🎯Today's Global Economy Pulse

Updated 1h agoWhat's happening: US inflation remains entrenched despite Fed optimism

Federal Reserve January FOMC minutes confirm that price pressures persist in the United States. The core consumer‑price index rose 0.3% month‑over‑month, keeping annual inflation above the Fed’s 2% target, and policymakers see limited room for further easing.

News•Feb 20, 2026

Jim Cramer's Top 10 Things to Watch in the Stock Market Friday

Jim Cramer highlighted ten market catalysts for Friday, Feb 20, ranging from macro data to individual stocks. Weak Q4 GDP growth at 1.4% pushed futures lower, while Texas Roadhouse rallied over 3% on a strong Q1 outlook. GE Aerospace received a buy initiation with a 27% upside target, and Klarna reported a disastrous quarter, prompting sharp price‑target cuts. Other notable moves included Blue Owl loan sales, CrowdStrike’s target reduction, and Live Nation’s earnings beat.

By CNBC – US Top News & Analysis

News•Feb 20, 2026

European Central Bank Analysis Highlights Stabilizing Euro Area Property Investment Amid Mixed Drivers

The European Central Bank’s latest focus piece finds euro‑area property investment has likely bottomed out in late 2024, with a brief, modest rebound in early 2025 that quickly faded. After a sharp decline that began in 2022, housing investment remains about 7 %...

By Crowdfund Insider

Social•Feb 20, 2026

Protecting Domestic EVs Requires Tariffs or Local Content Rules

Very good Rhodium piece on the cost advantage of Chinese EVs: “In practice, countries seeking to protect domestic industries have two broad options. One is to impose very high tariffs that account not only for subsidies but also for structural...

By Michael Pettis

Blog•Feb 20, 2026

Gold and Silver Recovering

The episode reviews a recent rally in gold and silver prices, noting modest gains in Europe and unusually low trading volumes on the U.S. Comex market due to a holiday. It highlights the scant speculative interest and low open interest...

By McleodFinance (Alasdair Macleod)

Podcast•Feb 20, 2026•7 min

Shutdown Shadow

The episode examines the impact of the 43‑day government shutdown on U.S. GDP reporting, noting that growth is still projected to be robust despite the delay. It discusses emerging signs that higher‑income households are curbing discretionary spending and outlines what...

By Reuters Morning Bid

News•Feb 20, 2026

WDI May Benefit From Shifting Interest Rate Policy

Western Asset Diversified Income Fund (WDI) trades at a 3.04% discount to NAV and offers a 12.41% yield, positioning it as a high‑yield income vehicle. The fund’s portfolio is heavily weighted toward high‑yield corporate bonds and a sizable floating‑rate component,...

By Seeking Alpha – ETFs & Funds

News•Feb 20, 2026

Brazil Imposes Anti-Dumping Duties on Chinese Steel

Brazil’s foreign trade committee approved five‑year anti‑dumping duties on a wide range of Chinese steel products after a 2024 investigation revealed pricing below market levels. The duties range from US$323 to US$670 per ton for cold‑rolled coil and US$285 to...

By Just Auto

News•Feb 20, 2026

Philippine Fast-Moving Consumer Goods Spending Growth Seen Slowing in 2026—Study

The Worldpanel by Numerator report projects Philippine FMCG spending to grow only 3‑4% in 2026, a sharp deceleration from last year’s 5.2% rise. The slowdown reflects weaker GDP growth, now seen at 5.3% versus an earlier 6% estimate, and higher...

By Manila Bulletin – Business

News•Feb 20, 2026

US-India Trade Marathon Eyes April Finish Line

India and the United States are moving toward an interim trade agreement that is expected to be signed in April, Union Commerce Minister Piyush Goyal announced. Negotiators will convene in Washington from Feb 23 to finalize the legal text, converting a...

By The Economic Times (India) – Economy

News•Feb 20, 2026

Economic Factors and Themes to Be Mindful Of

Investors face heightened global volatility in 2026 as leading central banks diverge—while the Fed and BoE continue rate cuts, the ECB sits near neutral and the BoJ tightens. Geopolitical flashpoints around the United States add safe‑haven demand, further weakening the...

By Vietnam Investment Review (VIR)

News•Feb 20, 2026

Danang Positioned as Crucial Economic Hub for Central Vietnam

Danang’s 2045 master plan re‑imagines the city as a megacity and international financial centre, integrating coastal, mountainous and border zones. The Danang International Financial Centre (IFC) began operations in early 2026, focusing on digital finance, asset tokenisation and green‑finance solutions....

By Vietnam Investment Review (VIR)

News•Feb 20, 2026

Central Bank of Ireland Calls for Stronger Economic Initiatives and Strategic Investments in 2026

Ireland’s central bank warned that the country must deepen economic resilience as it enters 2026, despite current strength. Governor Gabriel Makhlouf and Deputy Governor Vasileios Madouros outlined five domestic priorities, including targeted infrastructure, stronger indigenous businesses, fiscal buffers, household market...

By Crowdfund Insider

News•Feb 20, 2026

Southeast Asia Braces for 'Increasing Divergence' After Mixed 2025 Growth

2025 saw Southeast Asia split between export‑driven growth and contraction. Vietnam and Singapore recorded strong export gains despite U.S. tariff volatility, while the Philippines and Thailand were battered by severe weather events and political instability, dragging their economies down. The...

By Nikkei Asia – Economy

News•Feb 20, 2026

Japanese Market 'More Dynamic' Than London, Says Apollo CEO

Apollo Global Management’s CEO Marc Rowan told Nikkei that Japan’s corporate finance market is becoming more dynamic than London’s, prompting Apollo to expand its private‑credit platform in the country. He highlighted the need for long‑dated funding to support infrastructure, energy...

By Nikkei Asia – Economy

News•Feb 20, 2026

COMMENT: Myanmar’s Fragile Post‑election Balancing Act

Myanmar’s December‑January 2025‑26 election was conducted solely in areas under junta control, cementing the military’s claim to power while excluding large swaths of the population. The vote did little to curb the civil war, as resistance forces—including the People’s Defence...

By bne IntelliNews

News•Feb 20, 2026

All Global Experiences Useful for Vietnam S International Financial Hub

Vietnam aims to build an international financial centre by drawing on global precedents such as Dubai’s DIFC, China’s Shenzhen and Hangzhou, and Kazakhstan’s AIFC. Experts stress that independent, long‑term regulation, niche specialization in digital and green finance, and adaptive legal...

By Vietnam Investment Review (VIR)

News•Feb 20, 2026

Raised Ties Reaffirm Strategic Trust

Vietnam and the United Kingdom have upgraded their relationship to a comprehensive strategic partnership, the highest tier in Vietnam’s foreign‑policy framework. The deal follows Party General Secretary To Lam’s October visit to Britain and opens cooperation in politics, security, trade, education...

By Vietnam Investment Review (VIR)

News•Feb 20, 2026

India Sets ₹25,000 Crore Export Engine in Motion as Goyal Launches Plan

India’s Commerce Minister Piyush Goyal launched the ₹25,060‑crore Export Promotion Mission (EPM), a six‑year programme designed to boost outbound shipments and simplify export processes. The initiative consolidates multiple support schemes into a single, digitally driven framework aimed at micro, small...

By The Economic Times (India) – Economy

News•Feb 20, 2026

Five Things to Know to Start Your Day

Nigeria's federal government ordered ministries to defer 70% of the 2025 capital budget to 2026, limiting new projects to prioritize existing ones amid weak revenues. The Independent Corrupt Practices Commission raided former Kaduna governor Nasir El‑Rufai’s Abuja home as he remains...

By BusinessDay (Nigeria)

News•Feb 20, 2026

Strong Manufacturing Growth Lifts Flash PMI to Three-Month High of 59.3 in Feb

India’s flash Composite PMI rose to 59.3 in February, its strongest level in three months, driven by a surge in manufacturing activity. Total new orders grew at the fastest pace since November, pushing output to a four‑month high, while services...

By The Hindu BusinessLine – Economy

News•Feb 20, 2026

Africa Needs Patient Capital for the Long Term

Africa’s growth potential is hampered by a $350 billion SME financing gap and annual infrastructure needs of $130‑170 billion, far exceeding current investment. While the continent’s population tops 1.5 billion and GDP surpasses $3 trillion, capital flows remain fragmented and short‑term. The article argues...

By African Business

News•Feb 20, 2026

Google Bigger than India GDP? Sanjeev Bikhchandani Exposes the Flaw in that Viral Claim

A viral post claimed Google’s $4 trillion market capitalisation exceeds India’s GDP, prompting entrepreneur Sanjeev Bikhchandani to debunk the analogy. He explained that market cap is a stock measure reflecting investor expectations, while GDP is a flow metric tracking annual economic...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

Could Medical Care Help Cure China’s Services Trade Deficit?

China’s medical tourism is gaining traction as foreign patients praise rapid, affordable care in megacities like Shanghai and Beijing. While the absolute number of inbound patients remains modest, industry insiders see a growing pipeline driven by visa‑free entry, expanding international...

By South China Morning Post — Economy

News•Feb 20, 2026

Why Global Capital Is Looking at India Differently This Year

India’s economy is gaining traction through robust digital public infrastructure and maturing regulatory frameworks, positioning it as a distinct asset class for global investors. The latest Union Budget underscores this shift by offering a 20‑year tax holiday and a flat...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

US and Indonesia Agree to Cut Tariffs to 19% Under New Trade Deal

The United States and Indonesia have concluded a trade agreement that reduces U.S. tariffs on Indonesian goods to 19% from 32%. Indonesia will eliminate trade barriers on more than 99% of American exports across agriculture, healthcare, seafood, technology and automotive...

By bne IntelliNews

News•Feb 20, 2026

US Market | Credit Concerns Mount: Blue Owl Shake-Up Weighs on US Financial Stocks

Blue Owl Capital announced the sale of $1.4 billion of assets across three credit funds and permanently halted redemptions in one fund to return capital and reduce leverage. The announcement triggered a broad sell‑off in listed alternative‑asset managers such as Apollo,...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

RSBT ETF: It's A Directional Bet, Not A Diversification Vehicle

The Return Stacked Bonds & Managed Futures ETF (RSBT) posted a 12.25% year‑over‑year price gain after a tough 2022‑23 inflation cycle. The fund allocates capital between the AGG bond ETF and a suite of trend‑following managed‑futures strategies, positioning it as...

By Seeking Alpha – ETFs & Funds

News•Feb 20, 2026

Rupee Declines 27 Paise to 90.95 Against US Dollar in Early Trade

The Indian rupee slipped to 90.95 per U.S. dollar in early Friday trade, down 27 paise from its previous close. The decline was driven by a firmer dollar, higher Brent crude at $71.77 a barrel, and escalating U.S.-Iran tensions. Domestic...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

Pakistani PM Holds Talks with Rubio After Washington Summit

Pakistan’s Prime Minister Shehbaz Sharif met U.S. Secretary of State Marco Rubio in Washington on Feb 19, focusing on cooperation in critical minerals, energy, counter‑terrorism and potential American investment. The discussion also highlighted Pakistan’s backing of President Donald Trump’s Gaza peace plan...

By bne IntelliNews

News•Feb 20, 2026

Global Market | Japan’s Tightening Cycle Could Redraw the Map of Global Market Liquidity

The Bank of Japan has ended its ultra‑easy stance, pushing policy rates to the highest level in decades and pricing in another hike. Higher domestic yields are likely to trigger repatriation of Japanese savings, cutting the flow of low‑cost funding...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

Infra Sector Outlook Cautious as Weak Q3 Performance Leads to 4% YoY Contraction: Nuvama Research

India's infrastructure sector posted a 4% year‑on‑year revenue contraction in Q3 FY26, driven by eroding order books, payment delays, prolonged monsoons and construction bans. Average EBITDA margin slipped 40 basis points to 10.1%, while adjusted PAT margin fell to 5.2%....

By The Economic Times (India) – Economy

Social•Feb 20, 2026

Structural Conditions Set Stage for Multi-Year Energy Bull

The STRUCTURAL CONDITIONS are right for a multi-year bull energy market, says @ericnuttall That doesn't mean it's started or that it will be a straight line back to $90-$100 oil prices. Prices will remain volatile, cyclical, and politically distorted — even...

By Art Berman Blog

News•Feb 20, 2026

White House Maritime Action Plan Shows OMSA Leadership on Regulatory Reform

The White House released America’s Maritime Action Plan, a sweeping strategy to strengthen the U.S. maritime sector through regulatory reform, infrastructure investment, and workforce development. A central pillar targets the elimination of redundant, obsolete, or overly burdensome regulations, echoing Offshore...

By The Maritime Executive

News•Feb 20, 2026

Goldman: Gold to Grind Higher to $5,400/Oz by End-2026 on Strong Demand

Goldman Sachs projects gold prices to climb to $5,400 per ounce by the end of 2026, driven primarily by renewed central‑bank buying and modest private‑investor inflows linked to Federal Reserve rate cuts. The forecast assumes a conservative base case with...

By ForexLive — Feed

News•Feb 20, 2026

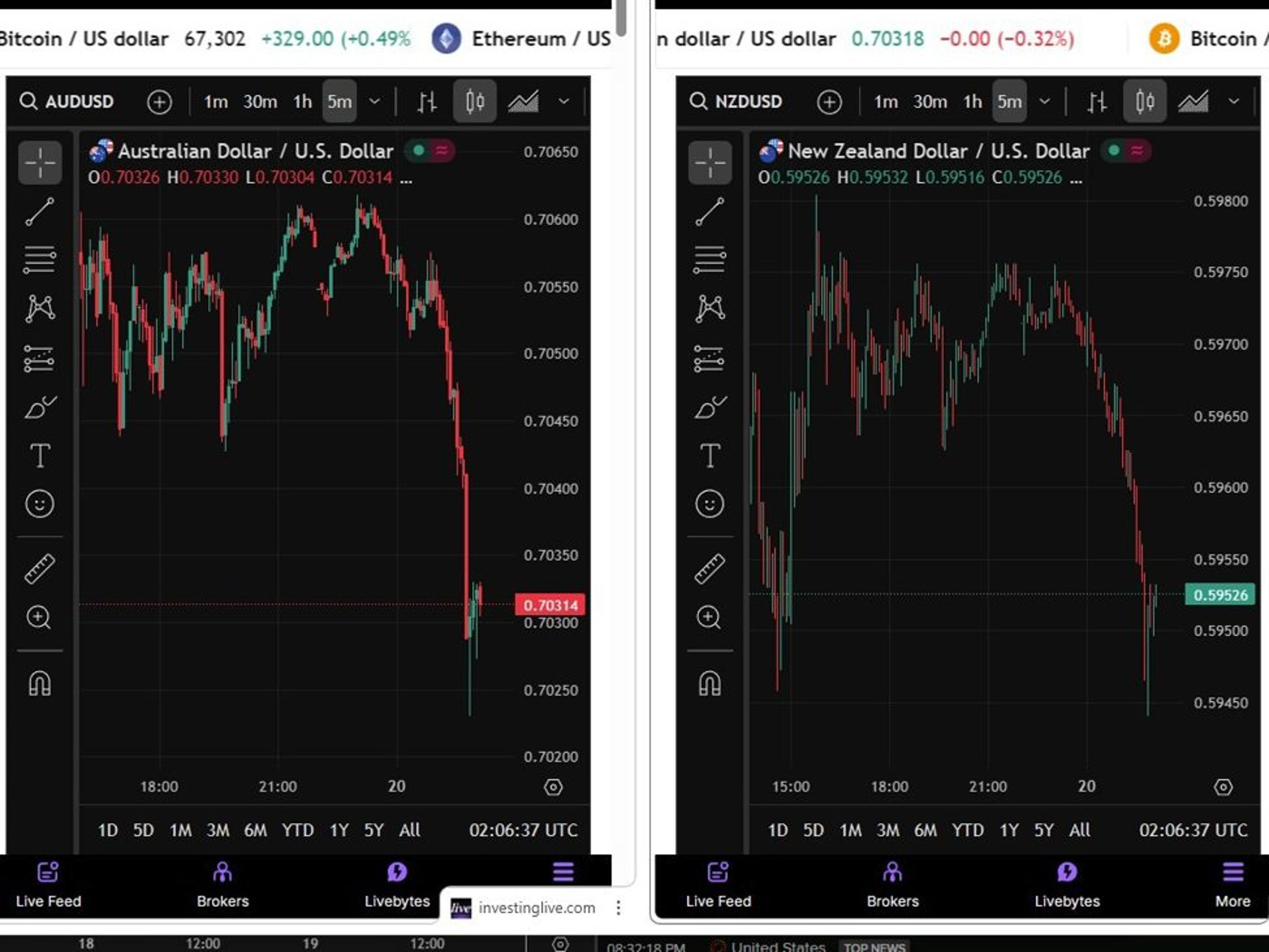

NZD, AUD Fall as RBNZ Says Inflation Returning to Target, No Preset Path

The New Zealand and Australian dollars slipped in Asian trade after the Reserve Bank of New Zealand signaled that inflation is already back within its 2% target band and is expected to stay there for the next year. Governor Adrian Breman emphasized that...

By ForexLive — Feed

News•Feb 20, 2026

Iran Tells UN Chief It Will Respond 'Decisively' If Subjected to Military Aggression

Iran warned the United Nations that any military aggression against it would be met with decisive force, stating that bases, facilities and assets of the perceived hostile force would be considered legitimate targets. The warning was delivered in a letter...

By Al-Monitor – All

News•Feb 20, 2026

US Removing Guardrails From Proposed Saudi Nuclear Deal, Document Says

President Trump has sent Congress a draft 123 Agreement to launch a civil nuclear partnership with Saudi Arabia that omits the long‑standing Additional Protocol and other non‑proliferation guardrails. The document allows Saudi Arabia to pursue uranium enrichment and spent‑fuel reprocessing,...

By Al-Monitor – All

News•Feb 20, 2026

USD Gains on Strong US Data Unlikely to Last; Policy Uncertainty, Political Risks to Cap

MUFG’s Derek Halpenny says the U.S. dollar’s recent rally, sparked by stronger‑than‑expected durable‑goods, housing and industrial production data and hawkish Fed minutes, is unlikely to be sustained. While the minutes hinted at a cautious stance on further rate cuts, Halpenny...

By ForexLive — Feed

News•Feb 20, 2026

Shares of Local Oil Explorers Surge on Supply Disruption Fears

Shares of Indian upstream explorers jumped as Brent crude breached $71 per barrel amid renewed US‑Iran tensions and temporary Strait of Hormuz closures. Oil India rose 5.2% and ONGC gained 3.6%, while downstream marketers HPCL and BPCL slipped nearly 5%...

By Economic Times — Markets

News•Feb 20, 2026

IMF Warns Venezuela’s Economy and Humanitarian Situation Is ‘Quite Fragile’

The IMF warned that Venezuela’s economy and humanitarian situation remain “quite fragile,” citing triple‑digit inflation, a sharply depreciating currency and public debt at roughly 180 percent of GDP. The country has seen massive emigration, with about 8 million people leaving since 2014,...

By Al Jazeera – All News (includes Economy)

Social•Feb 20, 2026

US Stock Market Hits Record Concentration: Top 10 Own 40%

🚨US market concentration BUBBLE in one chart: The top 10 US stocks make up a record 40% of the S&P 500 market value. At the same time, the weight of the largest stock in the S&P 500 relative to the 75th percentile...

By Global Markets Investor (newsletter author)

Social•Feb 20, 2026

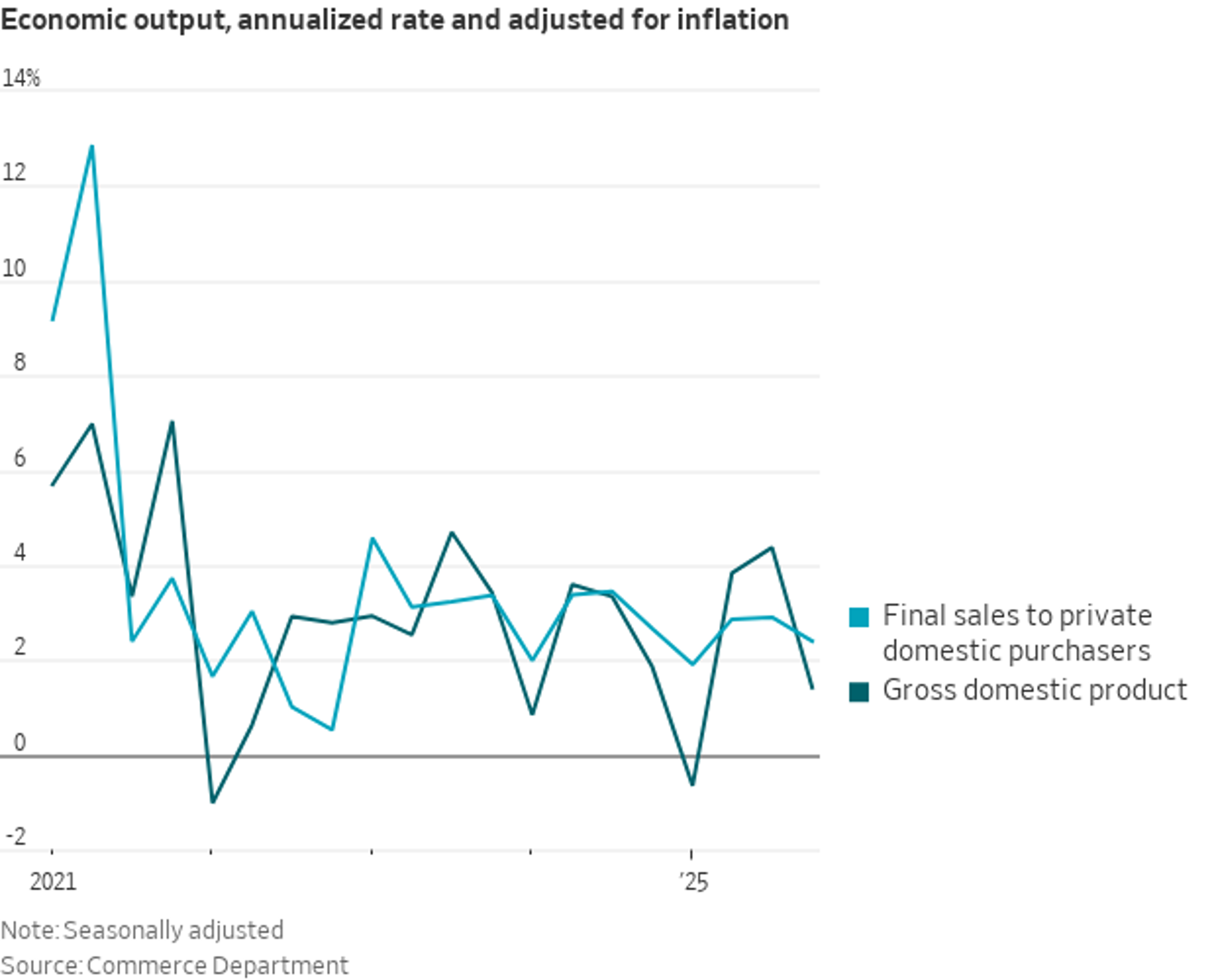

US Underlying Domestic Demand Grew 2.4% in Q4

US GDP: A gauge of underlying domestic demand—real final sales to private domestic purchasers (GDP less inventory change, net exports, and government spending)—grew at a 2.4% annualized rate in Q4 https://t.co/XefZvVp18v

By Nick Timiraos

Social•Feb 20, 2026

Trump’s 5.4% GDP Claim Was Just a Model

Remember when Trump was bragging about Q4 GDP growth, quoting a 5.4% rate? That was the Atlanta Fed's GDPNow model, not the actual. Now we have the actual: 1.4%. Moral: Don't take GDP "trackers" or anyone citing them, remotely seriously....

By Ian Shepherdson

Social•Feb 20, 2026

UK Retail Sales Record Fastest Growth in 20 Months

UK retail sales begin the year with the fastest growth in 20 months https://t.co/GPGNaZk4Oa via @irinaanghel12 https://t.co/kAm5UcAWvQ

By Zöe Schneeweiss

Social•Feb 20, 2026

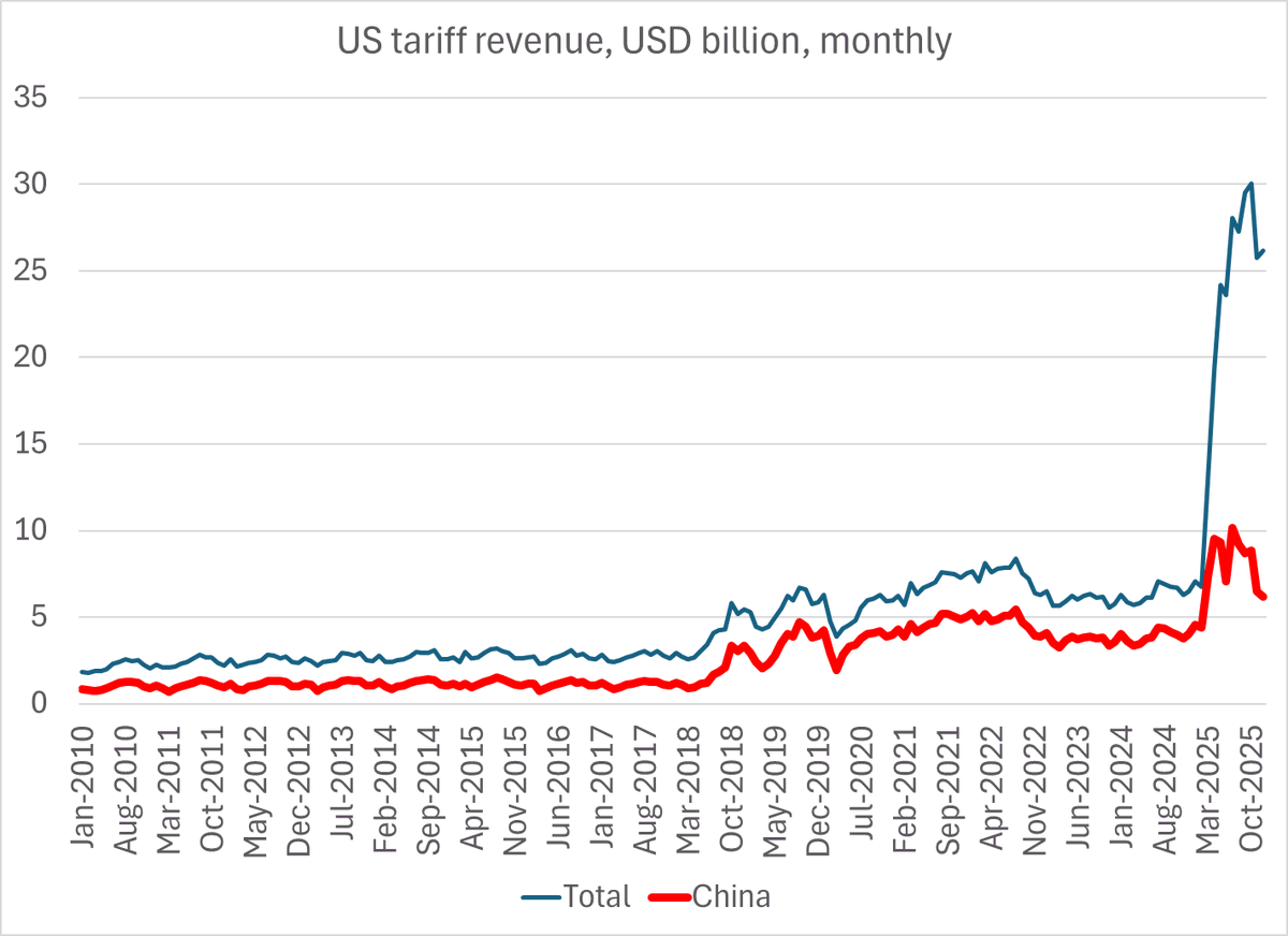

Busan Deal: US Sacrific

The impact of the "Busan" deal is now in the trade data -- the US clearly gave up a bit of tariff revenue (lowering the tariff on China) for a bit of supply chain peace, and the prospect of...

By Brad Setser

Social•Feb 20, 2026

IMF Estimates Chinese Yuan Undervalued by Roughly 19%

Just how undervalued is the Chinese yuan -- the IMF (via the Economist) just revised its estimate up to 19% (plus or minus 4%) 1/many https://t.co/IJ4Z1SmGIq

By Brad Setser

Social•Feb 20, 2026

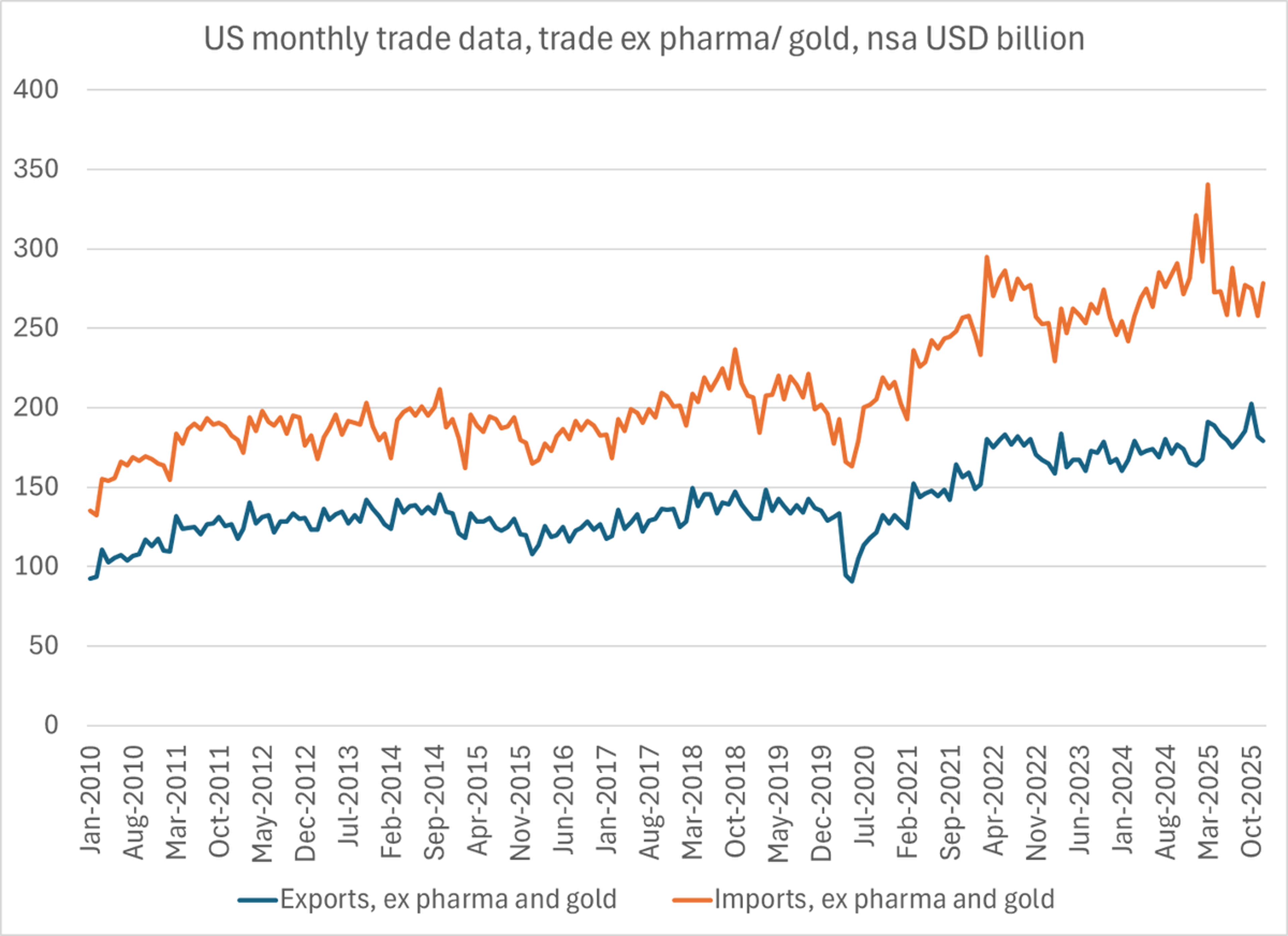

Exclude Pharma and Gold to Reveal True US Trade Trend

I think the best way to look at the underlying trend in the US trade data is strip out pharmaceuticals and gold (both were heavily influenced by the threat of tariffs, even though none were imposed on either category) 1/ https://t.co/7l20zR7CTr

By Brad Setser

Social•Feb 20, 2026

Rising PMI Could Spark Market Melt‑Down, Delay Fed Cuts

Will the stock market melt down if the US economy heats up, banishing traders' hopes for Fed rate cuts? All eyes turn to PMI data to find out. #stockmarkets #USD #fed #pmi #economy #interestrates #macro #trading https://t.co/fgEbuQrjnq

By Ilya Spivak

Social•Feb 20, 2026

Strategic Partnership Shouldn't Just Be German Production in China

Hope the "strategic partnership" is more than allowing German companies to produce in China for the German (and European) market ...

By Brad Setser

Social•Feb 20, 2026

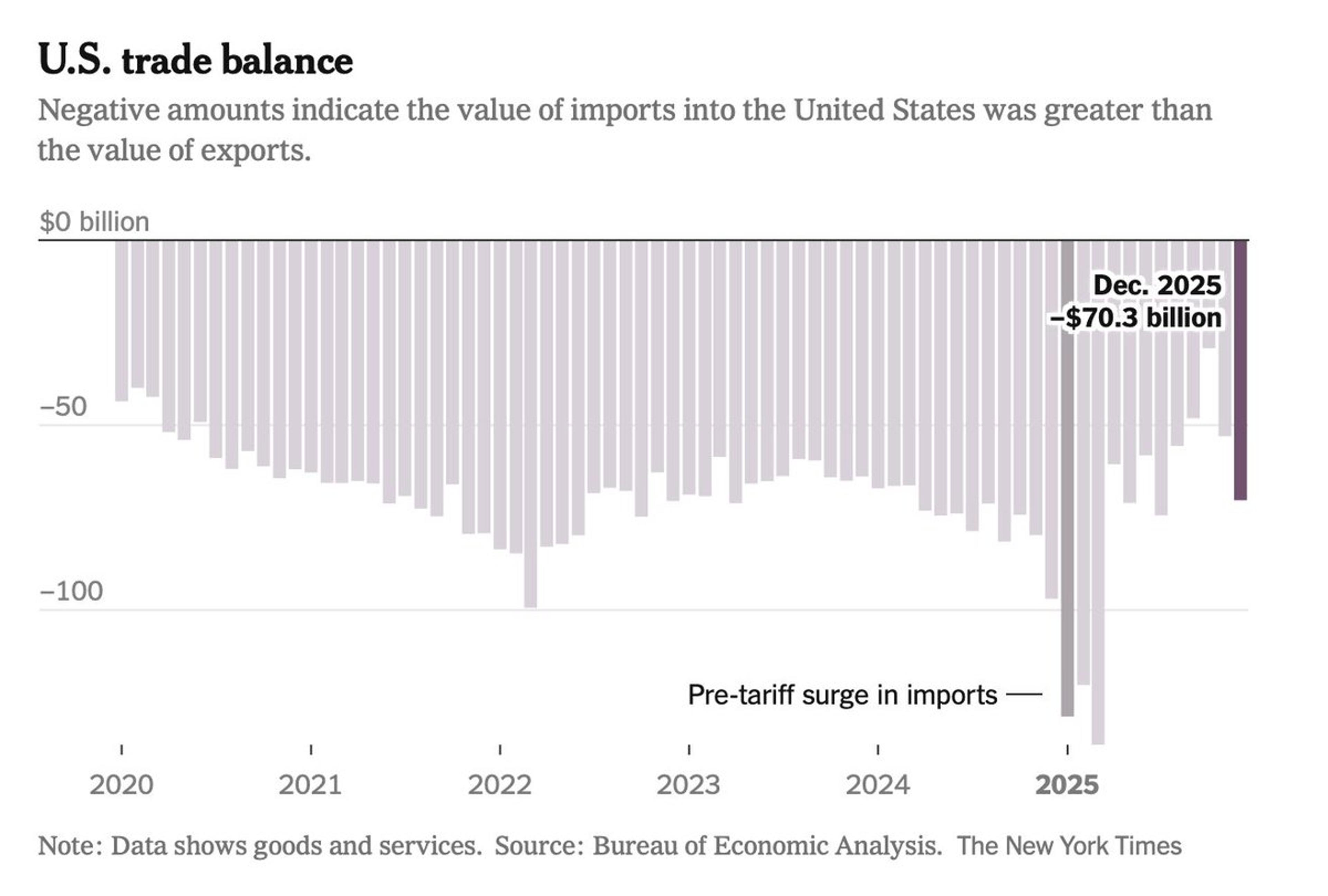

Trump's Tariffs Fail, Trade Deficit Widens to $70 B

Pres. Trump promised his steep tariffs would narrow the trade deficit and spark a manufacturing revival. New federal data show the U.S. trade deficit widened to –$70.3B in December 2025. So much for Trump's trade spin. https://t.co/NIGIRs4sQt

By Steve Hanke