🎯Today's Global Economy Pulse

Updated 1h agoWhat's happening: US inflation remains entrenched despite Fed optimism

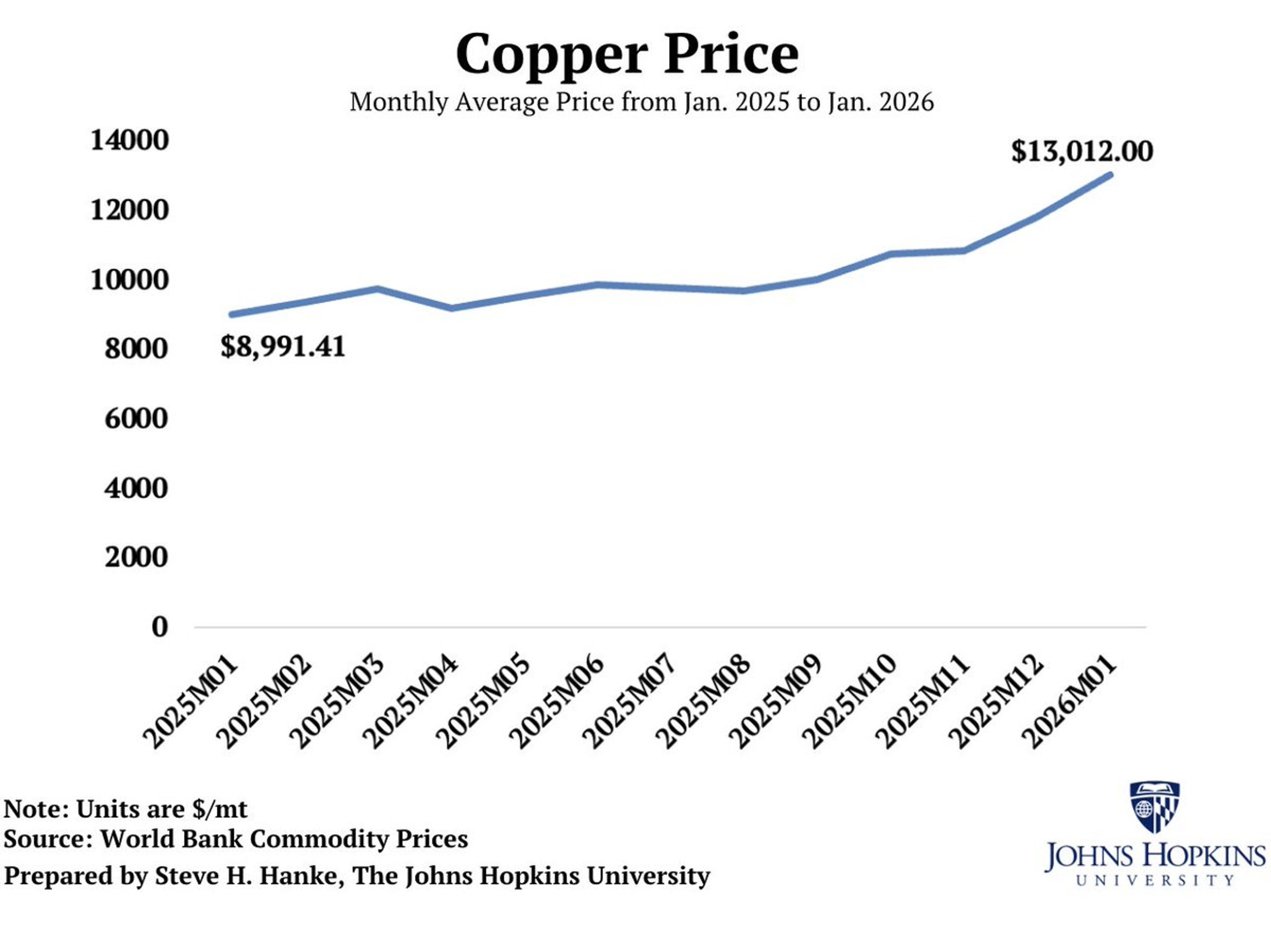

Federal Reserve January FOMC minutes confirm that price pressures persist in the United States. The core consumer‑price index rose 0.3% month‑over‑month, keeping annual inflation above the Fed’s 2% target, and policymakers see limited room for further easing.

News•Feb 20, 2026

Japan Inflation Slows to 1.5% in January, Core Measures Ease. What Will the BoJ Think?

Japan’s consumer price index slowed sharply in January, with headline inflation dropping to 1.5% year‑over‑year, the lowest level since March 2022 and below expectations. Core inflation excluding fresh food eased to 2.0% YoY, while the core‑core measure fell to 2.6%, ending a 45‑month run above the Bank of Japan’s 2% target. Despite the near‑term slowdown, the BoJ raised its FY2026 inflation projections, and the new government’s two‑year food‑tax suspension could keep price pressures subdued.

By ForexLive — Feed

Social•Feb 20, 2026

HSBC Cuts US DCM, Shifts Focus to Asian Banks

Macro: HSBC trims ~10% of US DCM in broader $1.8bn cost overhaul and pivot to Asia/Middle East. Key factors: management cuts, M&A/ECM pullback. Risk: execution/credit cycles. Trade: favor Asian bank equities. — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

News•Feb 20, 2026

Civil War-Torn Sudan Sits On Unexplored Mineral Riches Worth Billions

Sudan, despite a civil war that began in 2023, is courting foreign investors to develop its largely untapped mineral portfolio that includes gold, copper, uranium and rare‑earth elements. Gold production set a new record of 70 tonnes in 2025, generating...

By OilPrice.com – Main

Social•Feb 19, 2026

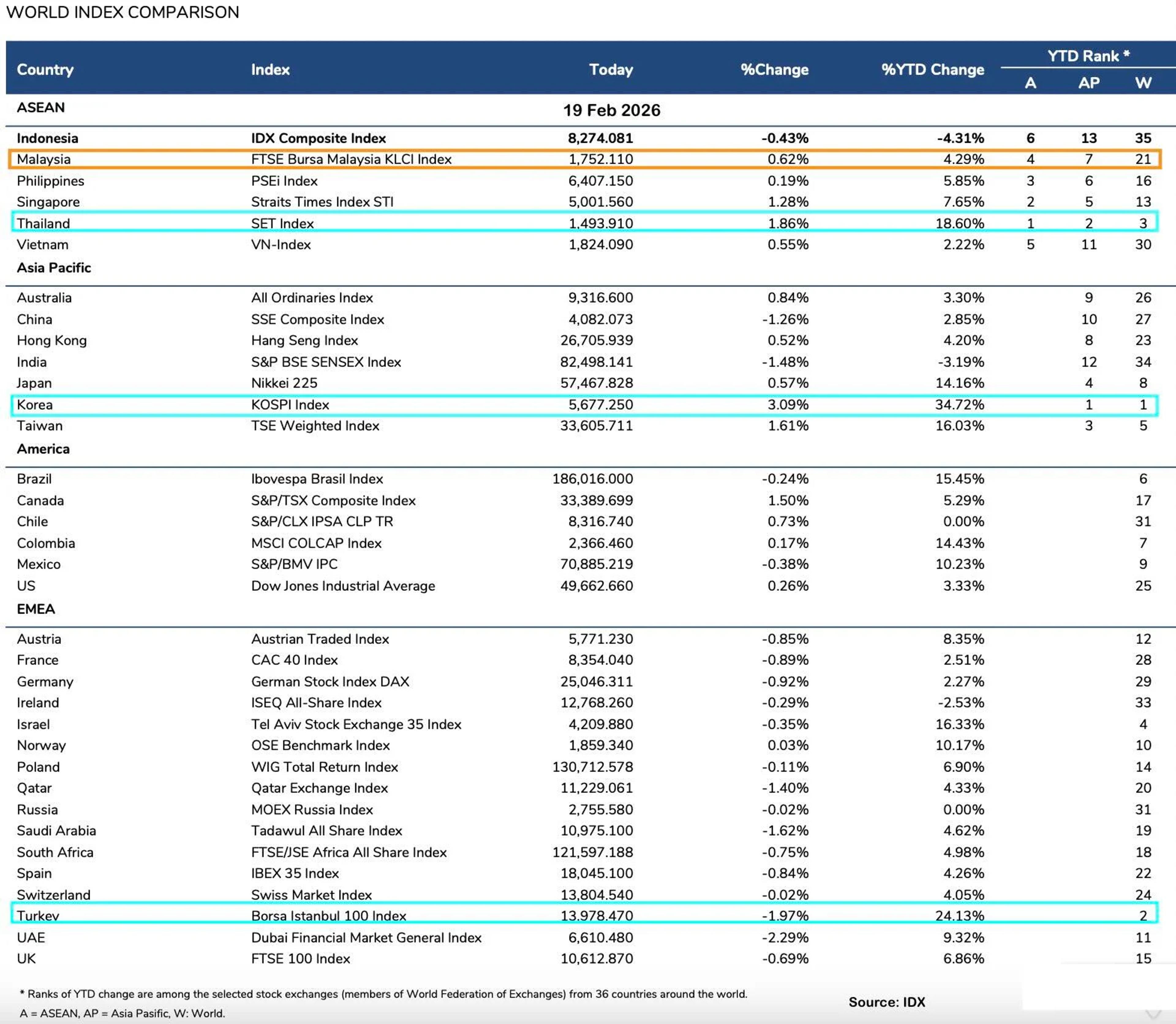

South Korea, Turkey, Thailand Lead YTD Market Gains

Best performing stock markets in the world (local currency) year-to-date. 1. S Korea +34.7% 2. Turkey +24.1% 3. Thailand +18.6% In Asia only Indonesia, India negative. Malaysia is up only 4.3%.

By Azharuddin | Azha Investing

News•Feb 19, 2026

Trump’s Energy Dominance Clashes with Soaring Bills at Home

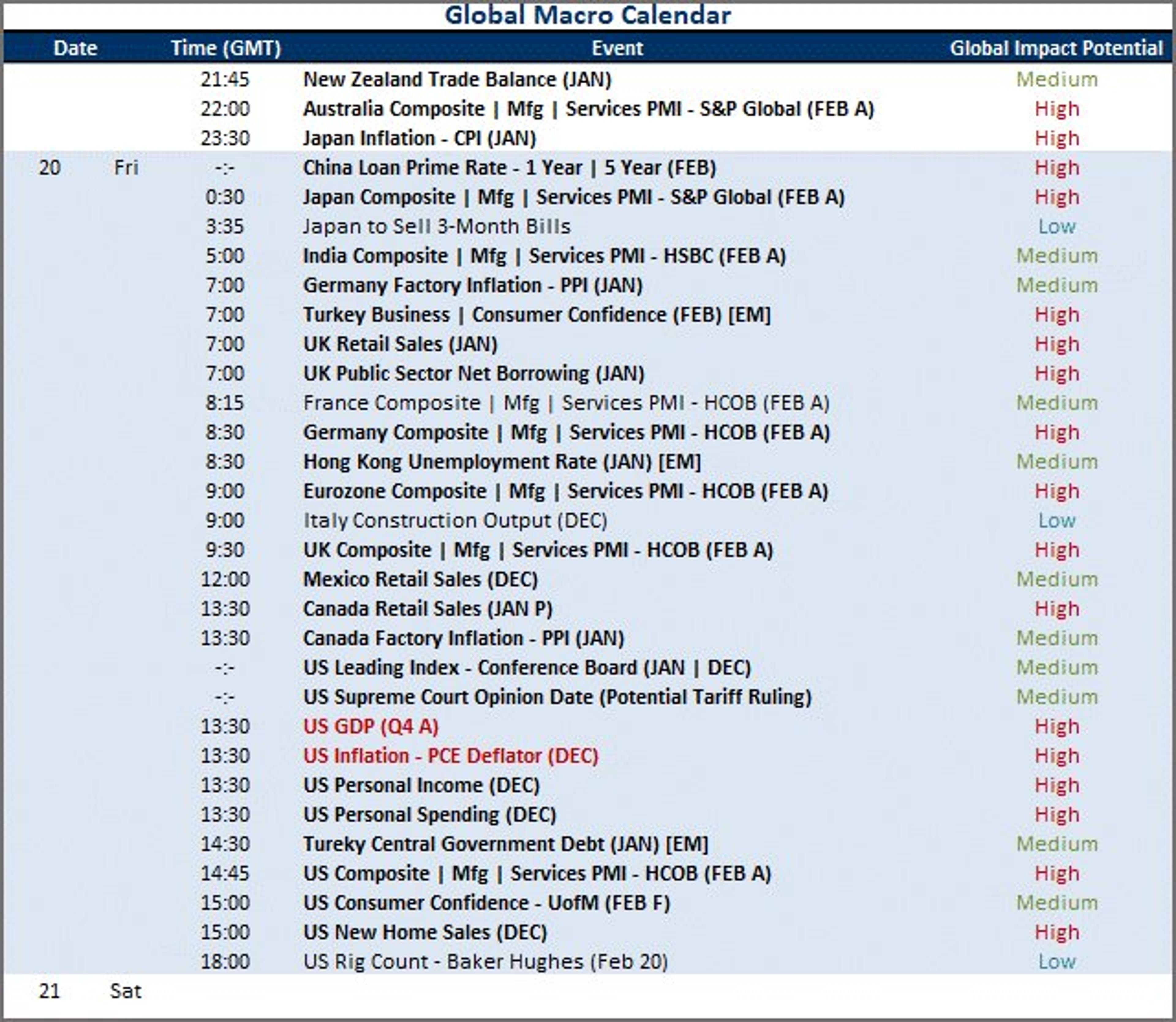

U.S. LNG exports are set to climb from 15 Bcf/d last year to 18.1 Bcf/d by 2027, driving record natural‑gas production. The surge in feed‑gas demand and AI‑powered data‑center growth is tightening domestic supply, pushing residential and wholesale electricity prices higher. While...

By OilPrice.com – Main

Social•Feb 19, 2026

Buy Newmont on Pullbacks as Gold Rises

Macro: gold up on rate‑cut hopes & geopolitics. Key: Newmont beat as realized $4,216/oz offset 24% output drop. Risk: output erosion, volatility. Trade: buy Newmont on pullbacks. — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 19, 2026

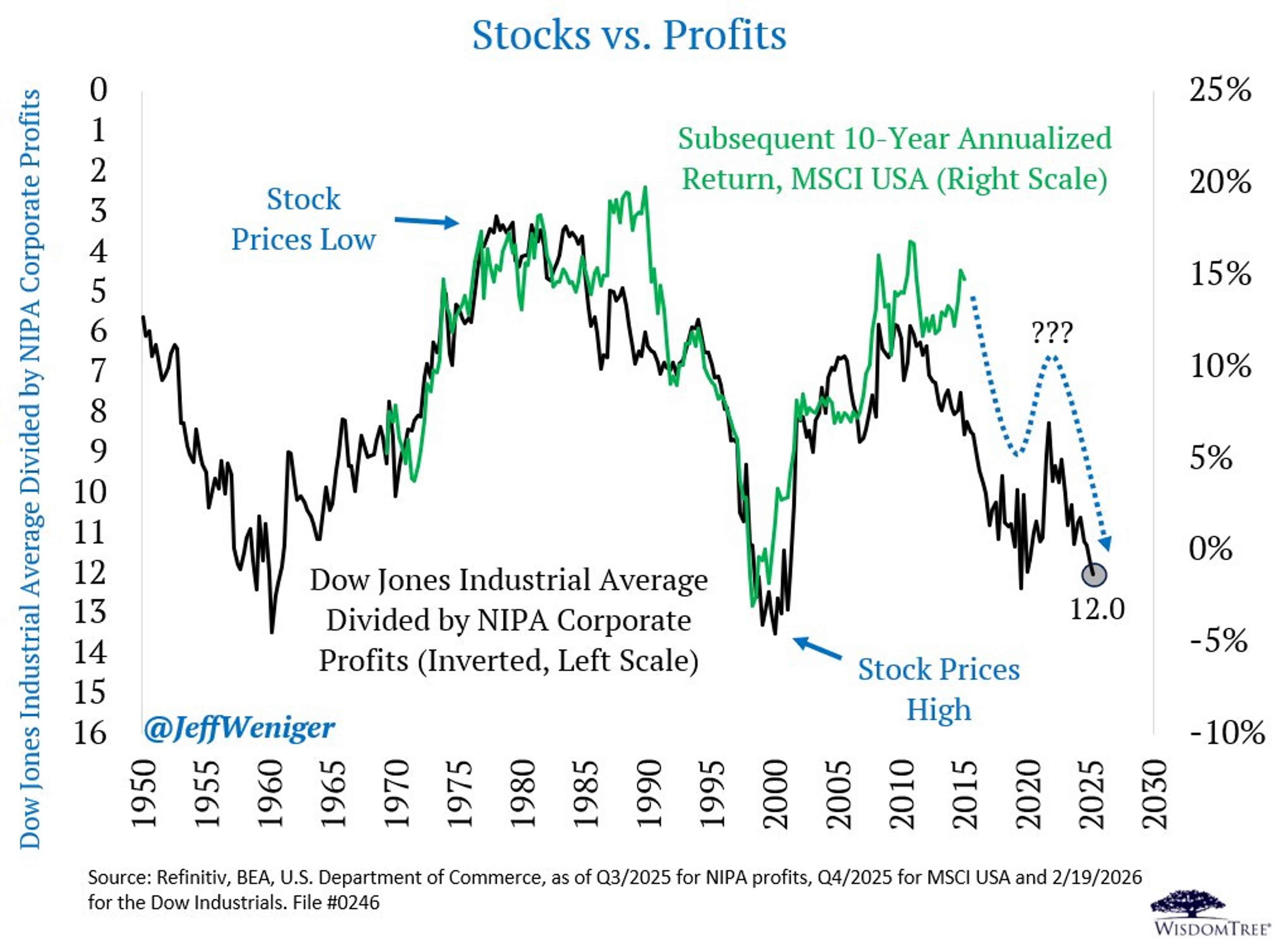

Energy and Materials Surge as Tech Falters in 2026

This is a pretty cool chart to show your investment committee. A classic stock price-to-corporate profits image that reveals extended conditions reminiscent of the turn of the century. If this chart has any prescience, we should remember that the leaders...

By Jeff Weniger

News•Feb 19, 2026

House E15 Council Eyes More US Biofuel Quota Waivers

The House Republican‑led E15 Rural Domestic Energy Council has revised its biofuel exemption plan, raising the annual cap from 450 million to 550 million Renewable Identification Number (RIN) credits. The proposal also authorizes year‑round sales of 15% ethanol gasoline (E15) and expands...

By Argus Media – News

Blog•Feb 19, 2026

BONUS In Brief: Vibes Out of Munich

The episode dissects the 62nd Munich Security Conference, highlighting Europe’s push for strategic autonomy, lingering reliance on the U.S., and a shared sense that the post‑World War II liberal order is eroding. Guests note France’s view that autonomy is a strategic...

By War on the Rocks

News•Feb 19, 2026

Stocks Slide as Traders Assess Walmart Earnings, Potential Iran Conflict: Live Updates

U.S. stock futures were largely flat on Wednesday night after the major indexes posted gains, with the Dow down 0.09%, the S&P 500 down 0.09% and the Nasdaq down 0.1%. Investors focused on Walmart’s upcoming fourth‑quarter earnings, a widely watched...

By CNBC – Markets

News•Feb 19, 2026

Sixth Straight Week of Decline: Container Rates Fall as Pre-Lunar New Year Surge Fails to Materialize

Global container shipping rates slipped another 1% to $1,919 per 40‑foot container, marking a sixth consecutive weekly decline. The expected pre‑Lunar New Year cargo surge failed to materialise, leaving both carriers and shippers with excess capacity. Transpacific lanes saw spot...

By gCaptain

News•Feb 19, 2026

Philippine Central Bank Cuts Rates in Latest Bid to Support Growth

The Bangko Sentral ng Pilipinas (BSP) lowered its overnight repurchase rate by 25 basis points to 4.25%, marking the ninth cut since August 2024. Inflation remains modest at 2%, comfortably within the 2‑4% target band, while the peso rallied to...

By Nikkei Asia — Economy/Markets

News•Feb 19, 2026

Subprime Demand Drives US Loan Growth to New Heights

Subprime borrowers propelled U.S. unsecured loan balances to a record $276 bn, a 10% increase year‑over‑year, with 26.4 million consumers holding such loans. Credit‑card issuers expanded lending to lower‑income customers, pushing total balances 4% higher to $1.15 trillion, but responded by trimming initial...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 19, 2026

Investors Unfazed by Uncertainties Around Tariffs in Med Tech

Investors remain steady in the med‑tech sector despite lingering tariff uncertainties, signaling confidence in long‑term growth. At the same time, research updates highlight the SCAN circuit as a core driver of Parkinson’s disease, TL1A overexpression in hidradenitis suppurativa, and an...

By BioWorld (Citeline) – Featured Feeds

Social•Feb 19, 2026

Bipartisan Push for 3% GDP Deficit Cap Gains Momentum

I Love and Endorse the Bipartisan 3 % of GDP Budget Deficit Solution In the House of Representatives there is now a bipartisan bill in the works to enact, and a growing agreement that we need, a 3% cap on the budget...

By Ray Dalio

News•Feb 19, 2026

World Briefs | Rwanda Hikes Lending Rate on Higher Inflation

Rwanda’s central bank raised its key lending rate by 50 basis points to 7.25% on Thursday, reacting to a jump in consumer price inflation to 8.9% year‑on‑year in January. The move aims to bring inflation back within the bank’s 2‑8%...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 19, 2026

Russia Warns of Escalation as US-Iran Tensions Intensify

Russia warned of an unprecedented escalation around Iran as the United States completes a military buildup slated for mid‑March. A Russian corvette joined Iranian naval drills in the Gulf of Oman, underscoring Moscow’s support amid heightened US‑Iran tensions. Negotiations over...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 19, 2026

World Briefs | Nigeria’s Tinubu and Germany’s Merz Talk Security, Power Deal in Phone Call

Nigerian President Bola Tinubu and German Chancellor Friedrich Merz discussed reviving a stalled electricity transmission project with Siemens and the purchase of used German helicopters, highlighting deeper security and power cooperation. France’s audit office warned that the country must shift...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 19, 2026

Pernod Ricard’s First-Half Sales Slip Limited by Improved Second Quarter

Pernod Ricard reported a first‑half sales decline across all five priority markets, with profits pressured by foreign‑exchange volatility and higher costs. The second quarter showed a modest rebound, helped by stronger demand in India and duty‑free channels. The group reaffirmed its...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 19, 2026

Bank Indonesia Keeps Rates Steady, as Rupiah Weakness Threatens to Delay Easing

Bank Indonesia left its policy rate unchanged at 4.75% as the rupiah continued to weaken amid fiscal‑sustainability concerns and volatile investor sentiment. Moody’s downgraded Indonesia’s credit outlook to negative, reflecting uncertainty over policy direction and transparency. Real‑rate differentials with the...

By ING — THINK Economics

Social•Feb 19, 2026

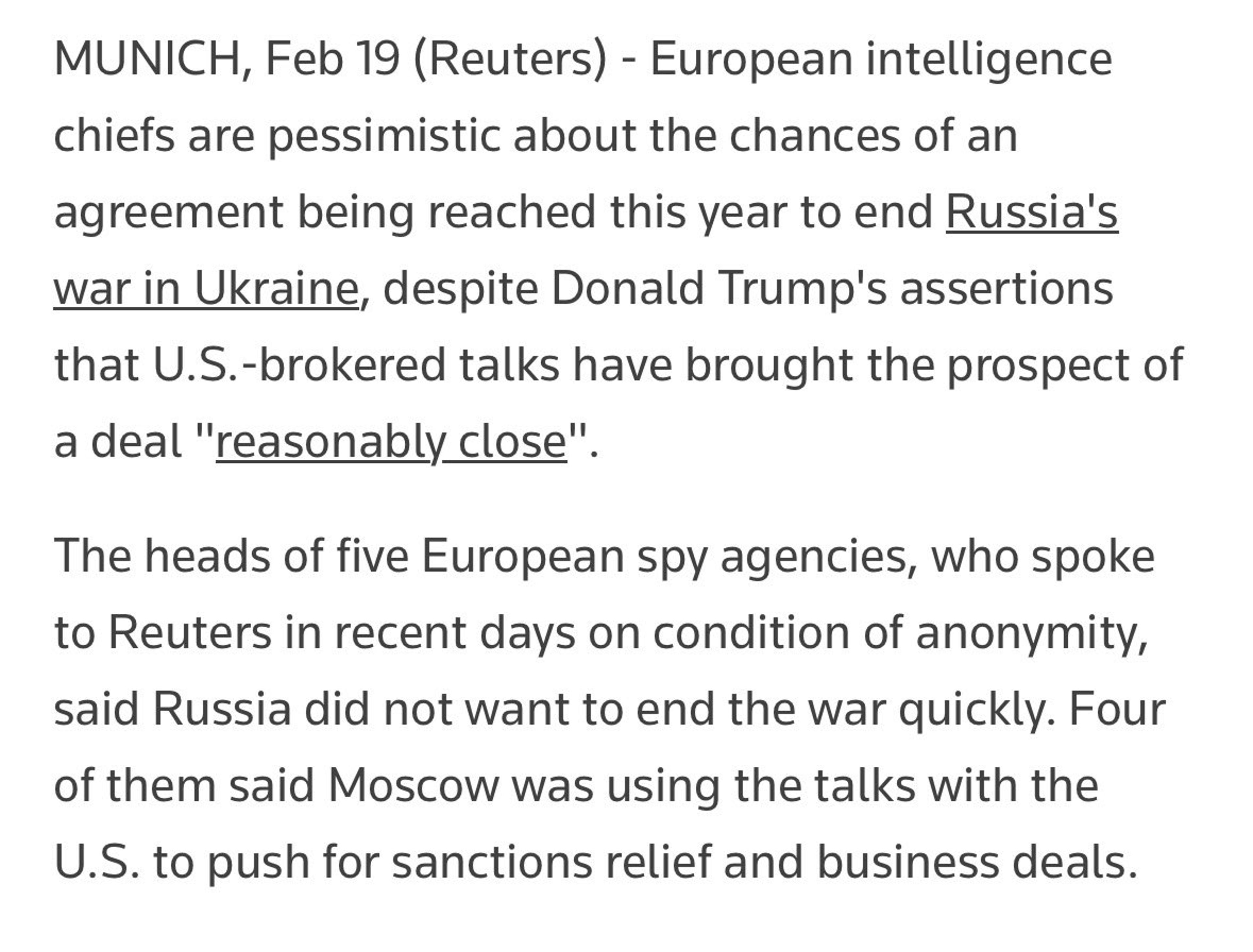

European Spies Say Russia Isn’t Seeking Peace, Talks Futile

“European intelligence chiefs are pessimistic about the chances of an agreement being reached this year to end Russia's war in Ukraine, despite Donald Trump's assertions that U.S.-brokered talks have brought the prospect of a deal ‘reasonably close’. The heads of five...

By Rob Lee

News•Feb 19, 2026

Philippines’ Central Bank Delivers Expected Rate Cut Paired with Uncertain Guidance

The Bangko Sentral ng Pilipinas trimmed its policy rate by 25 basis points to 4.25%, matching market expectations. However, the central bank softened its forward guidance, dropping language that it was nearing the end of easing and emphasizing lingering confidence...

By ING — THINK Economics

Social•Feb 19, 2026

Fuel Subsidy Masks Real Service Cost Surge

1.6% is a statistical illusion for the urban middle class While headline inflation is stable, the "unprotected" service sector is aggressive: Personal Care & Misc. → 6.6% Education → 3.2% Cause→Effect: Subsidized fuel (-0.7%) masks the reality of rising service labor costs. If you...

By David Chuah

Social•Feb 19, 2026

Nikkei Rises; Buy Nikkei ETF Amid FX Risks

Nikkei +0.71%; real estate, banks, textiles led; VIX-Nikkei 27.89. Leaders: Yokohama Rubber, Omron. Risks: FX (USD/JPY 155.11), commodity shocks. Trade: buy Nikkei ETF. — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

News•Feb 19, 2026

Turkey Launches Ramadan Food Price Crackdown as Inflation Anger Intensifies

Turkey’s government has banned chicken exports and launched a nationwide crackdown on "exorbitant" food prices as Ramadan begins. Trade inspectors are sweeping markets for hoarding and misleading practices, with fines up to TL 1.8 million for violations. Food inflation is running at...

By Financial Times – Commodities

Social•Feb 19, 2026

China Cuts US Treasury Holdings to Crisis Low

🚨Chinese officials had urged banks to limit purchases of US government bonds, and instructed those with high exposure to SELL their positions. Data shows China’s holdings of US Treasuries fell to $682.6 billion, the lowest since the Financial Crisis.👇 https://globalmarketsinvestor.beehiiv.com/p/is-the-us-dollar-gradually-losing-its-safe-haven-status

By Global Markets Investor (newsletter author)

Social•Feb 19, 2026

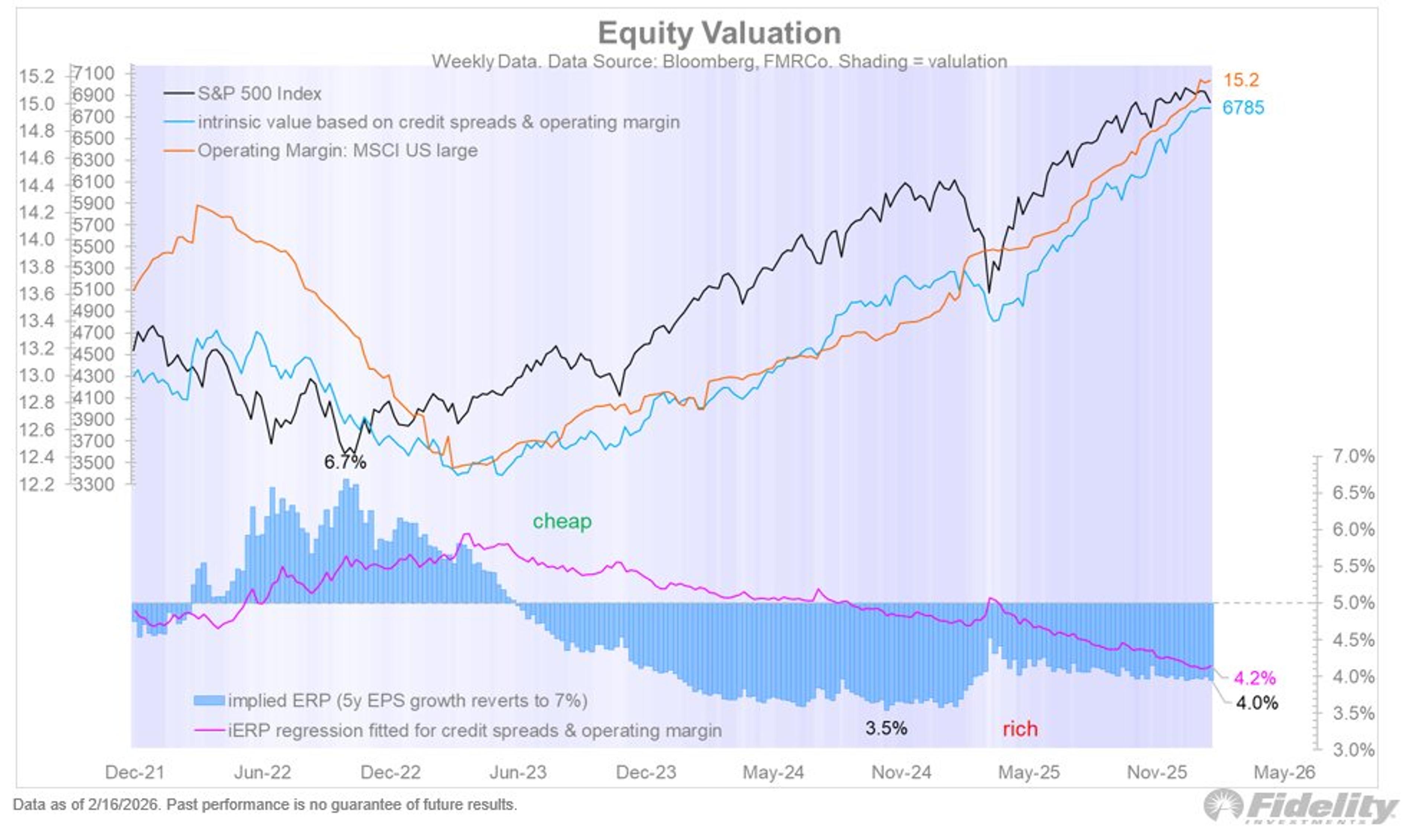

Rising Capex May Curb Buybacks, Pressure Valuations

With credit spreads low and profit margins seemingly on the rise, valuations seem OK at current levels. These two variables are important drivers for the equity risk premium, which is currently at 4.0% according to my version of the DCF...

By Jurrien Timmer

News•Feb 19, 2026

GrainCorp Confident of Global Grain Market Rebalance

GrainCorp CEO Robert Spurway told shareholders that global wheat oversupply of 18 million tonnes is driving low prices and tighter margins for grain handlers. Growers are holding back grain, reducing market availability, but the company expects inventories to rebalance eventually, though...

By Grain Central

Social•Feb 19, 2026

Fed Minutes Omit 2% Inflation Target Date, Signaling Uncertainty

One more note on the Fed minutes: Sometimes it's interesting what they don't say. Last year at every meeting until December, the staff forecast called for inflation to return to 2% by 2027. In December, the forecast pushed this back to...

By Nick Timiraos

Social•Feb 19, 2026

91 Days, Two Rate Calls, Then Warsh Takes Over

Only 91 days and two more rate decisions (Mar 18 and Apr 29) before Jerome Powell's term as Fed Chair ends (May 15th). Then it is the Warsh era...

By John Kicklighter

Social•Feb 19, 2026

Fed‑Treasury Coordination Must Be Transparent, Not Secret

Fed independence was a 20th century virtue. Fed inter-dependence is a 21st century necessity. The question was never whether the Fed and Treasury coordinate-it's whether that coordination happens in the dark or in the light The American people deserve monetary transparency...

By Jeff Park

Social•Feb 19, 2026

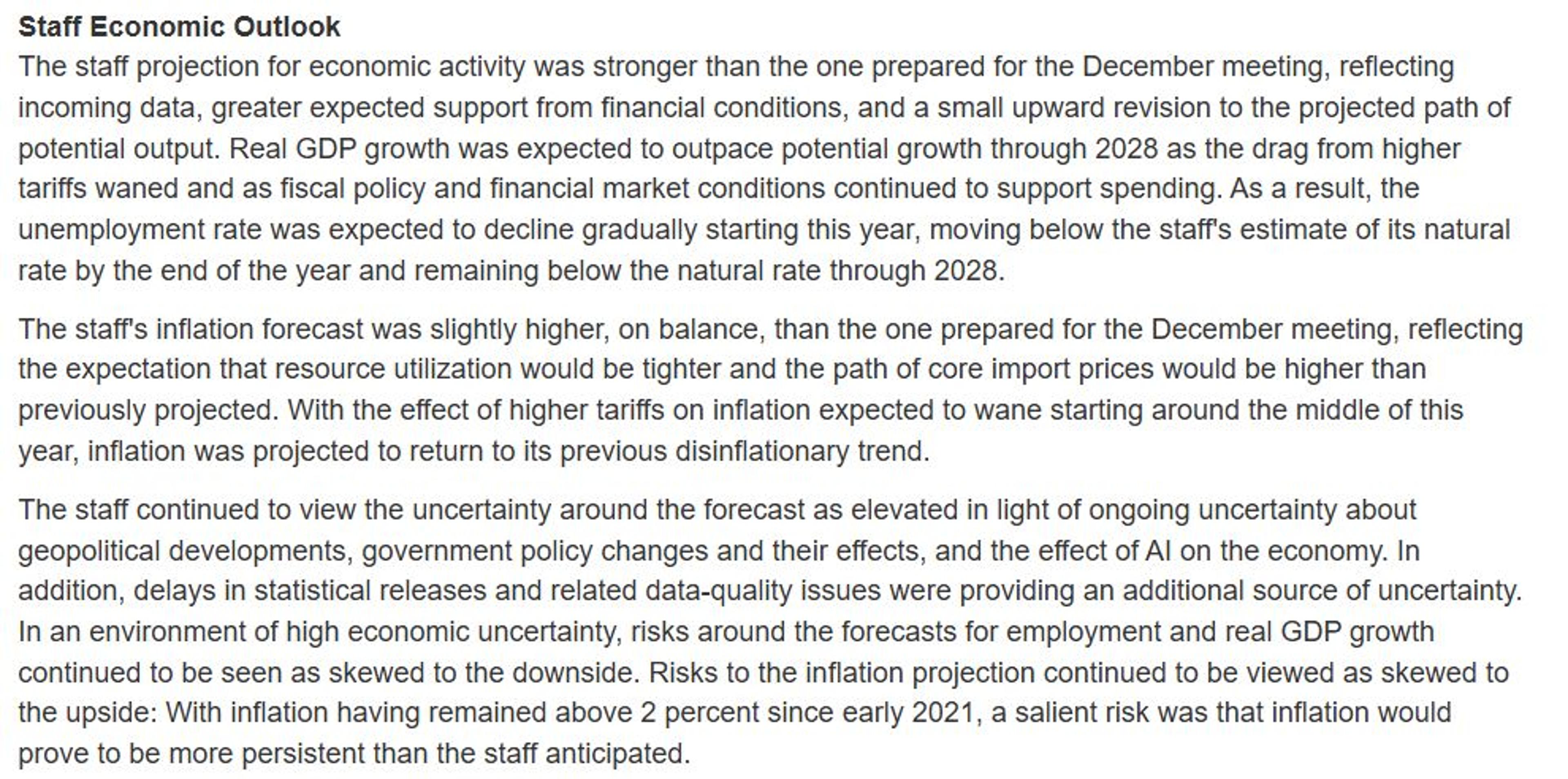

Grey Swan Risks Amid Busy Global Macro Calendar

While I will keep an eye out for grey swans catalyzing (Iran and Supreme Court's decision on tariffs principally), the global macro docket picks up through Friday. Top event risk includes: Japan CPI; February PMIs; Mexico and Canada retail sales; US...

By John Kicklighter

Social•Feb 19, 2026

AUD/USD Rally Pauses Near 2023 High, Streak Threatened

Australian Dollar Forecast: AUD/USD Rally Stalls Near 2023 High – Four-Week Streak at Risk https://t.co/srtBKcRq3k $AUDUSD Weekly Chart https://t.co/oGQK6Jc1uV

By Michael Boutros

Social•Feb 19, 2026

AI Data Centers Drain Power of 100k Homes

According to a report from the International Energy Agency, an average AI datacenter consumes as much electricity as 100,000 households. AI = HIGHER ELECTRICITY PRICES = AN AFFORDABILITY PROBLEM. https://t.co/65QNfr2y4U

By Steve Hanke

Social•Feb 19, 2026

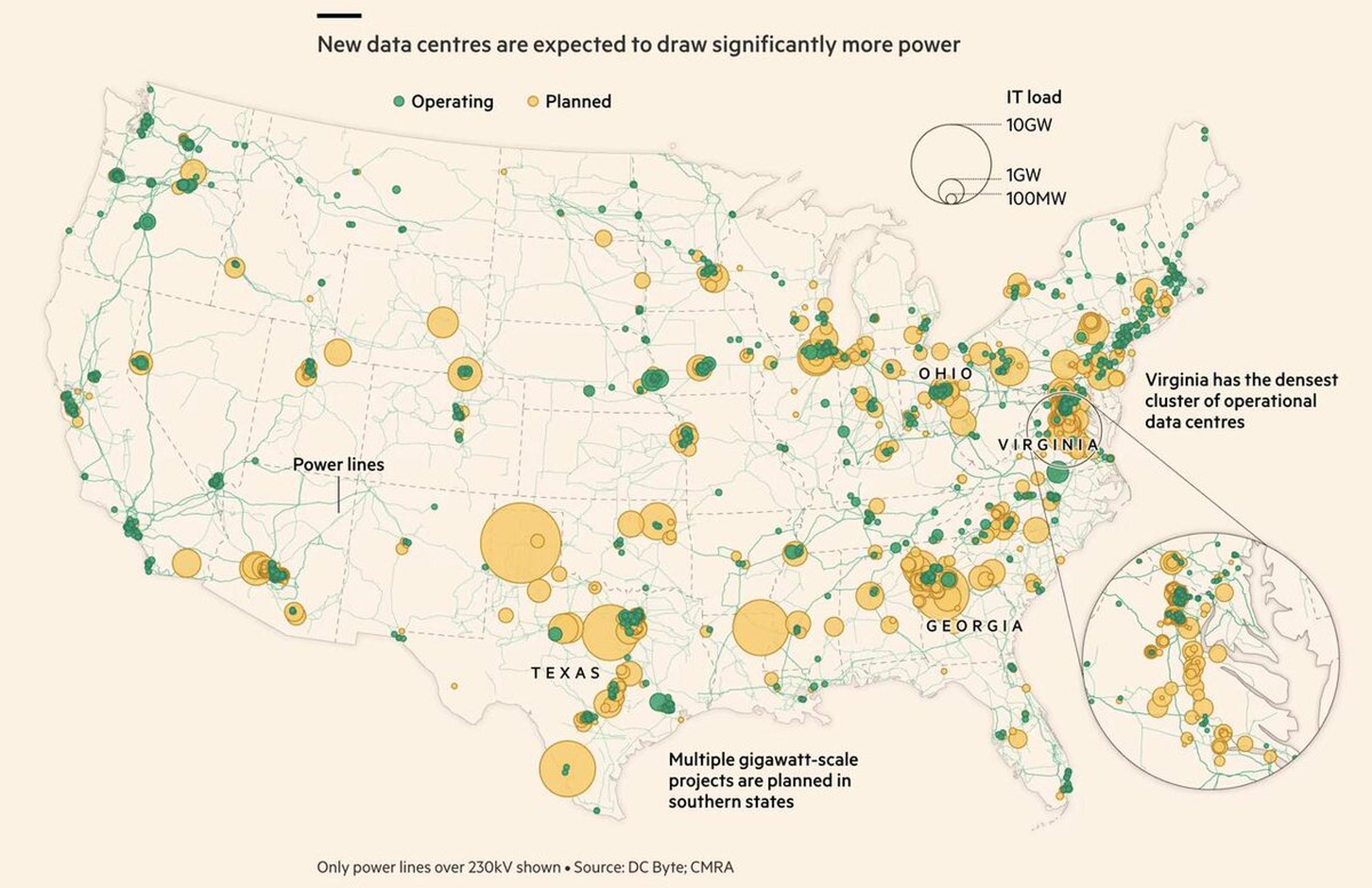

Copper Prices Jump 44% Year‑Over‑Year

Copper prices have surged to an average of $13,012/mt in January 2026 from $8,991/mt a year ago. That's a WHOPPING 44% INCREASE. BUY COPPER, WEAR DIAMONDS. https://t.co/FIhvIikhjQ

By Steve Hanke

Social•Feb 19, 2026

Small‑cap Outlook Dim Amid Credit Crunch, AI Slowdown

Asking for a friend how small caps are going to perform after everyone piled in long behind the economic reacceleration trade while private credit implodes, the AI capex buffer declines and the Fed remains on hold...

By Quinn Thompson

Social•Feb 19, 2026

US Strike Risk Adds Premium to Oil Market

Expectations of a possible US strike on Iran—currently oscillating between wait-and-see and watchful anticipation—have introduced a risk premium into an otherwise well-supplied oil market. My talk w/ @KellyCNBC @CNBCTheExchange https://t.co/XwyD5XmiRg

By Daniel Yergin

Social•Feb 19, 2026

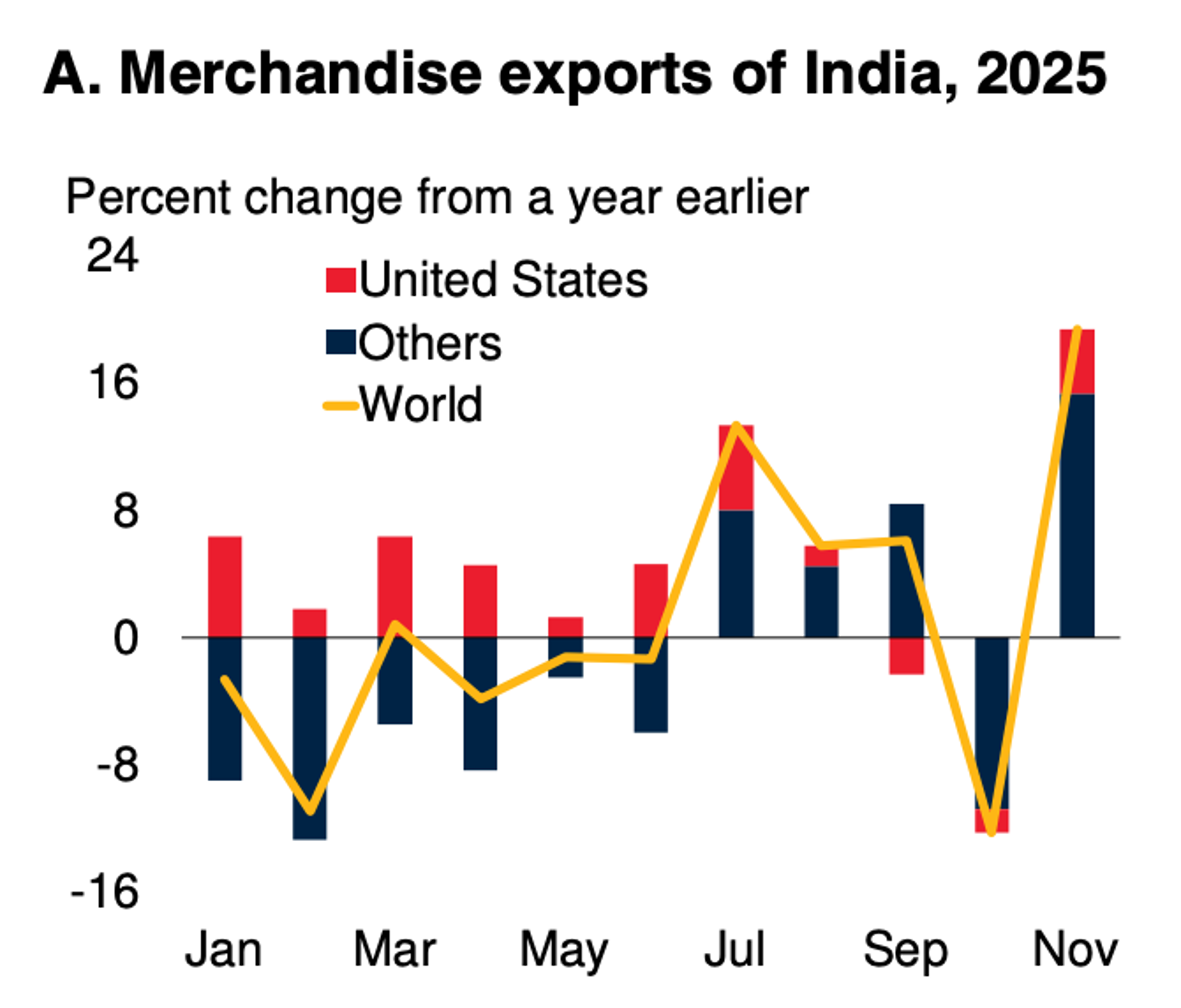

India's Exports Surge Despite Higher US Tariffs

From the World Bank’s Global Economic Prospects: Indian merchandise exports rose despite higher US tariffs. MODI’S ON A ROLL. https://t.co/yxKowcoHyv

By Steve Hanke

Social•Feb 19, 2026

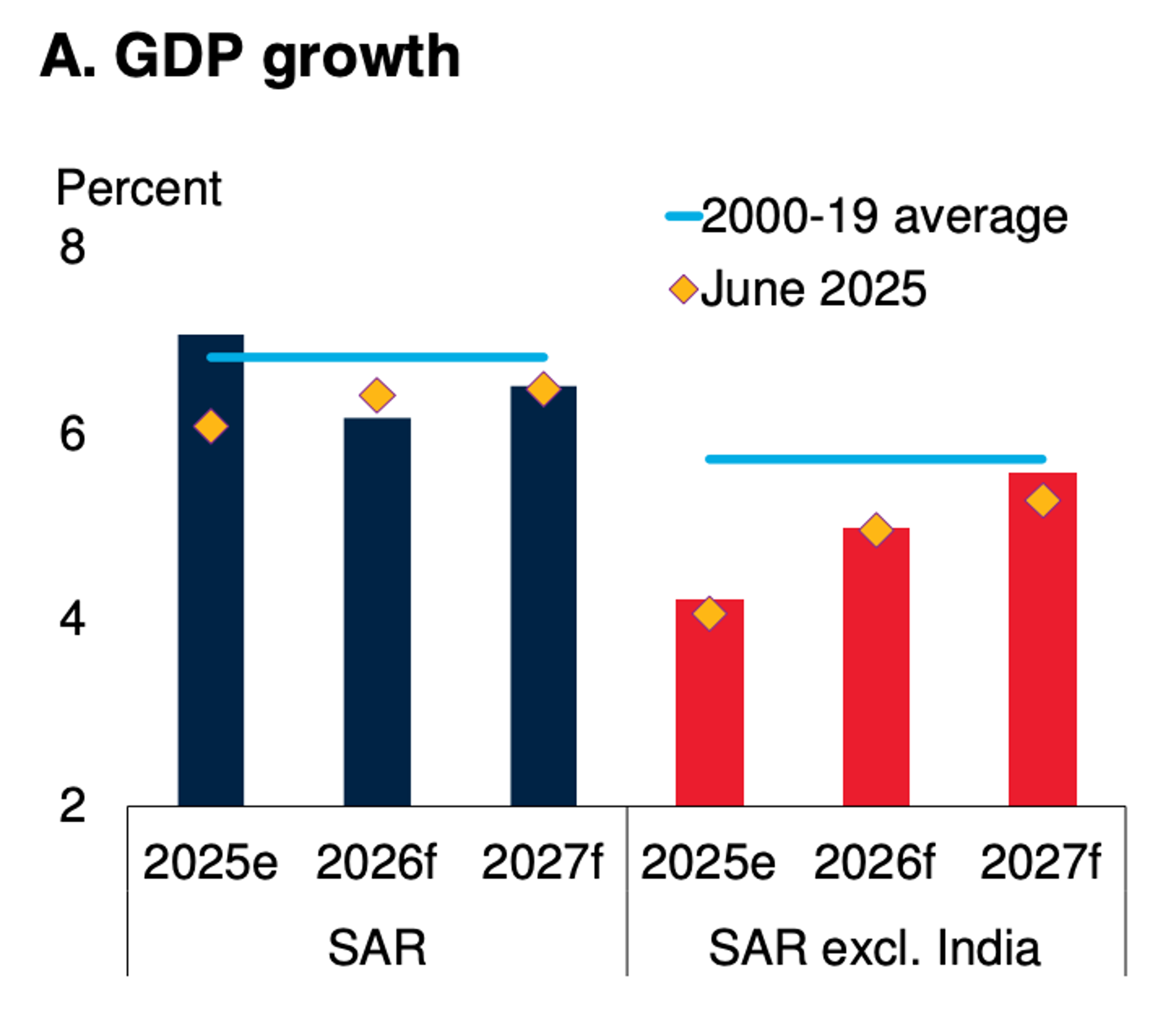

India's 6.5% Growth Beats China, Fastest Major Economy

As the World Bank notes, India is the fastest-growing major economy. India's growth rate of 6.5% is even outpacing China's. https://t.co/3S7a6Z6LbT

By Steve Hanke

Social•Feb 19, 2026

India Drives South Asia's 6‑7% Growth; Rest Lags

According to the World Bank, South Asia growth stays near 6-7%. Strip out India, and the region slows sharply. India is the growth story. https://t.co/Q8e7g9b1j3

By Steve Hanke

Social•Feb 19, 2026

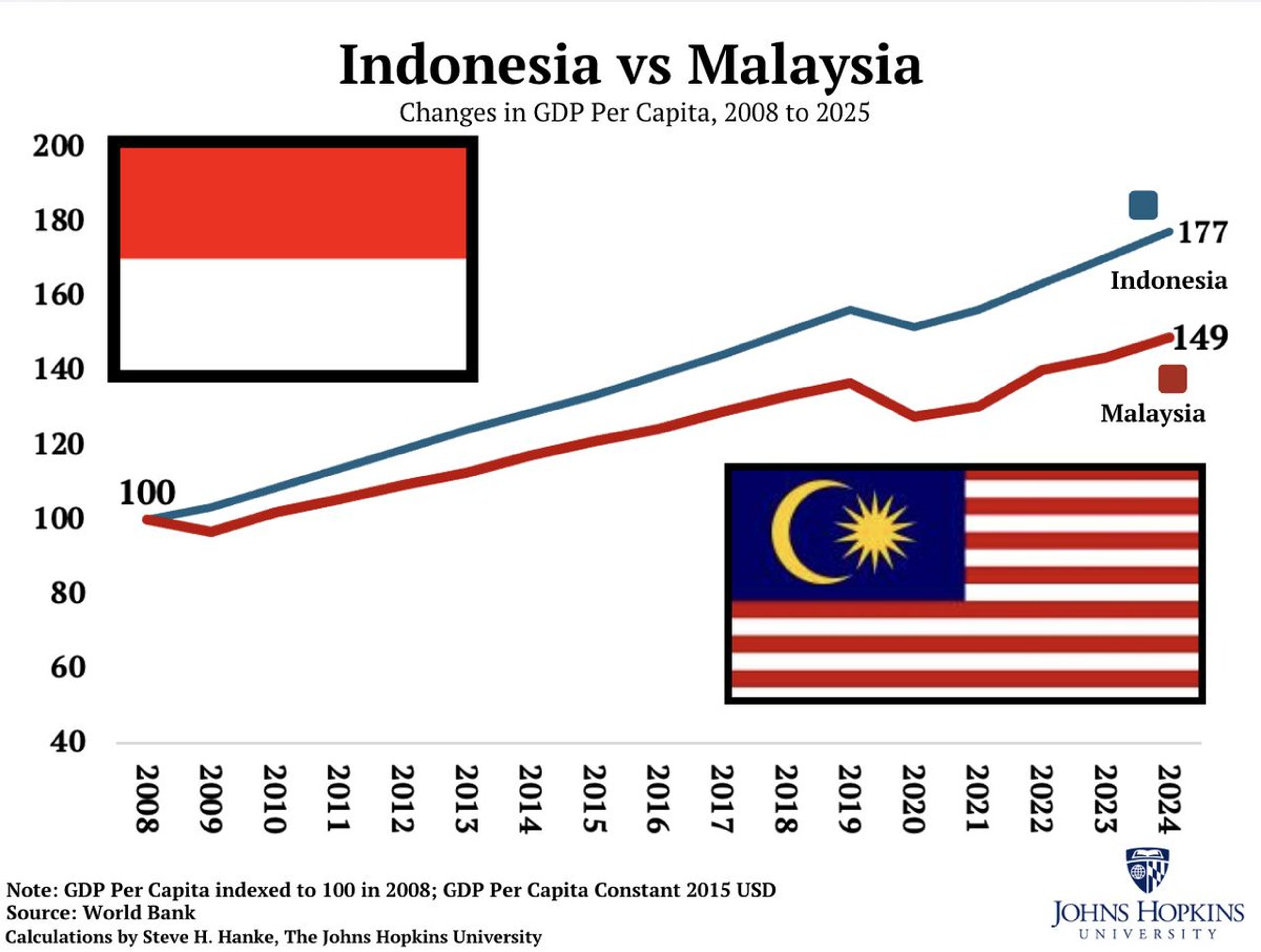

Indonesia Leads Malaysia in Palm Oil and Economic Growth

What do Indonesia and Malaysia have in common? They are the two biggest palm oil exporters in the world. Since 2008, Indonesia’s economy has outperformed Malaysia’s. https://t.co/mTUct95oZv

By Steve Hanke

Social•Feb 19, 2026

North Korea's Inflation Soars to 74.6%, World’s Third Highest

#NKWatch🇰🇵: Today, I measure North Korea’s inflation at 74.6%/yr — that’s the THIRD HIGHEST IN THE WORLD. Kim’s rockets fly, but inflation is what’s truly SKYROCKETING. https://t.co/EbYJ0oBnAW

By Steve Hanke

Social•Feb 19, 2026

Korea's Index Slides Below Historical Average After 150% Surge

It’s wild how Korea’s stock index is trading below its historical average following a nearly 150% price rally https://t.co/TyCTVuO5pW

By David Ingles

Social•Feb 19, 2026

US Iran Strike Would Spark Prolonged, Global Fallout

If the US strikes Iran, it won’t be a weekend event, writes @TheMichaelEvery Retaliation risks include terror cells in Europe The broader Middle East is flammable Energy markets are rightly pricing tail risk—but the real question is duration, not ignition #OilMarkets #Iran #Geopolitics...

By Art Berman Blog

Social•Feb 19, 2026

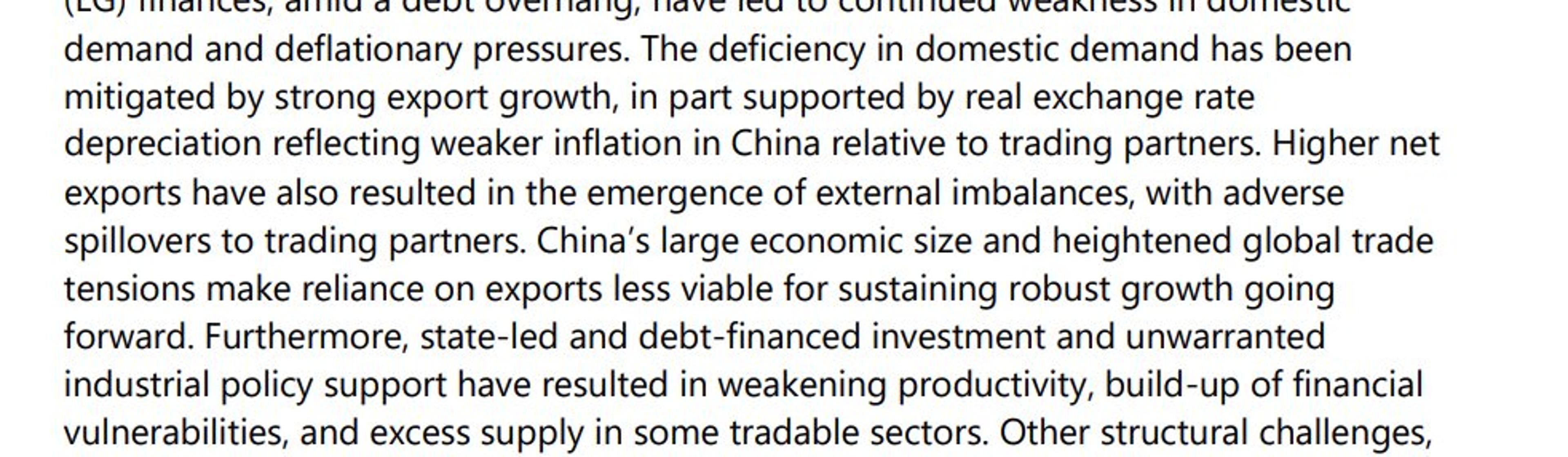

IMF: China's Export Growth Harms Its Trading Partners

The latest IMF analysis of China (The staff report/ Article IV) highlights that China's export driven growth has come at the expense of its trading partners. That is welcome, and very necessary message 1/many https://t.co/RTYAzRkFAv

By Brad Setser

Social•Feb 19, 2026

China Buys US LNG, Redirects It to Europe

China hasn’t stopped buying U.S. LNG It’s just not burning it at home. Long-term contracts still bind the two systems Flexible LNG markets let China arbitrage politics by diverting cargoes to Europe. Does anyone on Team Trump know this? https://t.co/CacMbcaSMk #LNG #China #EnergyMarkets #Geopolitics #TradeWar #NaturalGas

By Art Berman Blog

Social•Feb 19, 2026

Geopolitical Fears Add Incremental Risk Premium to Oil

Oil rallied on fear Iran headlines + Israel alerts = instant risk premium in a tight market But geopolitics don't matter. Except they do in small continuous increments that convert to a steady aggregate premium. https://t.co/6vQGj7YEmu #OilMarkets #Geopolitics #Iran #EnergySecurity #crudeoil

By Art Berman Blog

Social•Feb 19, 2026

TLT Call Skew at 90th Percentile, Expect Shakeout

Yep- Skew on TLT (calls expensive to outs) like 1 month out is in the 90th%tile. Gonna get shaken out before yields go lower. Let’s talk about this tomorrow on @ForwardGuidance

By Tyler Neville

Social•Feb 19, 2026

Blue Owl Stops Redemptions, Highlighting Exit Liquidity Risk

BLUE OWL PERMANENTLY HALTS REDEMPTIONS AT PRIVATE CREDIT FUND AIMED AT RETAIL INVESTORS — FT Being long scarcity might lead to illiquidity, but being long illiquidity doesn’t necessarily mean you’re long scarcity You’re long exit liquidity

By Jeff Park

Social•Feb 19, 2026

Korean Reforms Spark Value Ups, Awaiting IBKR Access

I initially thought the Korean reforms would be ineffective. But on the ground, I’m seeing many companies come up with highly positive value up plans. And valuations remain a fraction of those in Japan. Once IBKR opens access, the focus...

By Michael Fritzell