🎯Today's Global Economy Pulse

Updated 23m agoWhat's happening: US growth stalls to 1.4% annualized in Q4 2025 amid fiscal gridlock

The U.S. economy expanded at a 1.4% annualized rate in the fourth quarter of 2025, roughly half of analysts' expectations and the slowest pace since early 2024. The deceleration follows a 4.4% surge in the prior quarter and coincides with heightened legislative gridlock over fiscal policy and the debt ceiling.

News•Feb 19, 2026

GrainCorp Confident of Global Grain Market Rebalance

GrainCorp CEO Robert Spurway told shareholders that global wheat oversupply of 18 million tonnes is driving low prices and tighter margins for grain handlers. Growers are holding back grain, reducing market availability, but the company expects inventories to rebalance eventually, though timing is unclear. GrainCorp highlighted its diversified export strategy, especially into China and alternative markets, to mitigate tariff risks. The firm reported receiving 10.6 Mt of grain in the 2025‑26 harvest, with 2.3 Mt already in‑year.

By Grain Central

Social•Feb 19, 2026

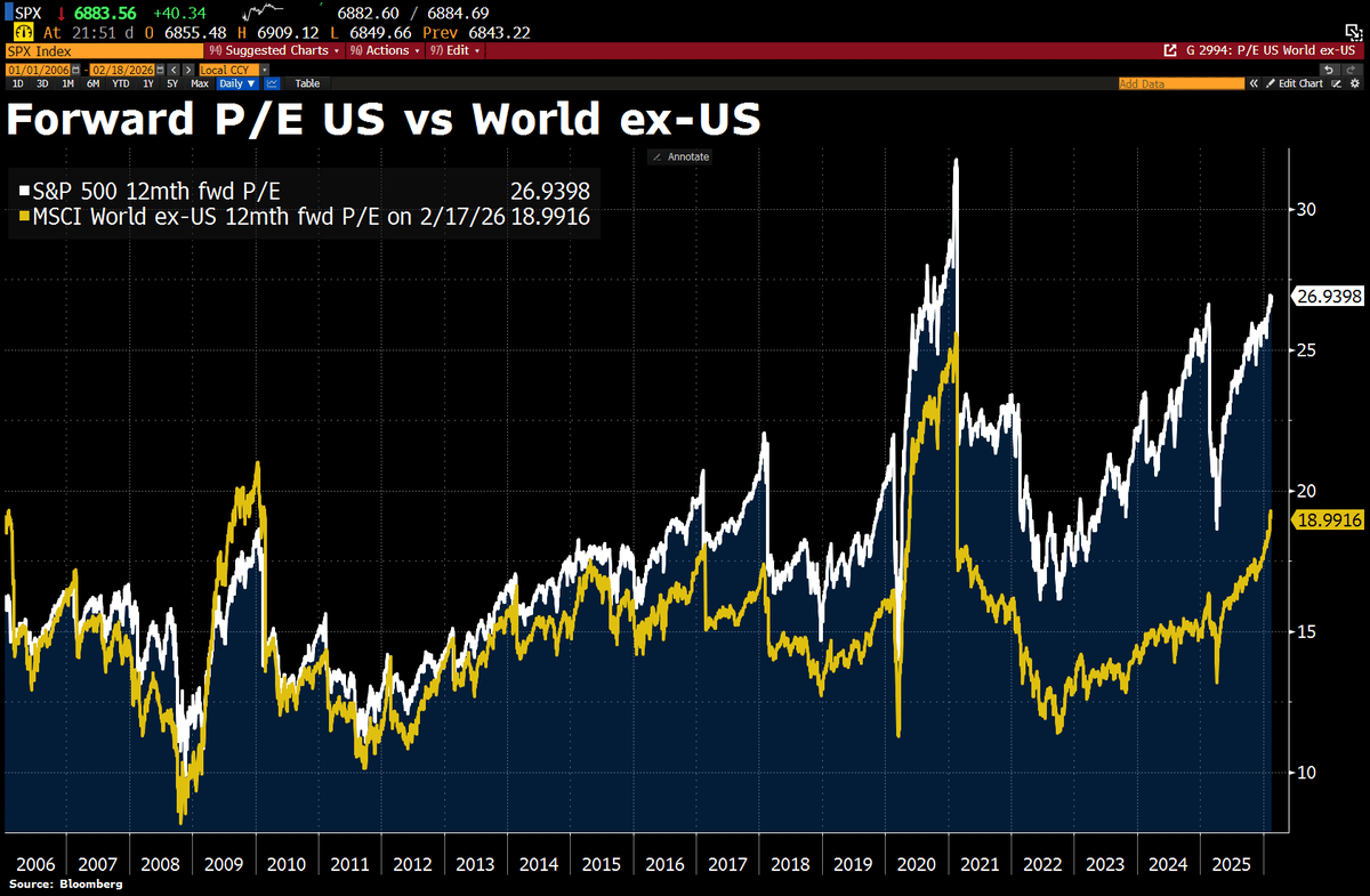

Fed Minutes Omit 2% Inflation Target Date, Signaling Uncertainty

One more note on the Fed minutes: Sometimes it's interesting what they don't say. Last year at every meeting until December, the staff forecast called for inflation to return to 2% by 2027. In December, the forecast pushed this back to...

By Nick Timiraos

Blog•Feb 19, 2026

Job Creation Soft

The Australian Bureau of Statistics reported that January 2026 saw a modest net increase of 18,000 jobs, with full‑time employment rising by 50,500 and part‑time employment falling by 32,700. Total employment reached 14,703,800 and monthly hours worked climbed to 2,013 million, while...

By MacroBusiness (Australia)

Blog•Feb 19, 2026

Banker Calls for Peak Banker

National Australia Bank CEO Andrew Irvine warned that Australia has hit "peak Australia," signalling that without a productivity boost the economy will stagnate. Real wages fell for the first time in two years, underscoring the pressure on living standards. Irvine...

By MacroBusiness (Australia)

Social•Feb 19, 2026

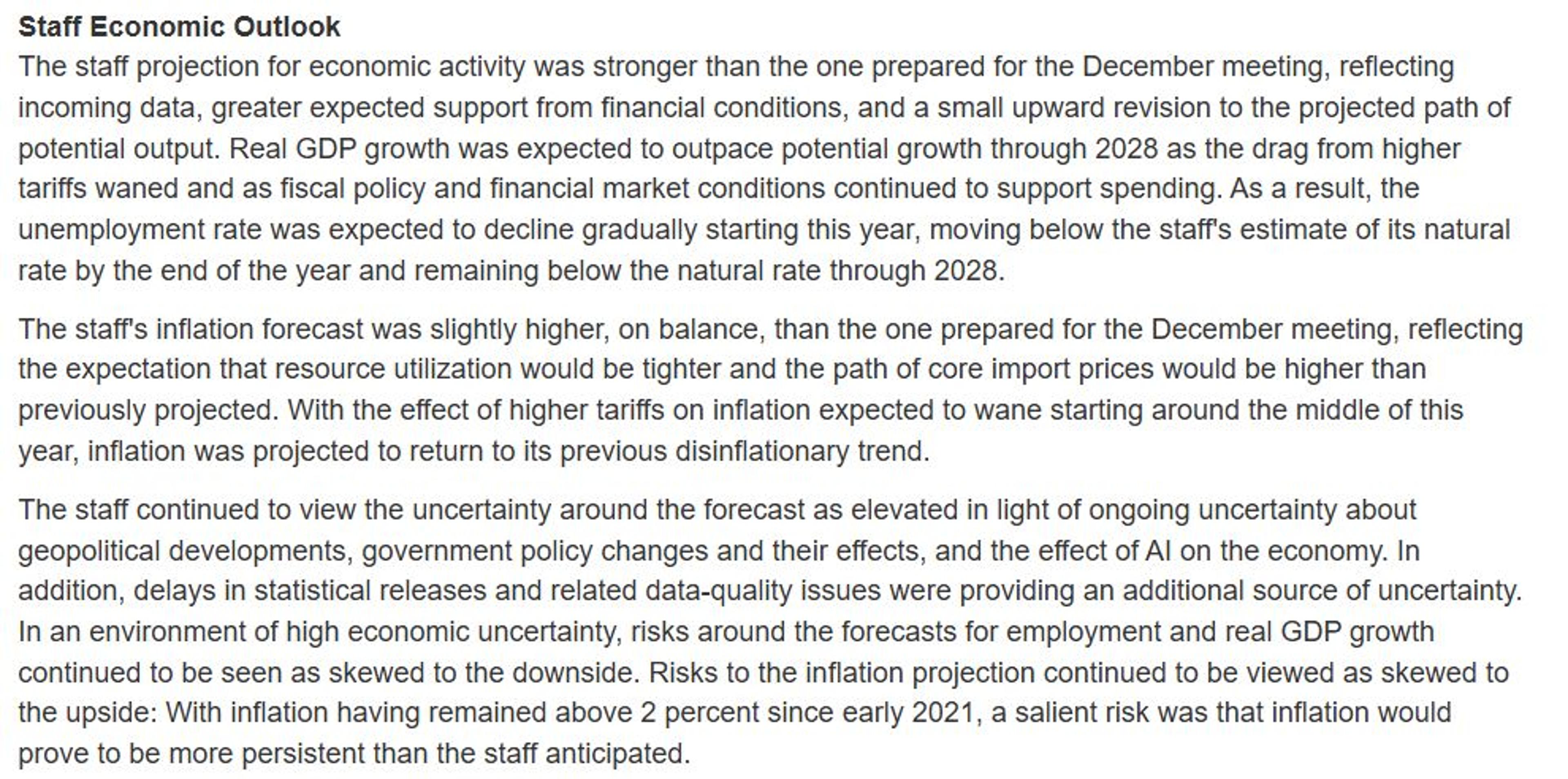

Defensives Hit Dot‑Com Lows, Poised for Rally

Chart of the Week - Defensives With tech in trouble (+a number of macro risks lurking on the horizon), defensives are starting to look interesting… Defensives (i.e. an equal-weighted basket of: Utilities, Healthcare, Consumer Staples) are turning up vs the S&P500 —after...

By Callum Thomas

Social•Feb 19, 2026

China Buys US LNG, Redirects It to Europe

China hasn’t stopped buying U.S. LNG It’s just not burning it at home. Long-term contracts still bind the two systems Flexible LNG markets let China arbitrage politics by diverting cargoes to Europe. Does anyone on Team Trump know this? https://t.co/CacMbcaSMk #LNG #China #EnergyMarkets #Geopolitics #TradeWar #NaturalGas

By Art Berman Blog

News•Feb 18, 2026

Isabel Schnabel: Fiscal Challenges Amid Geopolitical Uncertainty and Ageing Societies

Isabel Schnabel highlighted the euro area’s mounting fiscal pressures, noting that low debt levels often coincide with weak public investment. She examined Germany’s new defence and infrastructure package, showing it can lift GDP but also raise debt ratios under different...

By European Central Bank — Press/Speeches

Social•Feb 19, 2026

Geopolitical Fears Add Incremental Risk Premium to Oil

Oil rallied on fear Iran headlines + Israel alerts = instant risk premium in a tight market But geopolitics don't matter. Except they do in small continuous increments that convert to a steady aggregate premium. https://t.co/6vQGj7YEmu #OilMarkets #Geopolitics #Iran #EnergySecurity #crudeoil

By Art Berman Blog

Social•Feb 19, 2026

TLT Call Skew at 90th Percentile, Expect Shakeout

Yep- Skew on TLT (calls expensive to outs) like 1 month out is in the 90th%tile. Gonna get shaken out before yields go lower. Let’s talk about this tomorrow on @ForwardGuidance

By Tyler Neville

News•Feb 18, 2026

Dow Jones Industrial Average Gains 200 Points as Fed Minutes Loom and Nvidia Rallies on Meta Deal

The Dow Jones Industrial Average rose about 300 points, or 0.65%, as investors returned to equities ahead of the Federal Reserve’s January minutes. Nvidia surged over 2% after Meta announced an expanded AI‑chip partnership worth tens of billions, reinforcing Nvidia’s...

By FXStreet — News

Social•Feb 19, 2026

Blue Owl Stops Redemptions, Highlighting Exit Liquidity Risk

BLUE OWL PERMANENTLY HALTS REDEMPTIONS AT PRIVATE CREDIT FUND AIMED AT RETAIL INVESTORS — FT Being long scarcity might lead to illiquidity, but being long illiquidity doesn’t necessarily mean you’re long scarcity You’re long exit liquidity

By Jeff Park

Social•Feb 19, 2026

Korean Reforms Spark Value Ups, Awaiting IBKR Access

I initially thought the Korean reforms would be ineffective. But on the ground, I’m seeing many companies come up with highly positive value up plans. And valuations remain a fraction of those in Japan. Once IBKR opens access, the focus...

By Michael Fritzell

News•Feb 18, 2026

J.B. Hunt ‘a Little Bit More Positive’

J.B. Hunt’s CFO said demand is slightly stronger than early‑January expectations as truck capacity tightens, reflected in rising tender rejections and spot rates. Regulatory pressures on the driver pool and recent winter storms have limited supply, creating a modest but...

By FreightWaves

Social•Feb 19, 2026

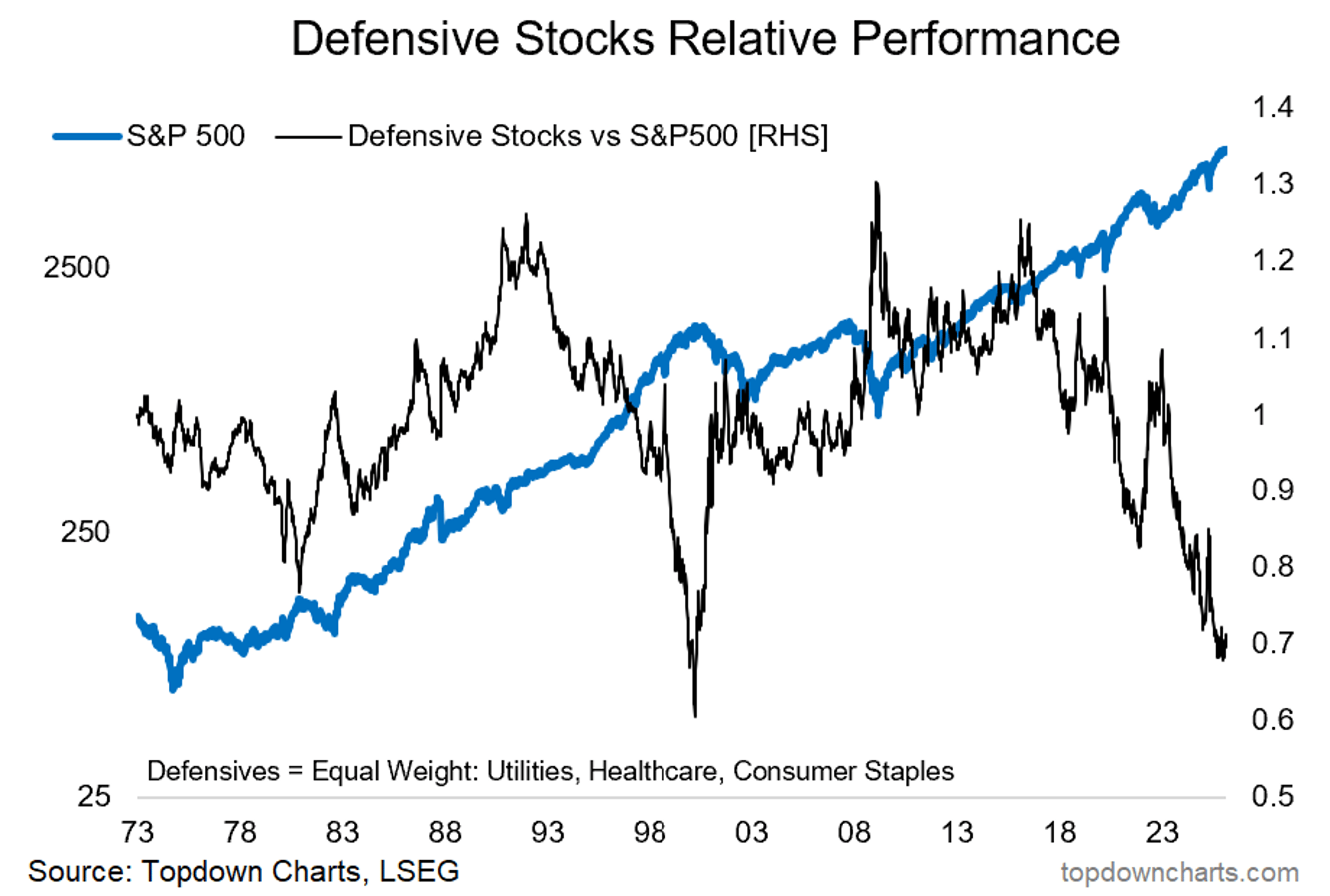

Long‑duration Assets Like Bitcoin, Growth Stocks Lose Favor

Bitcoin's drop has coincided with a decline in the Russell 1000's Pure Growth P/E. What do they have in common? Both are long-duration, and are being shunned during the underlying rotation into shorter-duration (cyclical) securities (think value, dividend payers, Energy...

By Michael Kantro

Social•Feb 19, 2026

Libya Redirects Oil Payments From Russia to Western Traders

Libya is cutting Russia out of its oil trade Fuel imports are shifting away from Russia toward large Western traders Sanctions didn’t “punish” Libya into changing behavior. They reshaped who gets paid. https://t.co/pmKRlqgEK1 #OilMarkets #Libya #EnergyGeopolitics #Sanctions #OPEC #crudeoil

By Art Berman Blog

News•Feb 18, 2026

US Stocks: Trump Adviser Hassett Suggests New York Fed Researchers Be Punished for Tariffs Argument

Kevin Hassett, former Trump economic adviser, blasted a New York Fed research paper that argued tariffs mainly hurt American consumers, calling it "shoddy scholarship" and the worst paper in Fed history. He urged that the authors be disciplined for their...

By The Economic Times – Markets

Social•Feb 18, 2026

US Vaccine Policy Shift Boosts MRNA Stock Appeal

Macro: US vaccine-policy swing heightens regulatory risk; FDA will review Moderna’s flu shot. Key: public dispute, amended filing; decision by Aug 5. Risk: political oversight. Trade: Buy MRNA. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 18, 2026

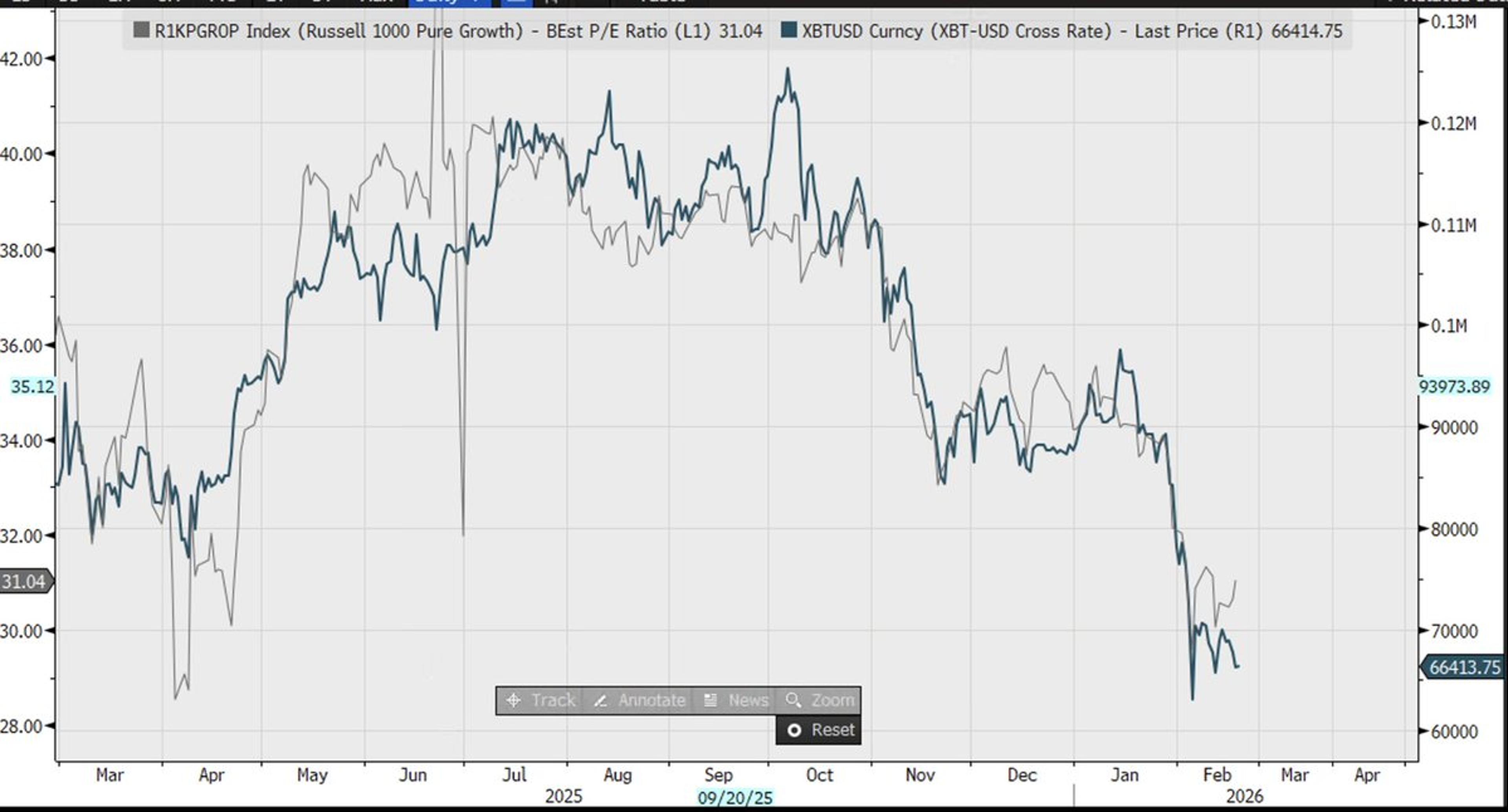

US Stock Premium at Risk as Tech Capex Rises

Although global markets have narrowed the gap with the US in recent weeks, US equities still trade at a roughly 40% valuation premium to the rest of the world. That premium could shrink further if big tech companies lose their...

By Holger Zschaepitz

News•Feb 18, 2026

Five US Policy Shifts Could Reshape Financial Markets

The Trump administration is advancing five domestic policy initiatives that touch credit, housing, monetary policy, corporate governance, and digital‑asset regulation. Proposed credit reforms would tighten loan underwriting, while housing changes could modify the mortgage interest deduction. Monetary officials hint at...

By Project Syndicate — Economics

Social•Feb 18, 2026

Global Growth Slows, Rates Sticky; Shorten Treasury Duration

Macro: global growth slows; rates remain sticky. Key factors: US CPI, China demand, energy. Risks: policy missteps, inflation shocks. Trade: shorten duration in US Treasuries. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 18, 2026

Data Centers Drive Growth as Fed Shows Internal Split

Today’s burst of economic data showed an economy still powered by the boom in data centers with some broader increases in vehicle orders (Dec) and production (Jan). Housing starts popped in December and were revised higher for November. Good...

By Diane Swonk

News•Feb 18, 2026

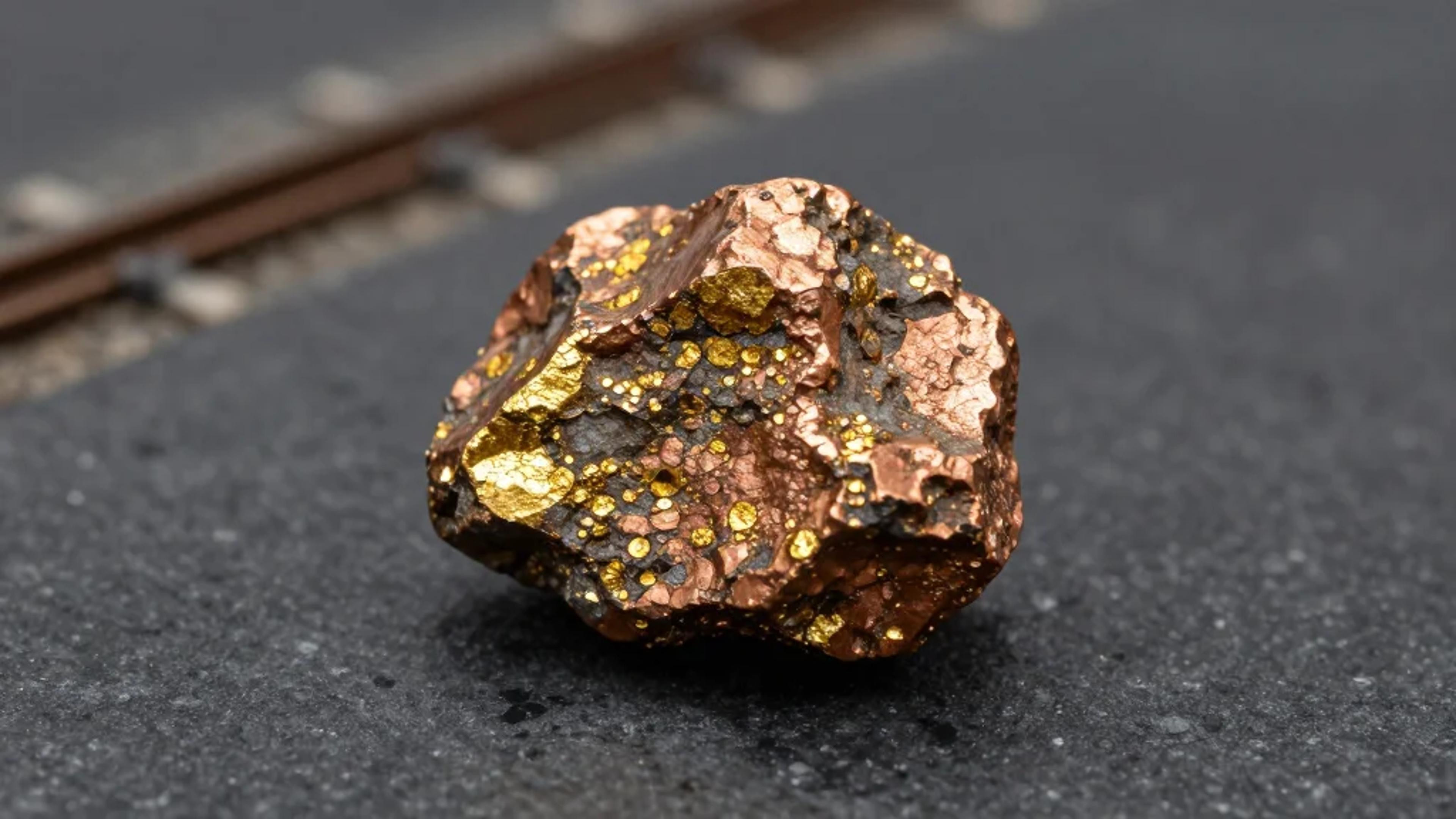

Mining Stocks Dominate TSXV’s Top Performers List

Metals and mining dominated the TSX Venture Exchange’s 2025 top‑performer list, with 48 of the 51 entries coming from the sector. Junior miners posted an average share‑price gain of 443% and a combined market capitalisation of $19.9 billion. Record liquidity supported...

By MINING.com

Social•Feb 18, 2026

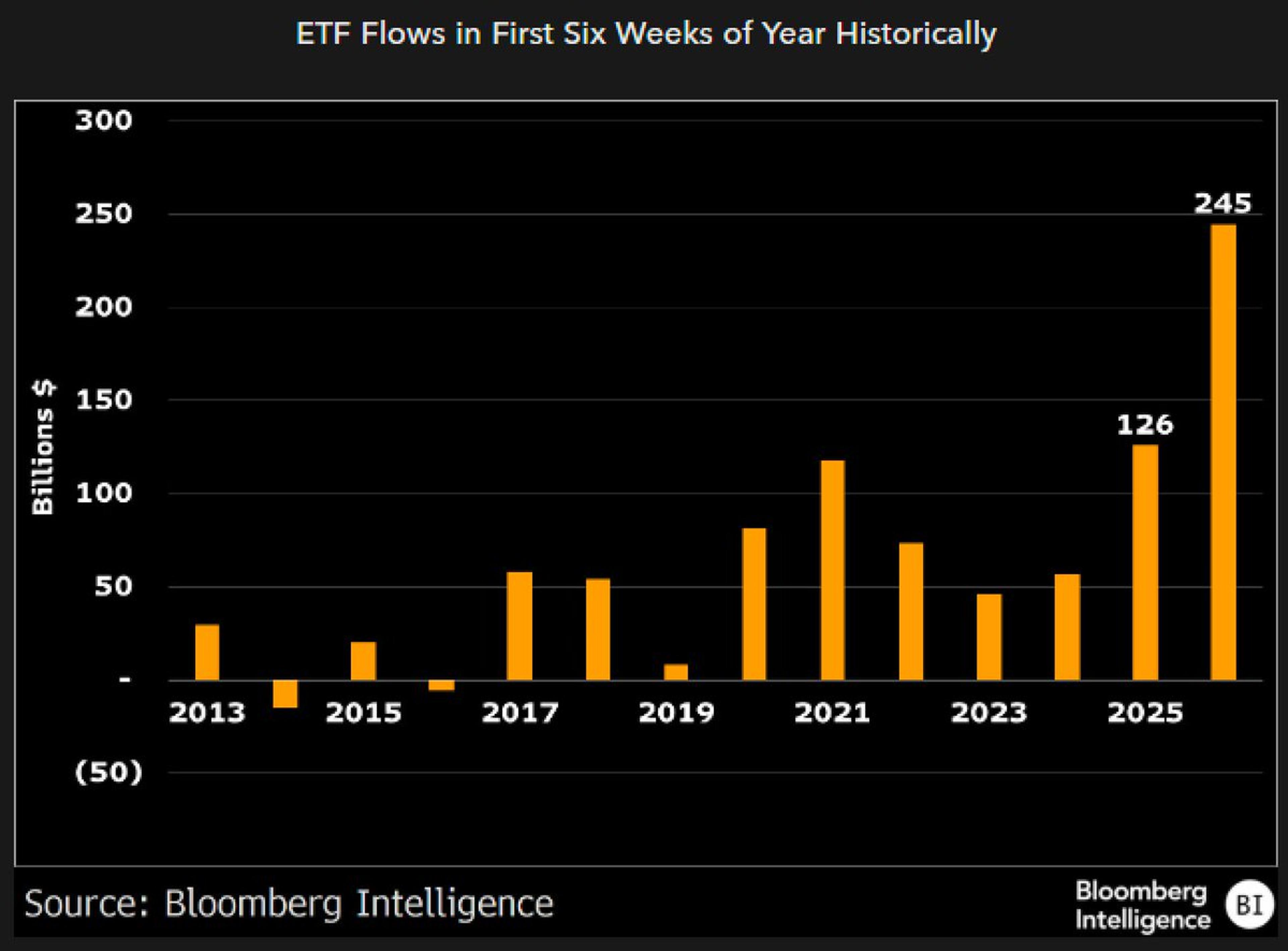

ETF Inflows Double Historic Pace in First Six Weeks

Here's ETF flows for the first six weeks of the year historically. This year is off to the best start almost by double. One reason is growing depth of cash vacuum cleaners. VOO, SPYM hoovering as always but there's already...

By Eric Balchunas

Social•Feb 18, 2026

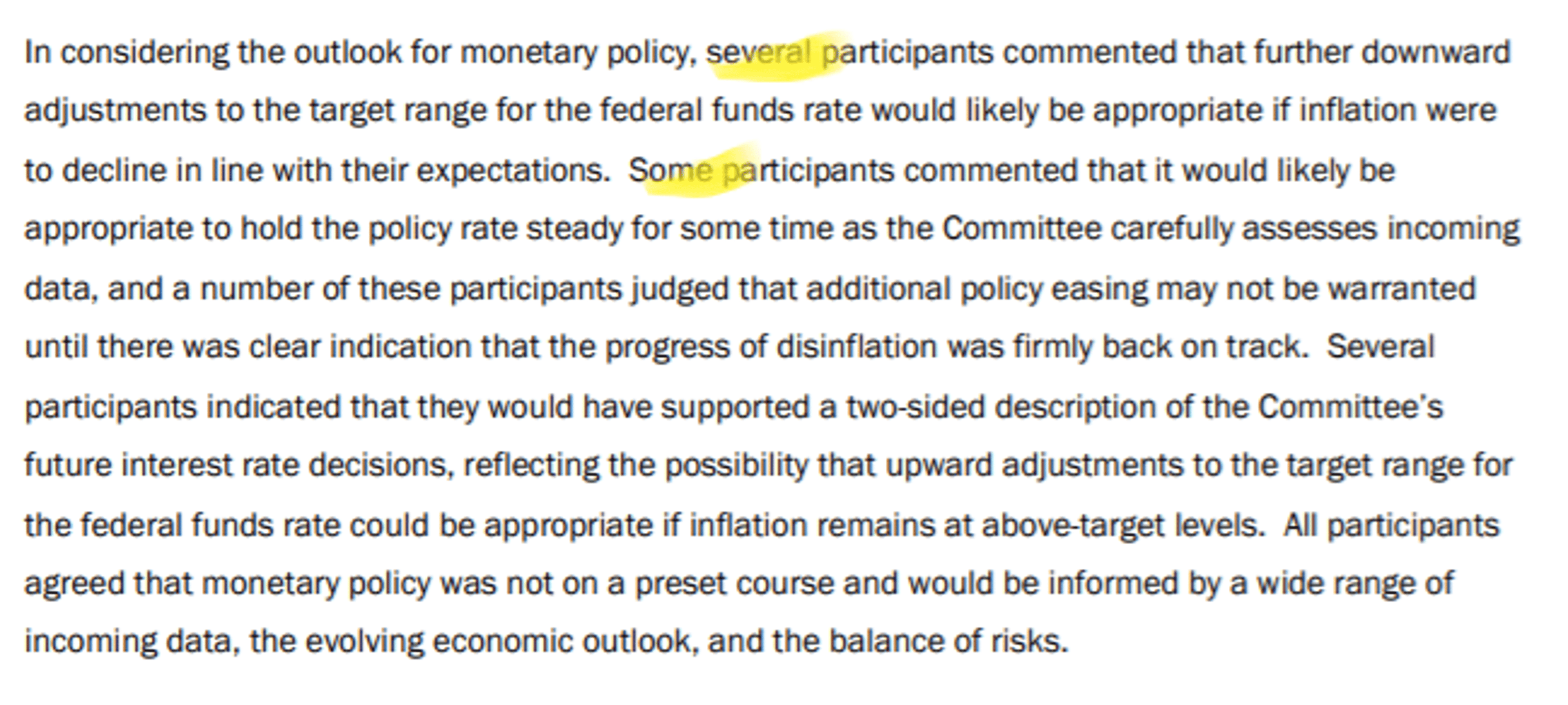

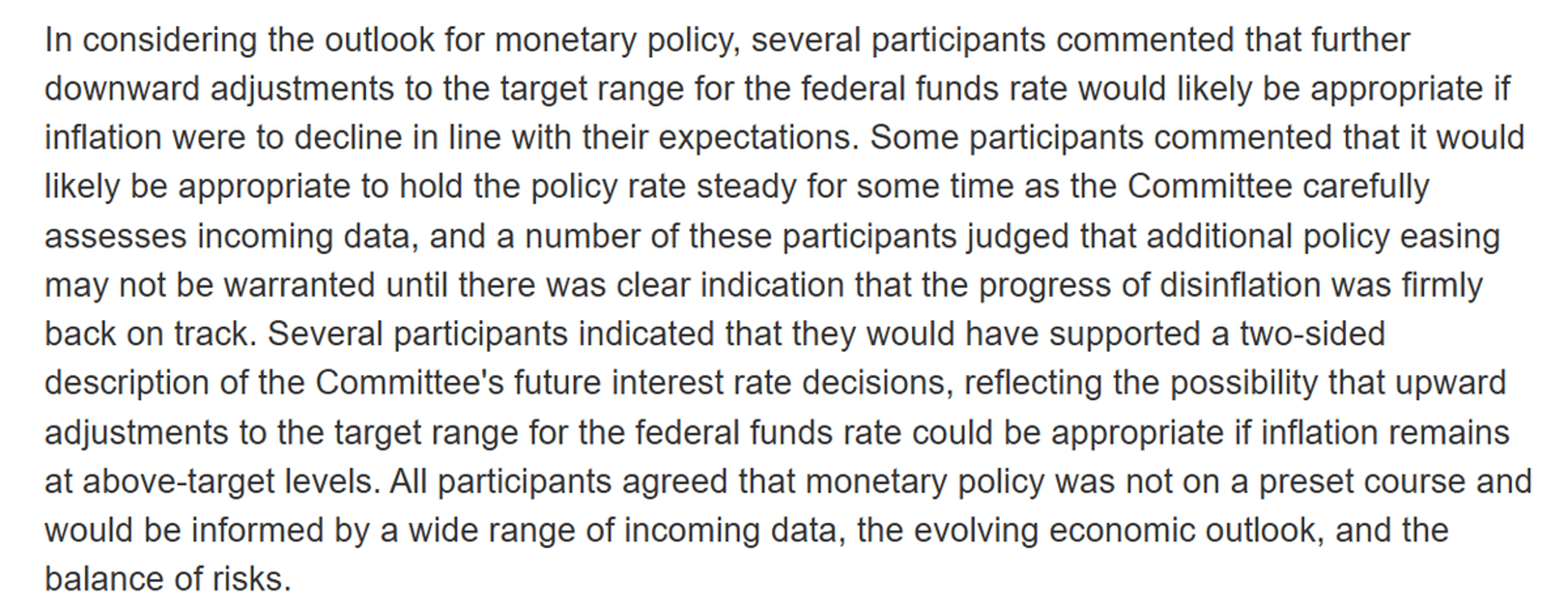

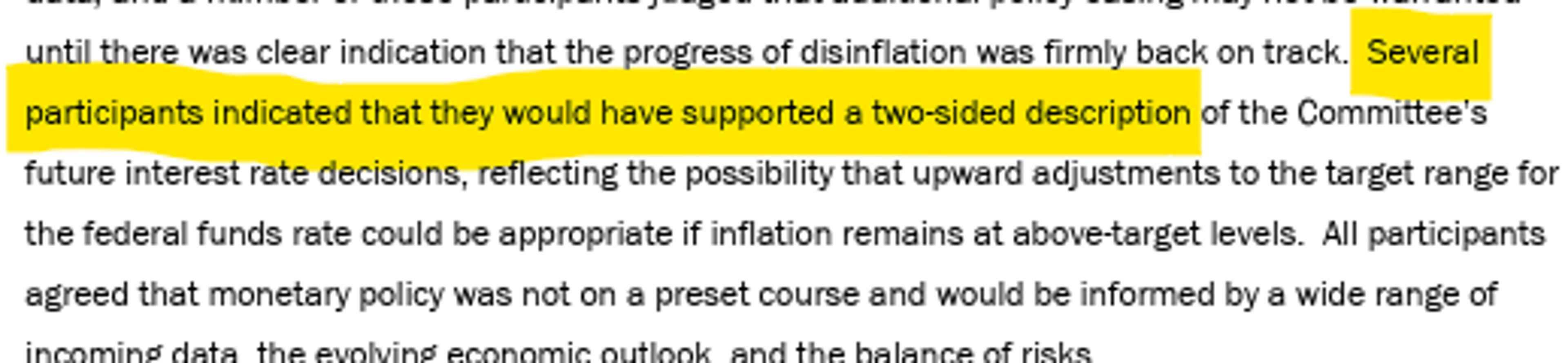

Fed Minutes Reveal Larger Faction Demanding Higher Cut Threshold

Minutes from the Fed's Jan. 27-28 meeting laid bare a lingering divide over where to set the bar for further rate cuts. In Fed speak, "some" is larger than "several" which means the group of "some" officials that includes those with...

By Nick Timiraos

News•Feb 18, 2026

The Big Four Recession Indicators: Industrial Production

Industrial production rose 0.7% in January, outpacing the 0.4% forecast, and posted a 2.3% year‑over‑year gain. Utilities output surged 2.1% month‑over‑month, while mining slipped 0.2% and manufacturing climbed 0.6%. The index’s current level is at or below the start‑of‑recession threshold...

By Advisor Perspectives — dshort (charts/econ & markets incl. rates)

Social•Feb 18, 2026

S&P Adds $500B, Gold Climbs; PCE Inflation Watch

WHAT A DAY, the S&P 500 has gained around $500 BILLION in market cap, up 0.8%. The index is now up 0.3% YTD 📈 Gold is also trading higher, back above $5,000/oz, as global tensions start to escalate 😳 Mark your calendars...

By Peter Tuchman (Einstein of Wall Street)

Social•Feb 18, 2026

Packed 24‑Hour Macro Calendar: Japan, US, China Data

The global macro docket for the next 24 hours of trade pics up. Japan has machinery orders, mfg activity survey, a 1-year and 20-year JGB auction, Jan CPI. Walmart and Alibaba report earnings. US and Canada trade balance. PBOC rate setting. Start...

By John Kicklighter

News•Feb 18, 2026

The 'Ex-America' Trade Is Off to a Roaring Start in 2026

Global equities have surged ahead of the U.S. market in 2026, with the MSCI EAFE up roughly 8% and the MSCI ACWI ex‑U.S. gaining about 8.5% year‑to‑date, while the S&P 500 is down 0.5%. Goldman Sachs notes this is the widest...

By Quartz — Economy/Markets (site-wide feed)

Social•Feb 18, 2026

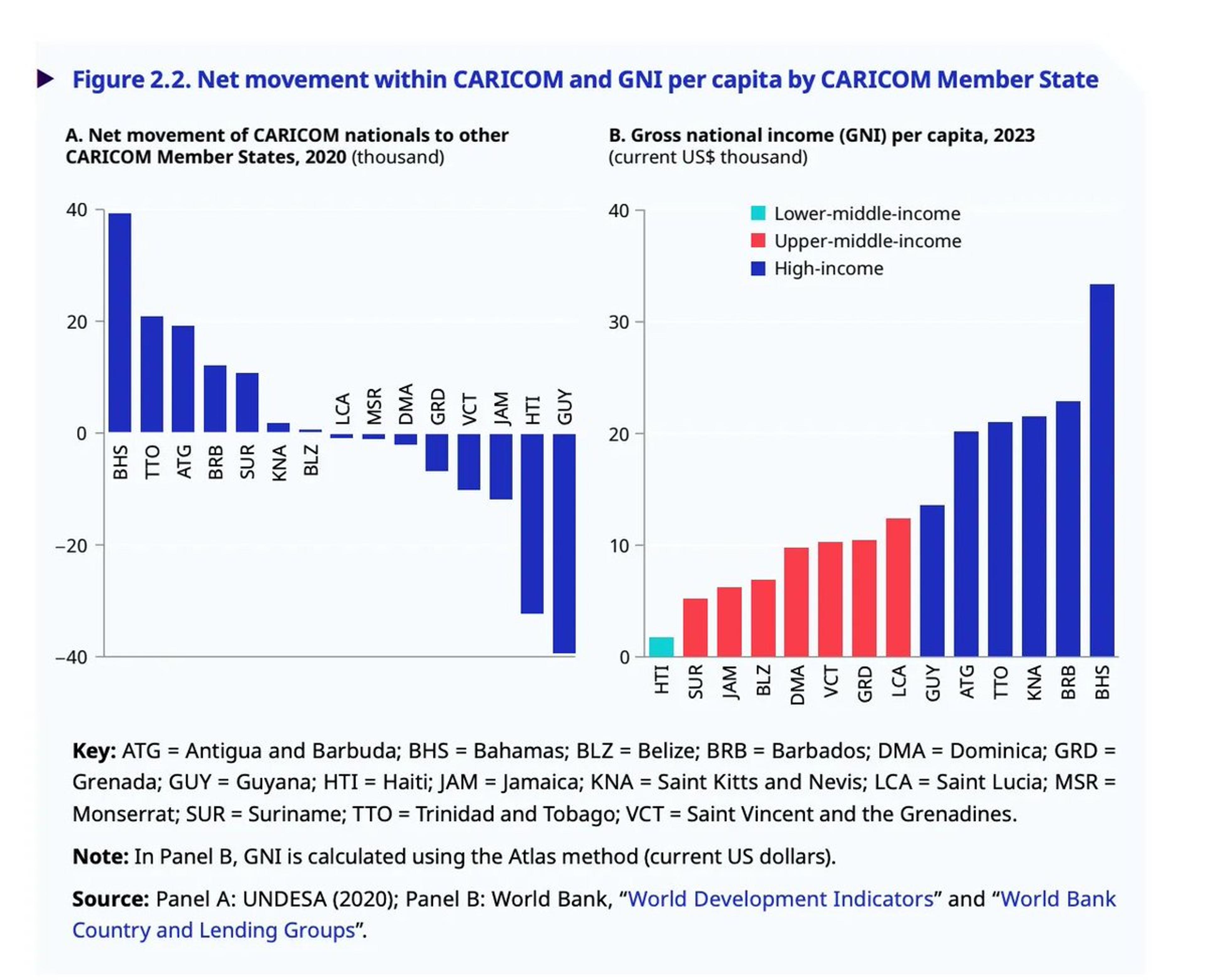

Income Gaps Fuel Migration Across CARICOM Nations

Stark differences in income drive migration within CARICOM (and these are official data). More at today's Chartbook Top Links: https://t.co/DaCnHTI3Wj

By Adam Tooze

Social•Feb 18, 2026

Tariffs Inflate Prices and Act Like Hidden Corporate Tax

A) Many studies have examined whether tariffs have been passed through to consumer prices, and they've found significant retail price increases B) Tariff burdens absorbed by US companies are an inefficient corporate tax, paid by Americans via lower wages or share...

By Scott Lincicome

News•Feb 18, 2026

Defence Giant BAE Hails Record Sales as Workers Remain on Strike

BAE Systems announced record 2025 results, with sales rising 10% to £30.7 billion and pre‑tax profit climbing to £2.6 billion. The company highlighted a historic order backlog as global defence budgets surge amid geopolitical tension. Meanwhile, Unite union members at the Lancashire...

By BBC News – Business

Social•Feb 18, 2026

Debt-Based Money Ensures Perpetual Debt, Devalues Assets

Bc of the interest component & exponential function of a debt based monetary system, there is never enough money to pay off the debt. And bc debts are always paid (either by lender or borrower), if they didn’t debase the...

By Brent Johnson

Social•Feb 18, 2026

Dalio Predicts US Will Print Money, Devalue Currency

Ray Dalio, founder of the world's LARGEST hedge fund, on the national debt: "When countries essentially go broke, what they do is... print money, devalue the currency, and create an artificially low interest rate...that is the way the [US] will do...

By Steve Hanke

News•Feb 18, 2026

Europe Is Squandering Its Leverage Over China

Europe is losing bargaining power with China as the continent’s growth stalls while Beijing posts a record trade surplus. German Chancellor Friedrich Merz’s upcoming China visit underscores the urgency, with Germany’s 2025 GDP expanding only 0.2% versus a $1.19 trillion Chinese surplus....

By Project Syndicate — Economics

Social•Feb 18, 2026

Lagarde’s Early Exit Fuels Concerns over ECB Politicization

The ECB should be apolitical. But now President Lagarde says she’s leaving early. According to people “familiar with her thinking,” this is so Macron can pick her successor before the French Presidential election in April 2027. Not very apolitical at...

By Robin Brooks

Social•Feb 18, 2026

Hawks Push Back, Hint at Two‑Sided Policy Language

FOMC minutes suggest that the hawks pushed back. "Several would support two-sided language" about policy direction and "several" noted that if inflation remains high, rate hikes might be necessary.

By Kathy Jones

News•Feb 18, 2026

India Keen to Diversify Crude Oil, Coking Coal Sources; Eyes High-Quality US Supplies: Piyush Goyal

India’s commerce minister Piyush Goyal said New Delhi will diversify crude oil and coking‑coal supplies, targeting high‑quality U.S. coal to reduce reliance on a few geographies. He highlighted a $100 billion aircraft demand from the United States over the next five...

By ET EnergyWorld (The Economic Times)

Social•Feb 18, 2026

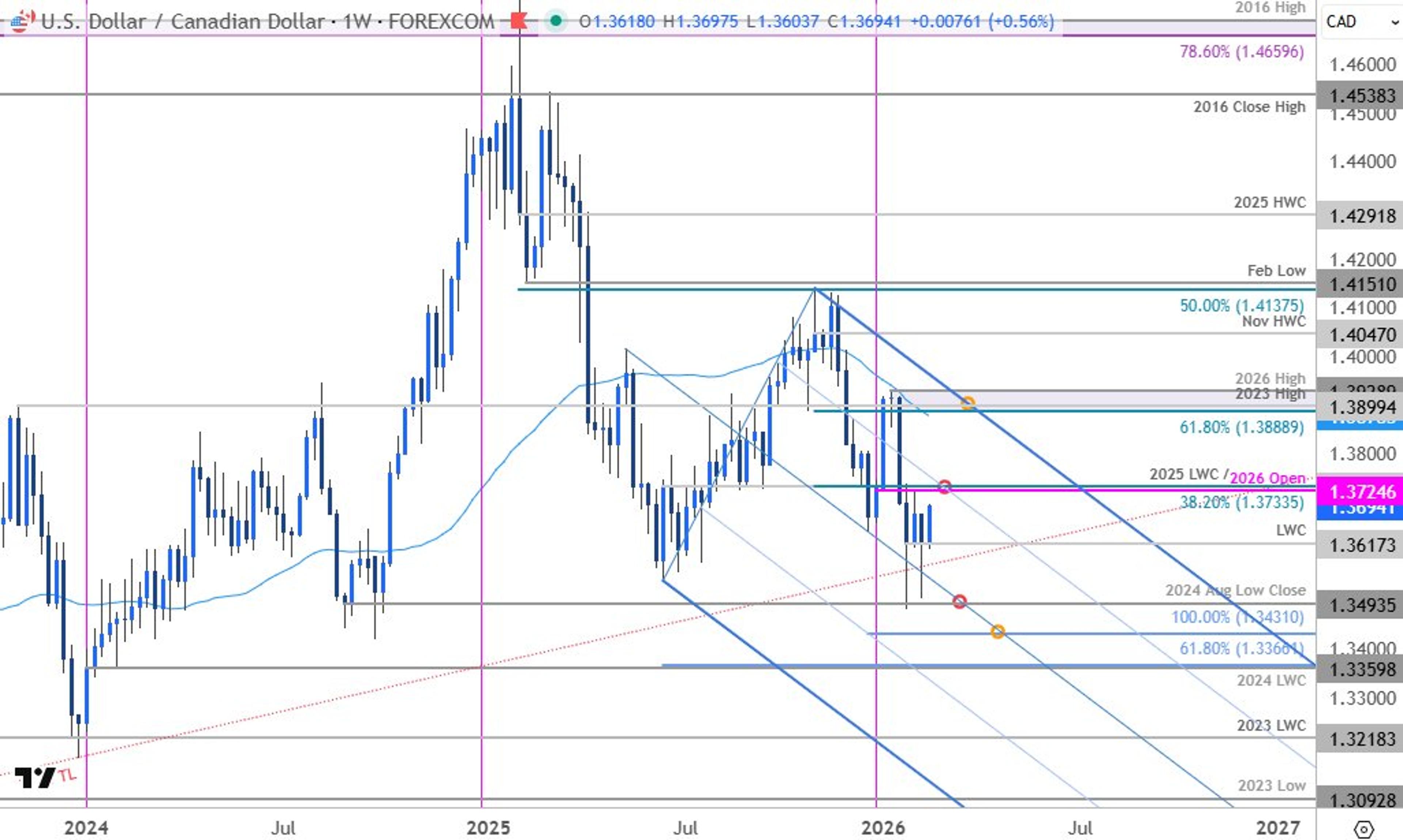

USD/CAD Nears Yearly High, Breakout Risk Rises

Canadian Dollar Forecast: USD/CAD Advances Toward Yearly Open – Breakout Risk Builds https://t.co/LswuuI4iVW $USDCAD Weekly Chart https://t.co/AfSOwTDtR3

By Michael Boutros

Social•Feb 18, 2026

FOMC Minutes Reveal Split Views: Cut, Hold, or Hike

Key paragraph of the FOMC minutes from January. (I am honestly a bit confused by the 'minutes math.') The main takeaway is that there is considerable disagreement. Cut, hold, and (even possibly) hike all got a nod. https://t.co/eV9ldjldl1 https://t.co/K53g1yqKJ8

By Claudia Sahm

News•Feb 18, 2026

Ground View: How Industry Leaders Are Shaping Pakistan’s Mining Future

The Pakistan Mineral Investment Forum (PMIF) will gather industry leaders in Islamabad to spotlight the country’s world‑class copper, gold, and critical mineral deposits, most notably the revived Reko Diq project. While the geology is undisputed, the article argues that mining...

By MINING.com

Social•Feb 18, 2026

FOMC Minutes Show Market‑Aligned Outlook, Fragile Jobs, Slowing Inflation

Few FOMC minutes takeaways: 1) Cmte basically in line with markets on major economic variables 2) Labor markets no longer outright weakening but remain fragile 3) Inflation decelerating as tariff passthru done, housing has downside (a misread on bad CPI method in Oct?) 1/...

By Guy LeBas

Social•Feb 18, 2026

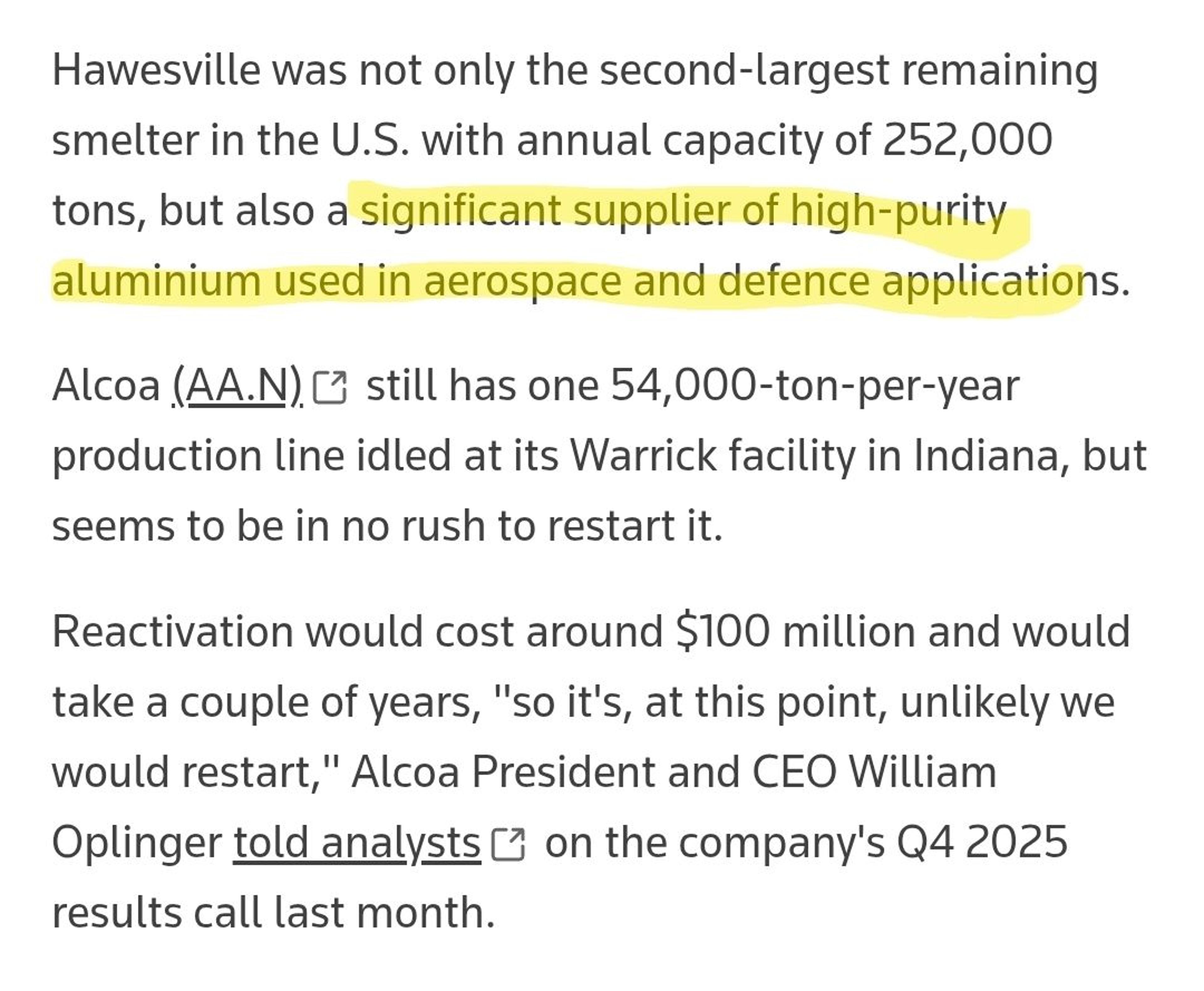

Tariffs Fail: US Down to Five Aluminum Smelters

"U.S. import tariffs haven't been enough to stop the United States losing another aluminium smelter, leaving the country with just five primary metal production plants." 😲 https://t.co/T5U4nxglb0 https://t.co/EOQY3OwzE6

By Scott Lincicome

News•Feb 18, 2026

China Gives Lithuania Punishing Silent Treatment over Taiwan

In 2021 Lithuania permitted a Taiwanese representative office to use the name "Taiwan" rather than "Taipei," directly challenging Beijing's One‑China policy. China answered not with public sanctions but with a silent diplomatic freeze, withdrawing embassy staff and removing Lithuania from...

By Asia Times – Defense

Social•Feb 18, 2026

Mania Depression: Elites Stagnate, Borrowers Slip Further

FWIW - The sentiment data suggests its not a "boomcession" we're experiencing but a "maniapression." Those at the top can't put enough into the markets, while those at the bottom fall further and further behind on their loans.

By Peter Atwater

Social•Feb 18, 2026

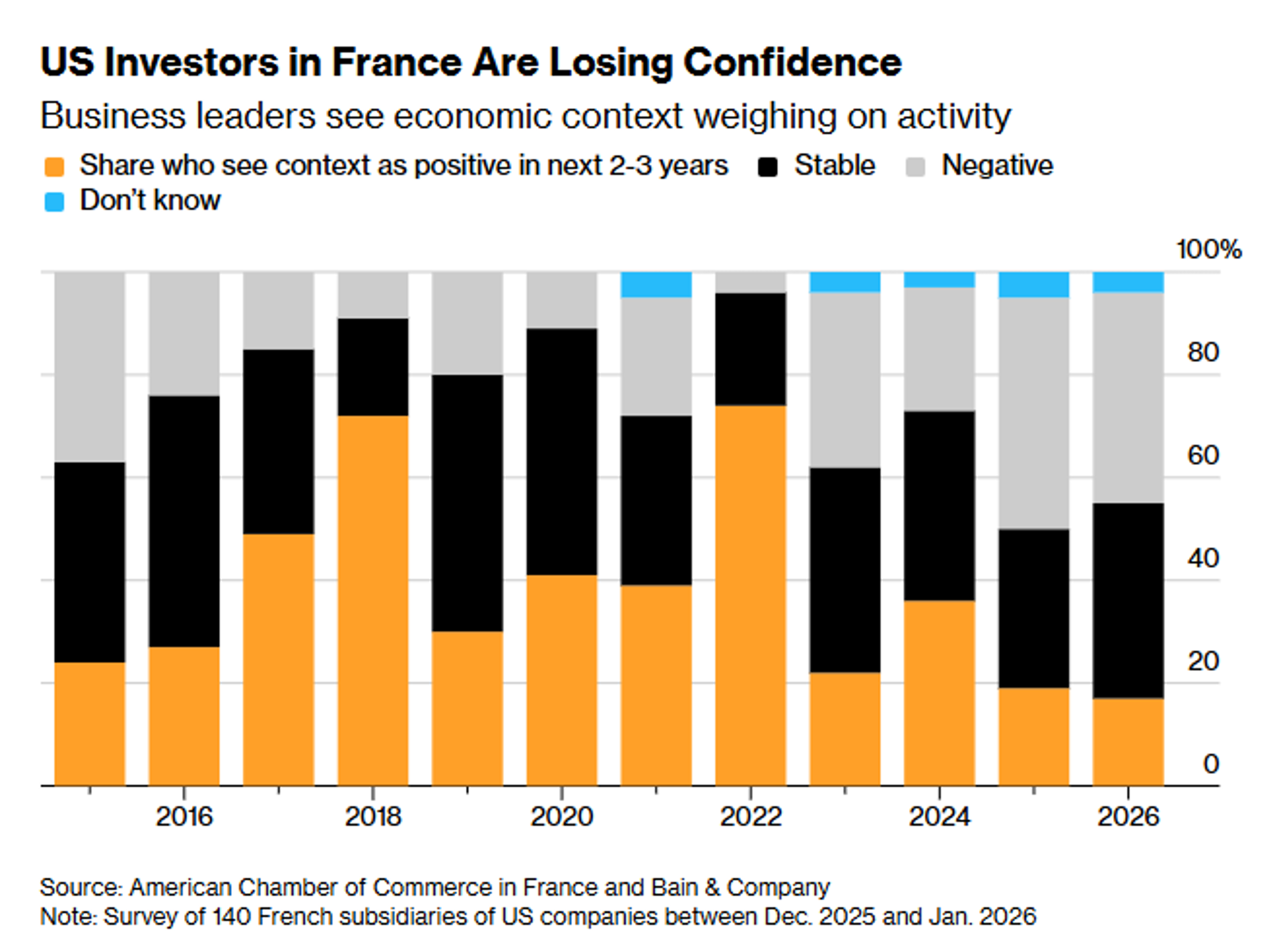

US Investors Turn Bearish on France as Macron Exits

US investors are gloomy on France as Macron era approaches its end https://t.co/a4q0NEuH3I via @WHorobin https://t.co/vhSuc9Ovr6

By Zöe Schneeweiss

News•Feb 18, 2026

AD Ports Joins Cameroon’s Douala New Dry Bulk Terminal Concession

UAE‑based AD Ports Group has entered a 30‑year concession with Africa Ports Development to design, build and operate a new dry‑bulk terminal at Cameroon’s Port of Douala. The partnership gives AD Ports an effective 51% economic stake and commits roughly...

By Seatrade Maritime

Social•Feb 18, 2026

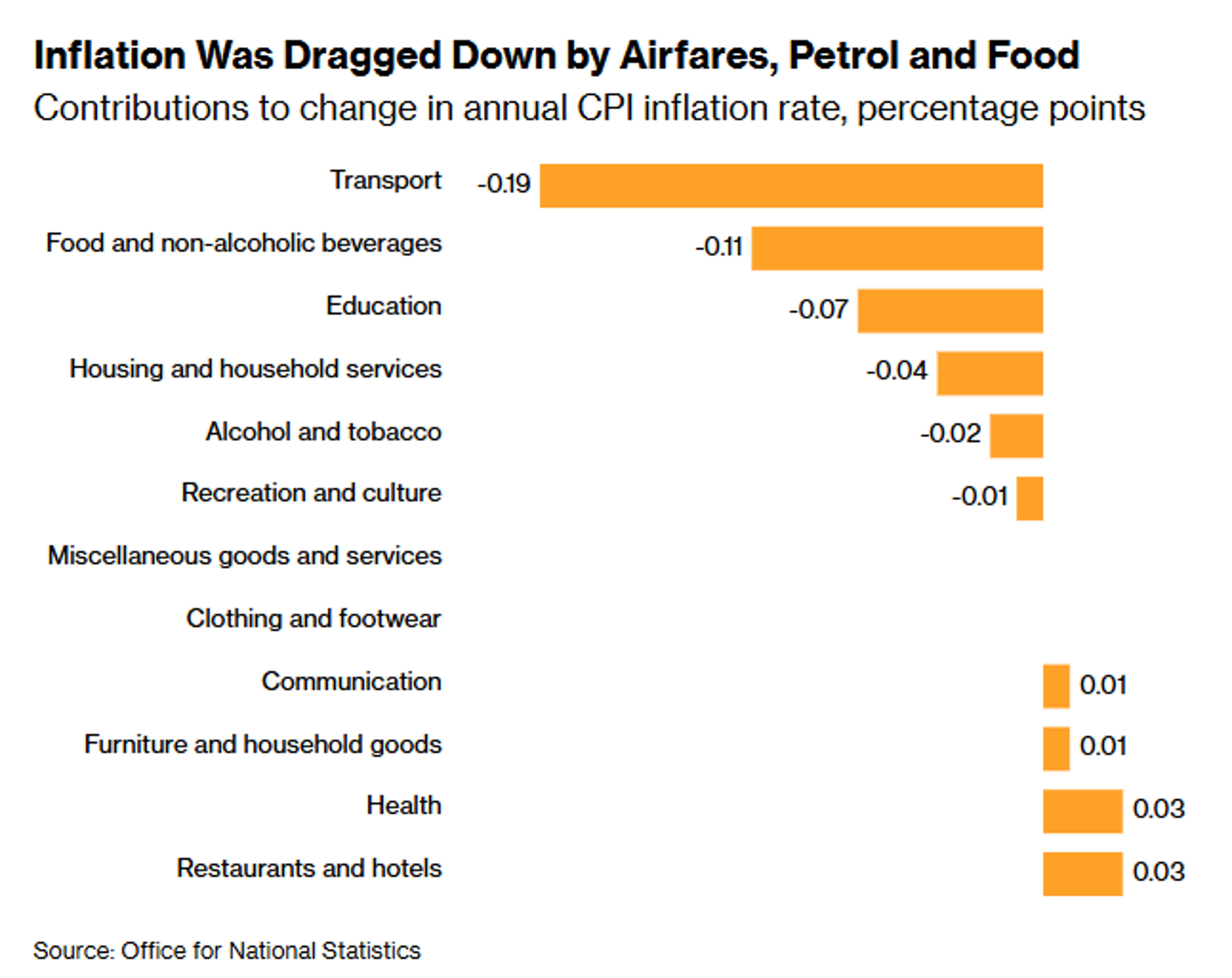

UK Inflation Hits 2025 Low, Strengthening BoE Rate‑Cut Case

UK inflation slowed to its weakest level since March 2025, bolstering the case for an interest rate cut when the Bank of England meets next month https://t.co/yJqzpiJ61p via @irinaanghel12 @PhilAldrick https://t.co/a5Mov7Jkhv

By Zöe Schneeweiss

Social•Feb 18, 2026

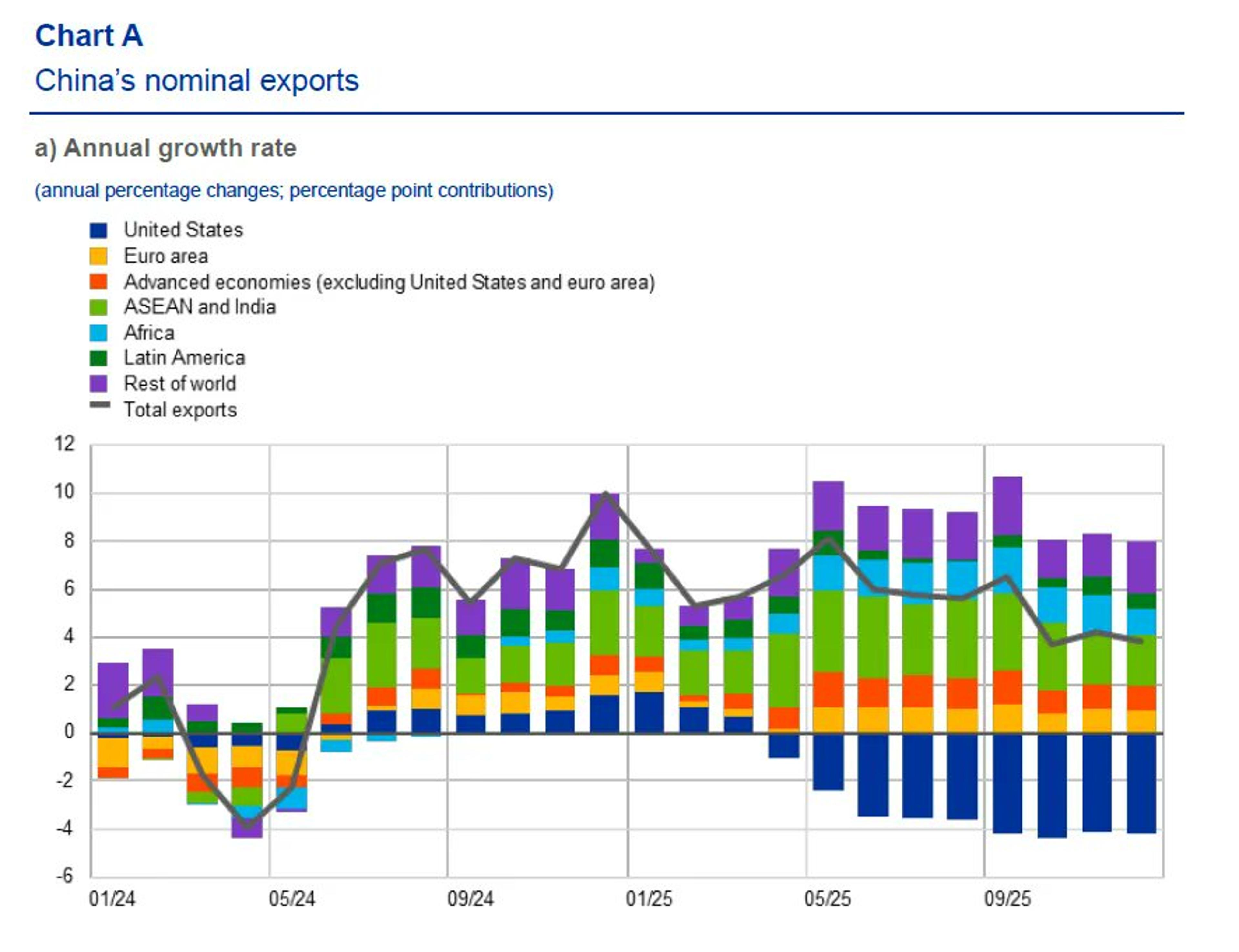

ECB Study Finds Tariffs Sparked Minor China Trade Diversion

Tariffs caused just a small China trade diversion, ECB study shows https://t.co/2xTwmZXdG6 via @weberalexander https://t.co/NfggkusEyQ

By Zöe Schneeweiss

News•Feb 18, 2026

Energy Transition Underpins Dry Bulk Sector

Electric‑vehicle sales have surged nearly 700% this decade, driving a rapid rise in spodumene shipments from Australia to China and doubling bulk volumes since 2023. Panamax vessels now carry almost half of the 7 million tonnes of dry bulk moved last...

By Seatrade Maritime

Social•Feb 18, 2026

Successor Must Be Independent, Pro‑Europe After Surprise Resignation

Bank of France Governor Francois Villeroy de Galhau says his successor must be independent and committed to Europe after his early resignation gave President Emmanuel Macron a surprise opportunity to pick the next central bank chief https://t.co/VVGP1D9Dj6 via @WHorobin https://t.co/rmqeTU4qJ7

By Zöe Schneeweiss