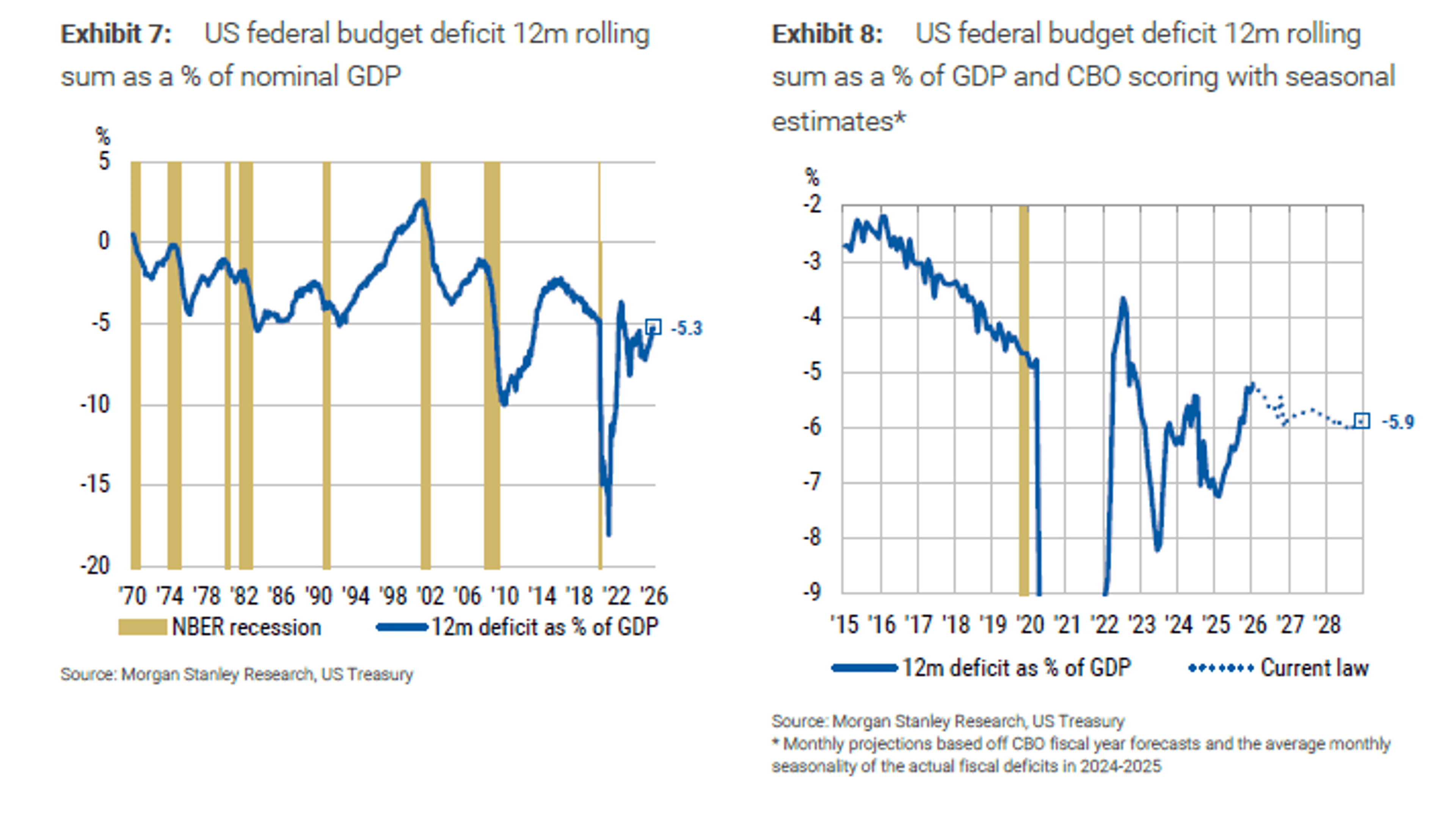

New Projections Quiet Bond Vigilantes, Ease Debt Fears

New US deficit and growth projections ""suggest a quiet period ahead for bond vigilantes and others who hand-wring over the unsustainable nature of the US debt and the inevitable market revolt – the Godot for which they have waited impatiently...

By Lisa Abramowicz

Blog•Feb 17, 2026

Baby Boomer Spending Helps Drive up Inflation

Australia’s Reserve Bank highlighted an unexpected surge in private demand, driven largely by heightened household spending from the baby‑boomer cohort. The increase in consumer‑durable price growth reinforced this trend, prompting the RBA to raise the official cash rate by 0.25%....

By MacroBusiness (Australia)

Social•Feb 17, 2026

US‑Iran Oil Talks Conclude Second Round, Third Round Pending

OIL MARKET: The 2nd round of US-Iran talks has concluded, and Iranian media says there would be a 3rd round of negotiations in the “near future” after both sides consult with their respective governments.

By Javier Blas

Social•Feb 17, 2026

Rate Moves Aren’t Driven by Current Data, ADP Shows

Big mistake is assuming move in rates is about current economic data. Reaction to ADP a good example

By Ed Bradford

News•Feb 17, 2026

China Introduces 30-Day Visa Waiver for UK and Canadian Nationals

China will allow UK and Canadian passport holders to enter visa‑free for up to 30 days. The waiver runs from 17 February to 31 December 2026 and covers business, tourism, family visits, exchanges and transit. It is expected to speed...

By Blooloop — Theme Parks

Social•Feb 17, 2026

Iran and Russia Clash over China Oil Supply Rivalry

The oil ministers of Iran and Russia met today. Contrary to popular belief, Moscow and Tehran are now bitter rivals in the oil market as the size of the black market for crude shrinks. Both compete to supply China. (My earlier @Opinion...

By Javier Blas

News•Feb 17, 2026

USD/JPY Is Looking for Direction Around 153.00 with Key US Data in Focus

USD/JPY is hovering around the 153.00 level as traders await key US data. The pair was rejected at the 153.70 resistance, found support near 152.70, and settled back near 153.00. Weak Japanese Q4 GDP, which fell short of forecasts, kept...

By FXStreet — News

Social•Feb 17, 2026

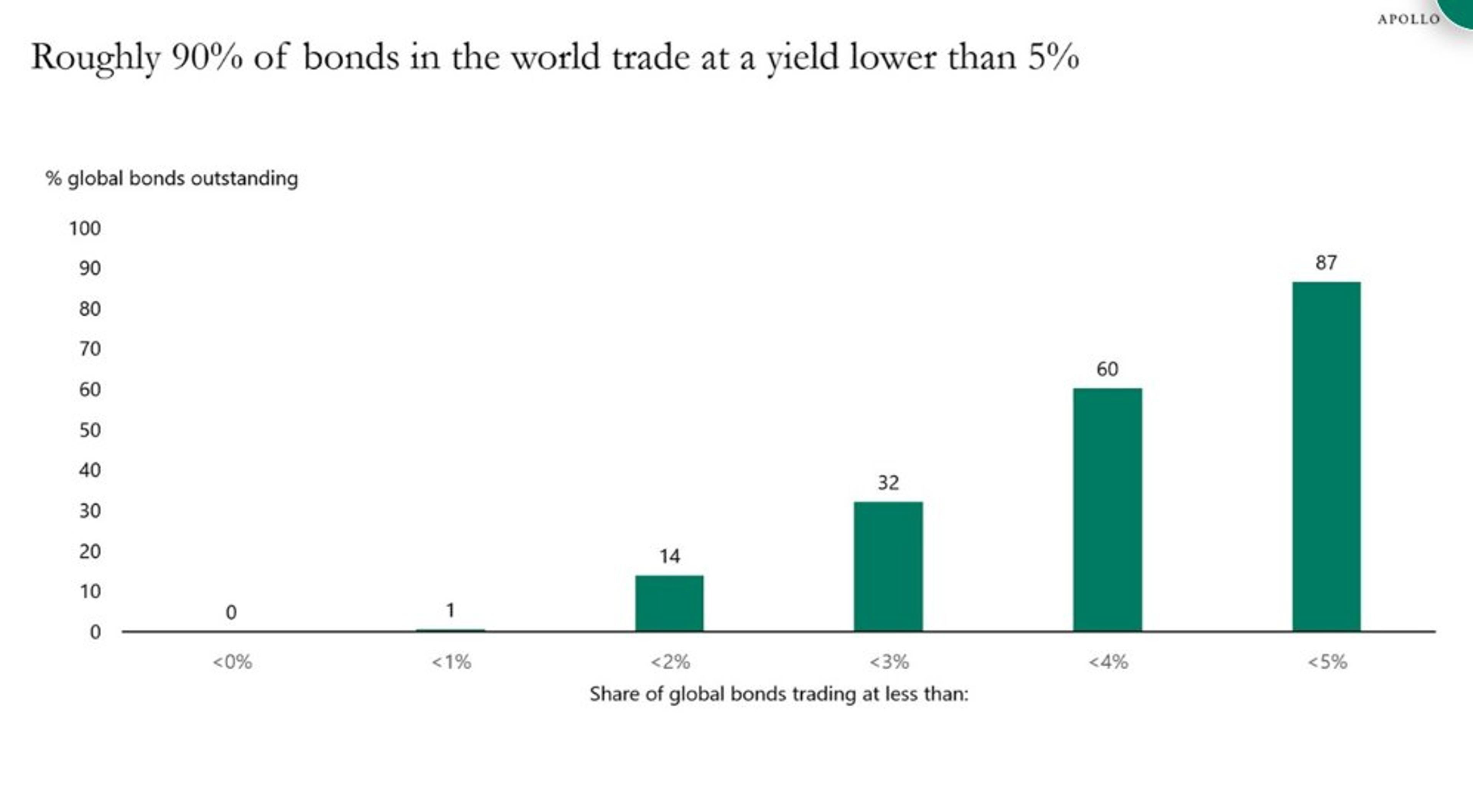

Global Bonds Yield Under 5%, Delivering ~2% Real Return

Almost 90% of global public bonds trade at a yield lower than 5%: Apollo's Torsten Slok. "With inflation at close to 3%, this means that investors in public fixed income only get a 2% real return each year." https://t.co/oCUWfCIGpn

By Lisa Abramowicz

News•Feb 17, 2026

Fund Managers Alarmed over Corporate Spending Even as Optimism at Five-Year High

Fund managers are at a five‑year high of bullishness, yet a record share warn that corporate America is overspending on capital expenditures amid uncertain returns. In Bank of America’s February survey of 162 managers, cash balances rose in February, signaling...

By MarketWatch – Top Stories