🎯Today's Global Economy Pulse

Updated 1h agoWhat's happening: US inflation remains entrenched despite Fed optimism

Federal Reserve January FOMC minutes confirm that price pressures persist in the United States. The core consumer‑price index rose 0.3% month‑over‑month, keeping annual inflation above the Fed’s 2% target, and policymakers see limited room for further easing.

News•Feb 13, 2026

US CPI Data Expected to Show a Mild Decline in Inflation in January

U.S. consumer price index data for January showed annual inflation easing to 2.4% from 2.7% in December, missing the 2.5% market forecast. Monthly CPI rose 0.2% and core CPI remained at 2.5% year‑over‑year, matching expectations. The softer headline number nudged the USD index lower, with the yen posting the biggest weekly gain against the greenback. Analysts see the reading as a potential catalyst for future Federal Reserve rate‑cut discussions, while EUR/USD hovers around 1.19.

By FXStreet — News

Social•Feb 13, 2026

ETFs Rake $250B in 28 Days, EM Overtakes Gold

There's only been 28 trading days this year and ETFs have already pulled in about $250b. More than double any other start to a year. Up until 2020, $250b was what they averaged for a YEAR. That's $9b/day pace, or...

By Eric Balchunas

Social•Feb 13, 2026

Labor Market Stabilizing: Health Care Leads, Construction Rebounds

Yes, most of the jobs last month (and the previous 18 months) have come from health care/social assistance. But if things were so bad would there be 32k in construction? Or 5k added in manufacturing? The labor market isn't great by...

By Ryan Detrick

/file/attachments/2988/13520410_638889.jpg)

News•Feb 13, 2026

France Aims to Boost Decarbonised Power Production by 20% over Decade, Encourage Demand

France’s new energy planning law (PPE) sets a decarbonised electricity goal of 650‑693 TWh by 2035, up from 540 TWh today, and aims for 70% of total energy consumption to come from clean power. The decree trims wind and solar targets by...

By Daily Maverick – Business

Social•Feb 13, 2026

OPEC+ Faces March 1 Decision on Production Hikes

OIL MARKET: The core group of OPEC+ countries need to decide on March 1 whether to re-start production increases after the Jan-Mar pause. Some members in the group see scope for resuming the monthly hikes, although conversations haven't started yet....

By Javier Blas

Social•Feb 13, 2026

US Loses Cheap‑borrower Advantage, Now Pays Debt Premium

The US exorbitant privilege - the ability to issue debt more cheaply than others - ended about a decade ago. We're now issuing debt at a premium, the result of deficits and debt that are out of control. This change...

By Robin Brooks

News•Feb 13, 2026

European Pulp Prices Climb Amid Ongoing BEK and NBSK Negotiations

European pulp markets are seeing divergent trends as bleached eucalyptus kraft (BEK) prices jumped $120 per tonne for January, while northern bleached softwood kraft (NBSK) only posted modest gains. The BEK surge is driven by supply constraints from Iberian strikes,...

By Fastmarkets – Insights

Social•Feb 13, 2026

CPI Insights on Friday the 13th: Inflation Talk

I will be on @YahooFinance at 8:30 am today to talk about the CPI. Friday the 13th and inflation. (My preview thread below.)

By Claudia Sahm

Social•Feb 13, 2026

Trump Admin Eyes Tariff Cuts, Citing Price Hikes, Complexity

BOMBSHELL @FT scoop: Trump admin mulls cutting steel/aluminum tariffs bc these taxes 1) raise US prices; 2) are insanely complicated; 3) had other unintented consequences (incl lobbying). They're admitting, in other words, that gravity exists. Good. https://t.co/o4RkfMWxlF

By Scott Lincicome

News•Feb 13, 2026

USD/CAD: Sideways Range with Tariff Risks – Rabobank

Rabobank analysts Molly Schwartz and Christian Lawrence project the USD/CAD pair to remain largely sideways throughout 2026, confined to a 1.36‑1.41 band. The outlook is driven by persistent US‑Canada trade tensions, a looming USMCA review, and a weakening U.S. dollar...

By FXStreet — News

Social•Feb 13, 2026

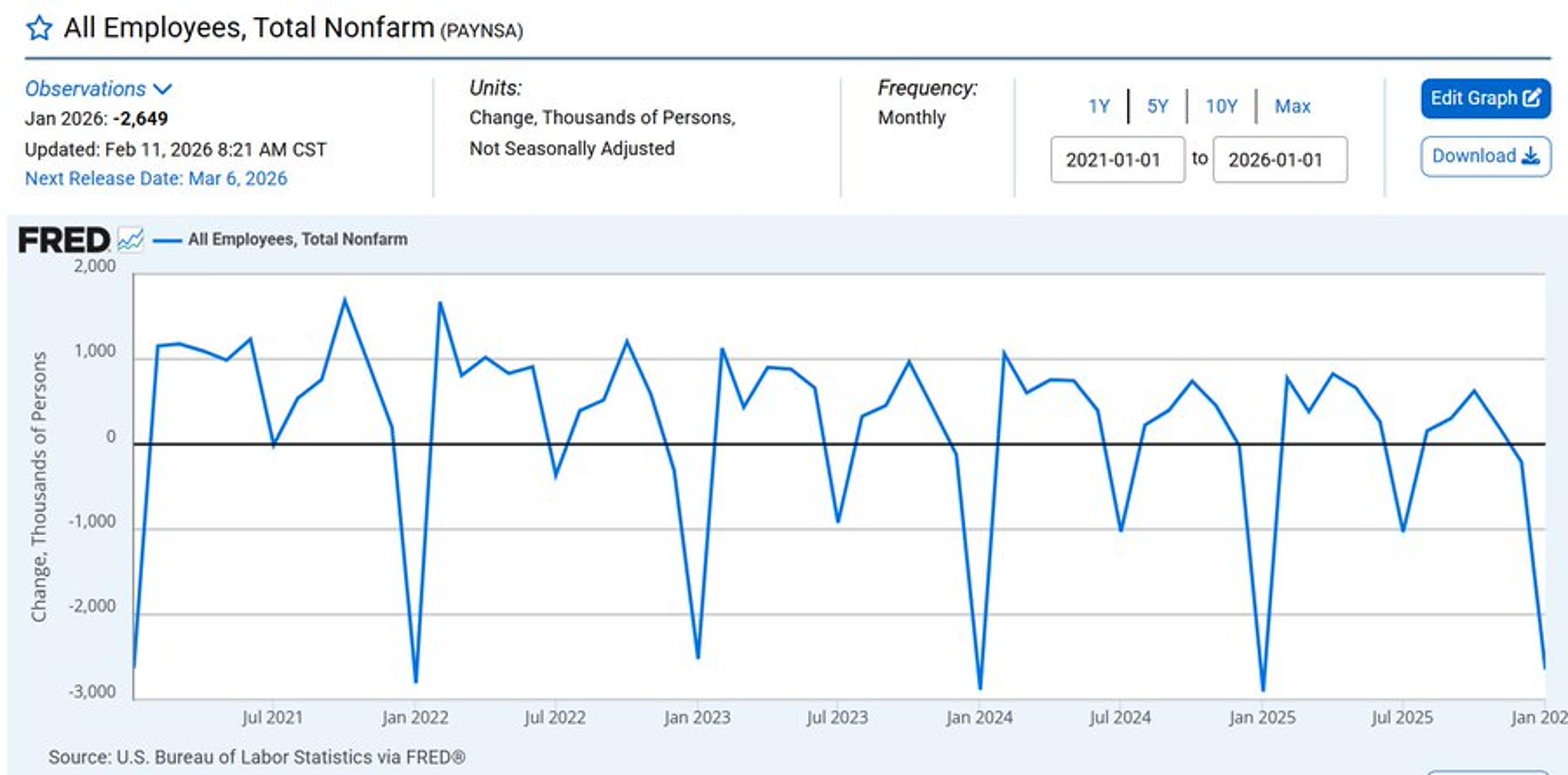

January Job Loss Smaller, Yields 130k Seasonal Gain

Great question. Drop in hiring happens every January. On a non-seasonally adjusted basis (left), we lost 2.6 million jobs in January 2026, but that was a smaller loss than a typical January ... so we got a good print seasonally adjusted...

By Claudia Sahm

News•Feb 13, 2026

Polish Disinflation Continues Despite Upside Surprise in January CPI

Poland’s January flash CPI showed headline inflation at 2.2% YoY, modestly above the 1.9% consensus but still under the NBP’s 2.5% ± 1‑point target. The decline was driven by a 7.1% drop in gasoline prices, while food prices held steady at 2.4%...

By ING — THINK Economics

Social•Feb 13, 2026

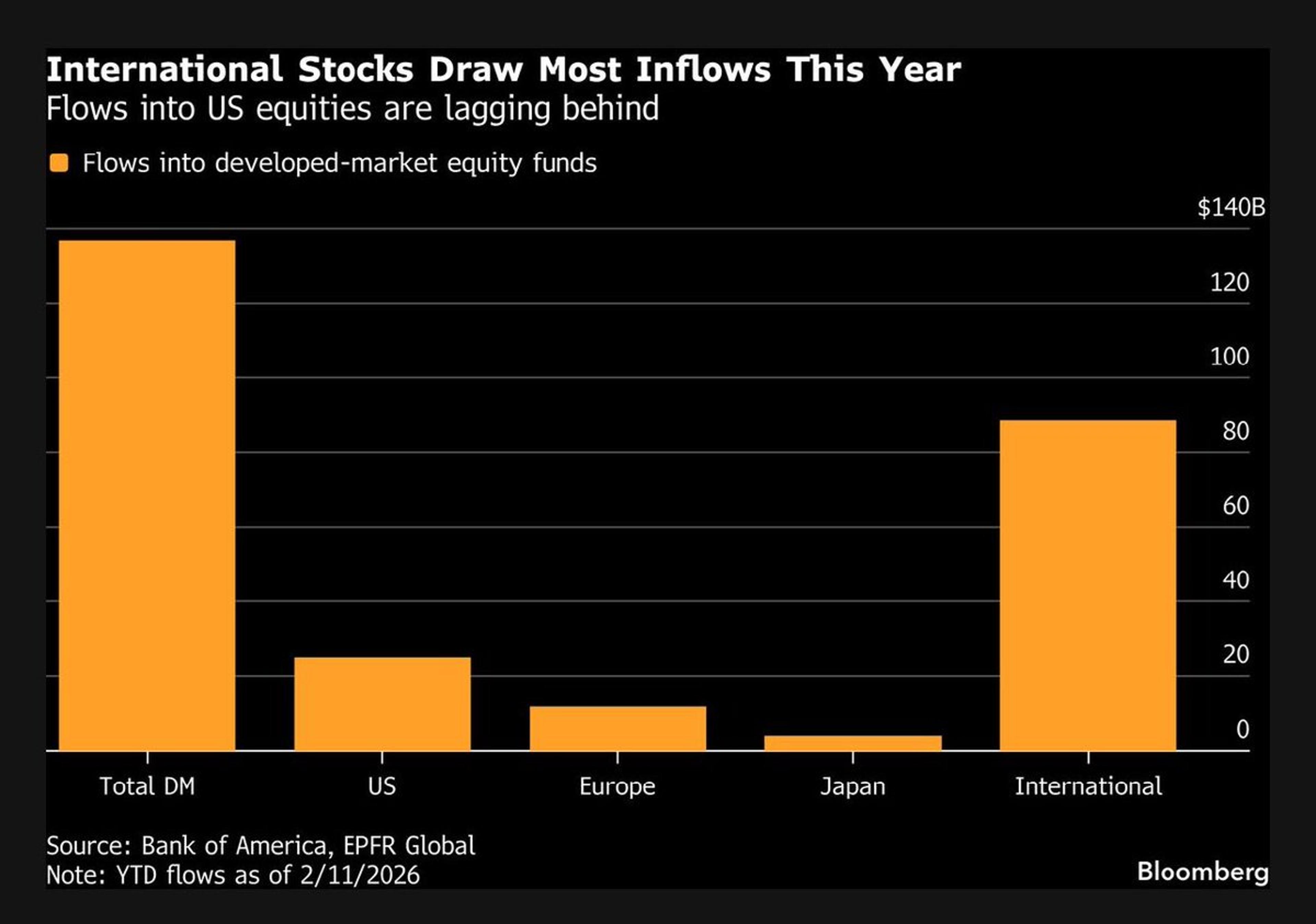

Global Fund Flows Outpace US, Shifting Investment Balance

US exceptionalism is turning into global rebalancing: BofA’s Michael Hartnett. Stock funds in Europe, Japan and other international developed markets have drawn $104 billion this year vs the $25 billion that’s flowed into US funds: BofA citing EPFR Global. https://t.co/ah9arXM6u9...

By Lisa Abramowicz

News•Feb 13, 2026

Rupee Closes Nearly Flat, Modest Depreciation Bias Lingers

India’s rupee ended Friday essentially unchanged, closing at 90.6350 per dollar, a slight dip from the prior session. The currency faced pressure from weak domestic equities, elevated interbank dollar demand, and maturing non‑deliverable forward contracts, while the Reserve Bank of...

By The Economic Times – Markets

News•Feb 13, 2026

We’re Trimming Our 2026 Romania Growth Forecast After a Bumpy End to 2025

Romania’s economy entered recession in early 2024 and posted a 1.9% quarterly contraction in Q4 2025, the steepest drop since 2012. Revised data also turned Q1 2025 growth negative, prompting analysts to slash the 2026 GDP outlook from 1.4% to 0.6%. The...

By ING — THINK Economics

Social•Feb 13, 2026

US Firms and Consumers Shoulder Most 2025 Tariff Burden

1/5 The New York Fed finds that "U.S. firms and consumers continue to bear the bulk of the economic burden of the high tariffs imposed in 2025." https://t.co/X3Xz2tRn1j

By Michael Pettis

Social•Feb 13, 2026

Trump Narrows Confusing Steel, Aluminum Tariffs Ahead of US‑EU Deal

The Trump administration is working to narrow its broad tariffs on steel and aluminum products that companies find difficult to calculate and the EU wants reined in as part of its pending trade deal with the US https://t.co/638iBN7IU0 via @jendeben...

By Zöe Schneeweiss

News•Feb 13, 2026

Cameroon Clamps Down on Shadow Fleet as Flag Purge Begins

Cameroon’s ship registry, now Africa’s third‑largest, surged 126% in the past year, largely due to Russian‑linked vessels adopting its flag. The fleet’s average age has risen to 32.7 years, prompting safety concerns after several high‑profile incidents. Under pressure from the EU...

By Splash 247

News•Feb 13, 2026

Poland’s Economy Expanded by 4%YoY in the Final Quarter of 2025

Poland’s economy posted a 4.0% year‑on‑year increase in the fourth quarter of 2025, outpacing the 3.8% growth recorded in Q3. Quarterly expansion accelerated to 1.0% from 0.9% in the prior period, driven primarily by a surge in private consumption that...

By ING — THINK Economics

Social•Feb 13, 2026

Distinguish Inefficiency From Global Uncompetitiveness in EU Manufacturing

1/7 My latest piece was written for friends who are EU policymakers or advisors. In it I argue that there is a difference between an inefficient manufacturing sector and a globally uncompetitive manufacturing sector. We shouldn't conflate the two. https://t.co/qer7BAvgnc

By Michael Pettis

News•Feb 13, 2026

Turkey’s Current Account Deficit Remains on a Widening Track

Turkey posted a December current‑account deficit of $7.3 bn, well above the $5.3 bn forecast, pushing the 12‑month rolling deficit to $25.2 bn (about 1.8 % of GDP). The gap widened mainly because the trade balance slipped to a $‑7.4 bn deficit and primary‑income balances...

By ING — THINK Economics

News•Feb 13, 2026

Splash Wrap: The Week in Shipping in 233 Words

The Pentagon intercepted a tanker suspected of moving Venezuelan oil, underscoring Washington’s aggressive stance on illicit exports. Vanuatu warned users about a fake registry website, while Cameroon suspended new shadow‑fleet registrations and began deregistering existing vessels. In the tech arena,...

By Splash 247

News•Feb 13, 2026

Both the Number of New Workforce and Jobs Stagnant in Korea, Reports Indicate

South Korea faces a looming labor shortage as its economically active population is projected to grow only 0.46% by 2034, creating a gap of roughly 1.22 million workers. Despite the demand for an additional 54,000 workers per year through 2029 and...

By The Korea Herald – RSS hub (includes Business)

Social•Feb 13, 2026

ECB Still Assessing Full Effects of Euro Appreciation

ECB has yet to see full impact of euro appreciation, Kazaks says https://t.co/qqisWsfsJD via @aaroneglitis @Skolimowski https://t.co/TTDxRGmgMY

By Zöe Schneeweiss

News•Feb 13, 2026

Rates Spark: Dutch Pension Funds May Prepare Early for 2027 Transitions

Almost €1 trillion of Dutch pension assets are slated to transition by 2027, but early hedge rebalancing has already begun. Smaller funds moved interest‑rate hedges in December 2025, while larger players like PMT and PFZW are timing their flows for the first...

By ING — THINK Economics

News•Feb 13, 2026

China Merchants to Restart Wuhan Qingshan Shipyard

China Merchants Shipbuilding Industry Group announced the full restart of its long‑dormant Wuhan Qingshan shipyard in 2026, reviving a facility that ceased new‑building in 2018. The 113‑hectare river‑front yard, equipped with a 2,200‑metre wharf, will focus on small and medium‑sized...

By Splash 247

News•Feb 13, 2026

Maran Dry Returns to Newbuilds with Capesize Order at Hengli

Maran Dry, the bulk carrier arm of Angelicoussis Shipping, has placed an order for four new capesize vessels at Hengli Heavy Industry’s Dalian yard, with options that could expand the deal to six ships. This marks the company’s first new‑build...

By Splash 247

News•Feb 13, 2026

Singaporeans to Get Nearly $400 in Vouchers, up to $316 in Cash as Cost-of-Living Support

Singapore's 2026 budget introduces a Cost‑of‑Living Special Payment, granting eligible adults up to S$400 cash and providing every household with S$500 in Community Development Council vouchers. The cash payout targets citizens earning up to S$100,000 and owning no more than...

By VNExpress – Companies (subset)

News•Feb 13, 2026

Asia Week Ahead: Key Growth Data From Japan

Japan is set to publish key macro data next week, including Q4 2025 GDP, export figures, and inflation. Analysts forecast a modest 0.3% quarter‑on‑quarter GDP rebound after a 0.6% contraction, driven by recovering construction and strong semiconductor exports. Inflation is expected...

By ING — THINK Economics

News•Feb 13, 2026

Oceanbird Lands First Commercial Order

Oceanbird, the Alfa Laval–Wallenius joint venture, announced its first commercial sale, delivering two Wing 560 wing sails for retrofit in Europe slated for early 2027. The order fills the initial production slots, shifting Oceanbird from prototype demonstrations to a commercial rollout. The...

By Splash 247

Podcast•Feb 13, 2026•30 min

Weekend Edition: From Dairy to Data: Can NZ Outgrow Australia’s Shadow?

In this episode, Phil and NAB’s Ray Attrill dissect the widening gap between New Zealand and Australia as AI‑driven investment costs strain US markets and commodity prices slide, while the Aussie dollar weakens below 71 cents. They explore how rising AI spending,...

By NAB Morning Call

Social•Feb 13, 2026

US Must Secure Mineral Sources, Not Just Funding

You can’t stockpile what you don’t control. The easy part is $12 billion from the Trump Adminstration. The hard part is finding the mines, processing & pricing. Washington needs to build alliances instead of burning them. https://t.co/JfhrJs5VnH #CriticalMinerals #Geopolitics #China #SupplyChains #EnergyTransition #Mining #USPolicy

By Art Berman Blog

Social•Feb 13, 2026

Shipping Decarbonizes Regardless of U.S. Policy Shifts

Shipping is decarbonizing with or without Washington. Capital has already committed: dual-fuel vessels dominate orderbooks, and investment decisions are being driven by EU rules, port levies, and future-proofing U.S. politics comes & goes https://t.co/LBSLcVd8Xn #Shipping #IMO #Decarbonization #EnergyTransition #ESG #Maritime #ClimatePolicy

By Art Berman Blog

News•Feb 13, 2026

The Industry Blind Spot that Lets Crew Suffering Escalate

Shipping consultant Frank Coles warns that seafarers face systemic abuse hidden by the industry’s self‑regulation. Crew members endure long contracts, limited shore leave, and mental‑health strain while owners chase cheap labor across weak‑law jurisdictions. Regulatory bodies draft safety rules but...

By Splash 247

News•Feb 13, 2026

CNOOC Targets 40% Offshore Wind Capacity Ramp up in 2026

China National Offshore Oil Corporation (CNOOC) announced a 40% increase in offshore wind capacity for 2026, targeting 3.5 GW of installed power. The expansion, executed with turbine maker Ming Yang Smart Energy, will roll out advanced turbines across southern provinces. Falling costs...

By Splash 247

News•Feb 13, 2026

Malaysia’s Population Growth Slows to 0.6% in Q4 2025

Malaysia’s fourth‑quarter 2025 demographic report shows population growth decelerating to 0.6%, reaching 34.3 million. Live births fell 5.4% while the elderly share rose to 8.0%, indicating an ageing trend. Labour demand grew 1.8% to 9.21 million jobs, the strongest since Q1 2024, with...

By Human Resources Online (Asia)

News•Feb 13, 2026

Appointment to the Monetary Policy Board

The Reserve Bank of Australia announced that Professor Bruce Preston has been appointed to the Monetary Policy Board, effective immediately. Preston brings a distinguished academic record and extensive experience in public‑policy economics. Governor Michele Bullock also thanked outgoing board member...

By Reserve Bank of Australia — Media Releases

Social•Feb 13, 2026

Photo Op Won’t Revive Venezuela’s Oil Without Real Investment Conditions

You don’t revive Venezuela’s oil sector by touring dilapidated fields @SecretaryWright This is a pointless photo op Tell us about restoring conditions in which companies would risk capital to revive oil production. Otherwise, keep the photos on your phone #EnergyPolicy #Venezuela #OilMarkets #Geopolitics...

By Art Berman Blog

Social•Feb 13, 2026

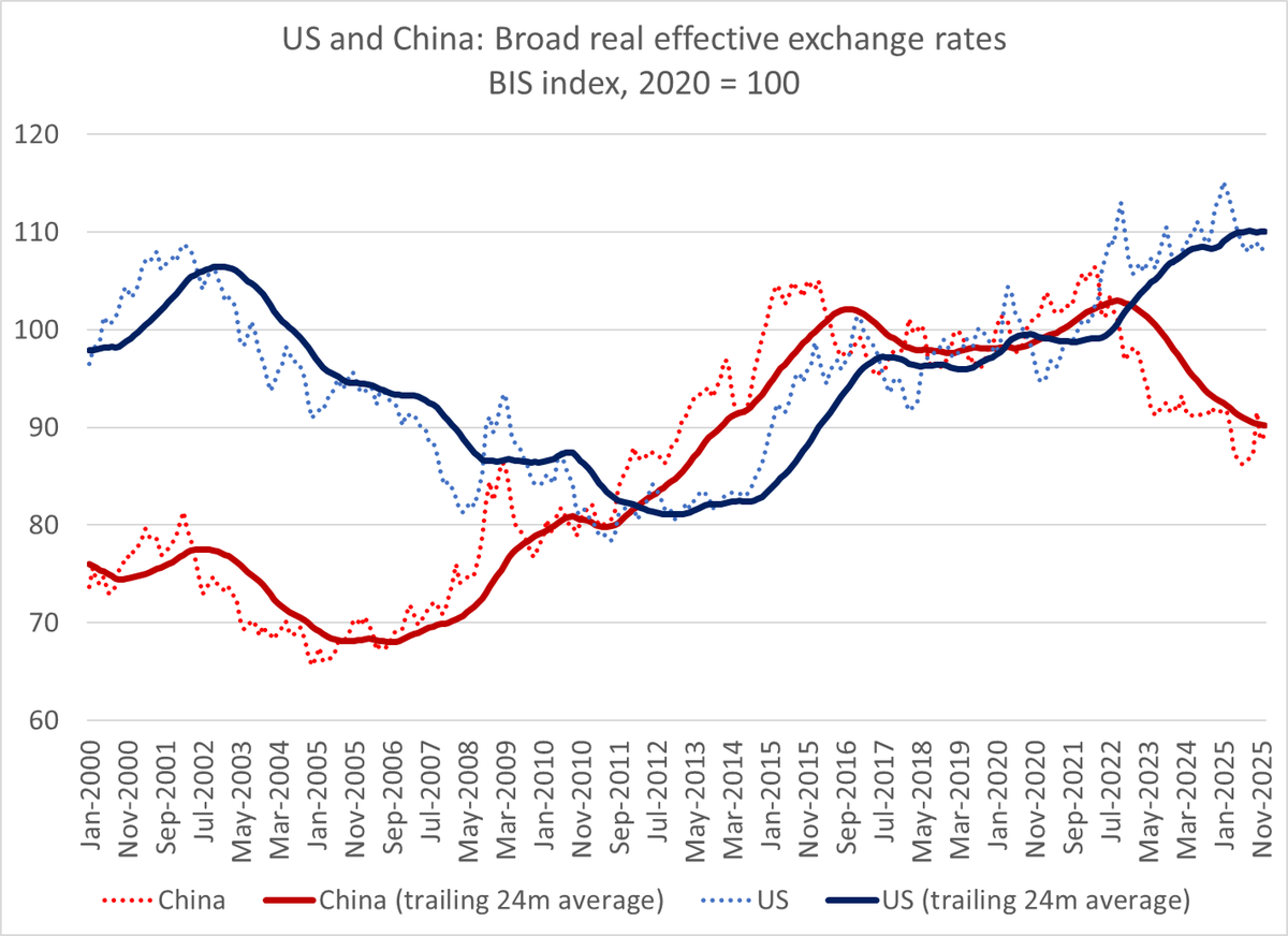

Inflation‑adjusted Dollar

A pet peeve. Talk about current dollar weakness. Numbers here are through December -- but in December the broad inflation adjusted dollar was stronger than in 01 or 02, the peak before 22-24 1/ https://t.co/c7KU9z1C6t

By Brad Setser

Social•Feb 12, 2026

Call Centers Signal AI‑Driven Job Crisis Ahead

A good canary in the coal mine for AI-caused job loss will be call centers. We're currently projecting ~2.75M call center jobs in the US in 2026. In 2016 it was ~2.63M. The global call center market size has grown...

By François Chollet

Social•Feb 12, 2026

From Labor to Compute: Economy’s Next Quantum Leap

1900: Internal Combustion + Electricity = 5x GDP growth. 2026: AGI + Humanoid Robotics + Space-based Energy = 50x GDP growth. This is NOT a cycle; instead, we are in a phase change for the species. The transition from being...

By Peter H. Diamandis

Social•Feb 12, 2026

SOLS: Cheap US Uranium Conversion Monopoly Amid Global Shortage

Thread(1/2) 🧵 We put our SOLS long thesis above the paywall in our Atoms vs. Bits primer yesterday, so I’m also going to summarize for all you degenerates on X. The story is simple: the uranium trade has resulted in nearly every...

By Citrini7 (pseudonymous)

Social•Feb 12, 2026

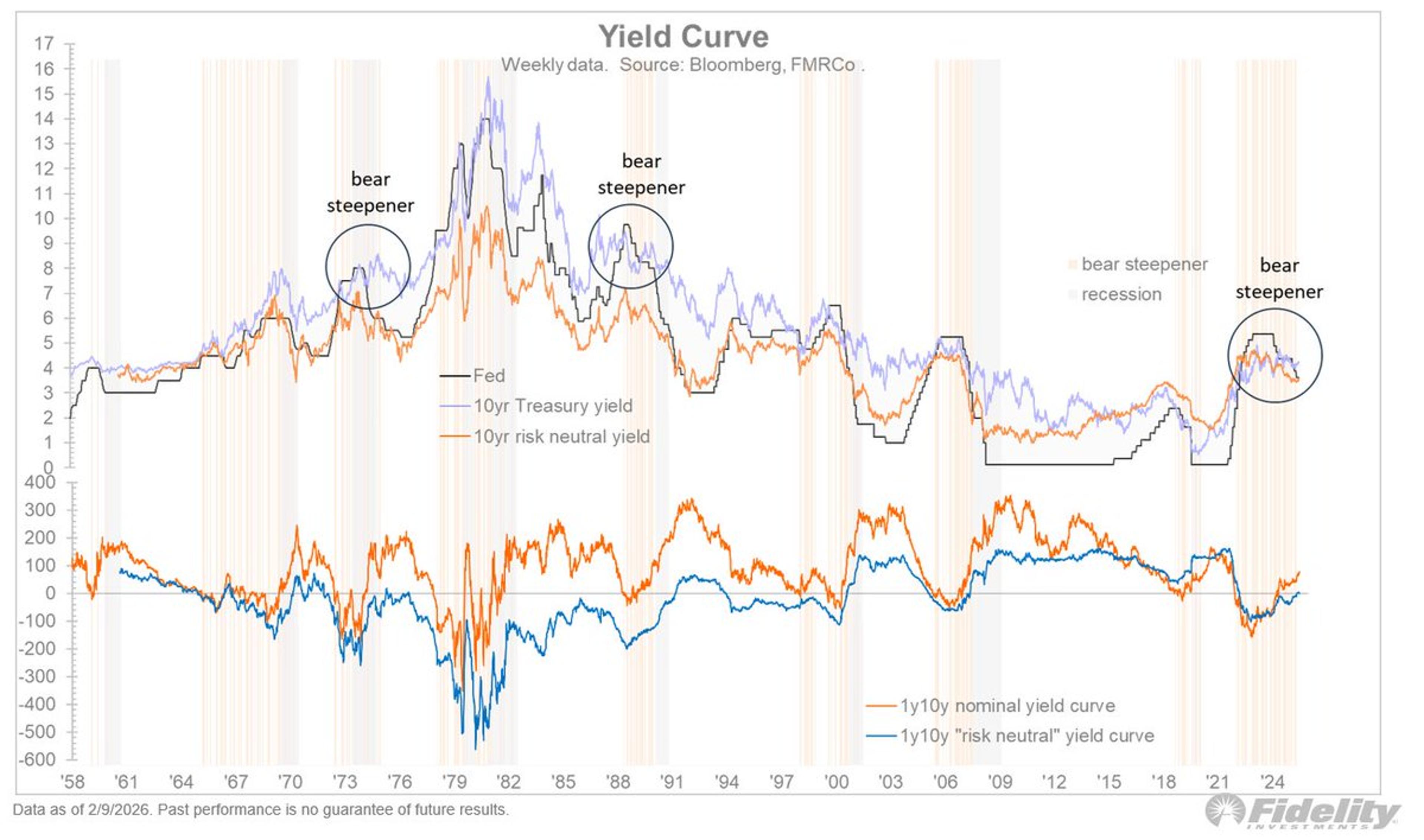

Steepening Yield Curve Could Shift QE Benefits to Main Street

How might the Fed/Treasury do that? One possibility is to cut short rates to steepen the yield curve, and deregulate the banks into buying the long end so that the Fed’s balance sheet can be “privatized.” If those QE assets...

By Jurrien Timmer

Social•Feb 12, 2026

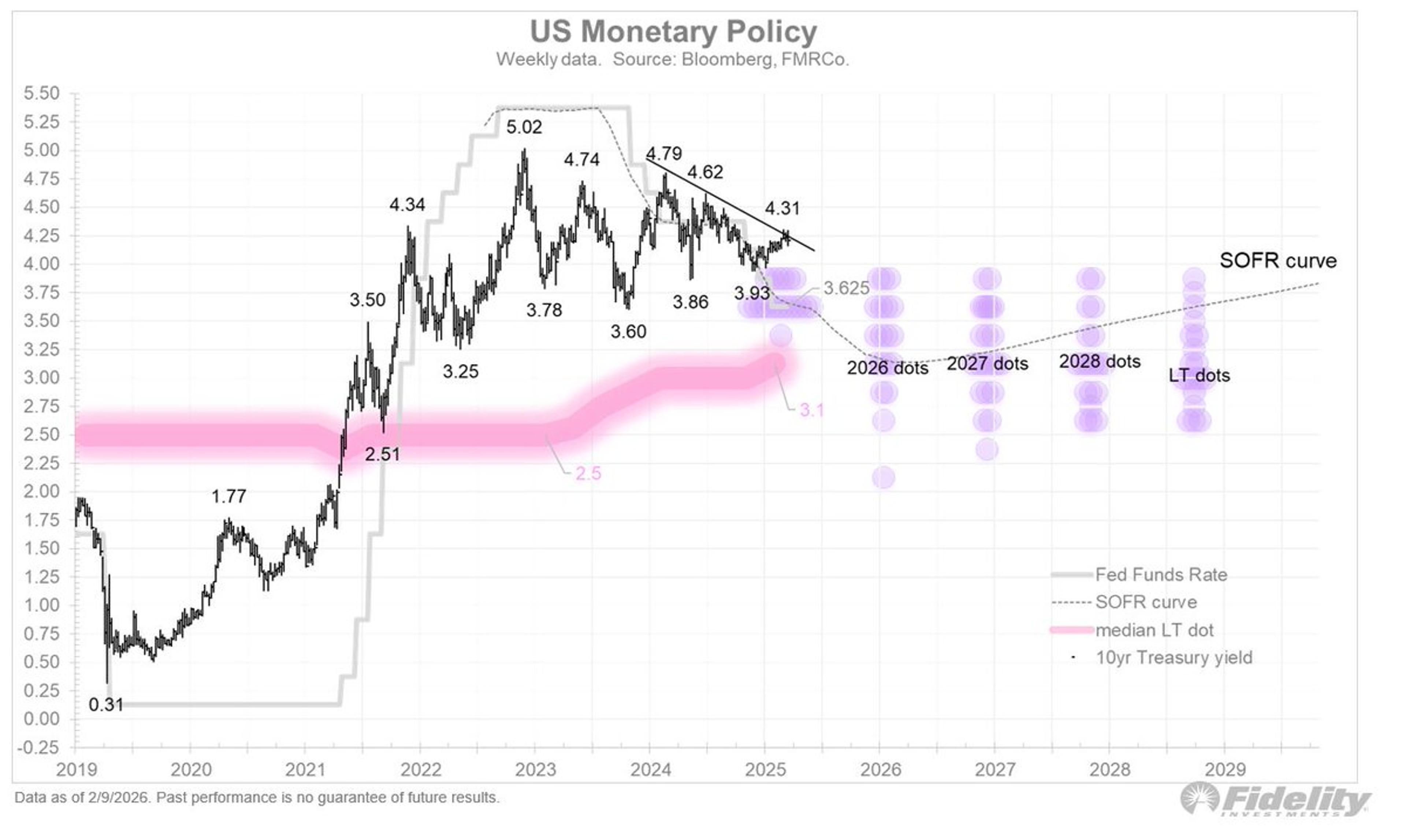

Fed Treasury to Coordinate

Things have been quiet on the rate side, with the 10-year yield trading at around 4 ¼ percent and expectations for a few more rate cuts (down to 3.1%) holding firm. We will likely soon have a lot more coordination between...

By Jurrien Timmer

Social•Feb 12, 2026

Tight Credit Spreads, Fast‑Food Struggles, Tariff Burden Revealed

🆓 Thursday links: tight credit spreads, fast food woes, and who is paying the cost of tariffs. https://t.co/NOuKmm78S8 image: https://t.co/Lhs7cz5vWL https://t.co/nj3y6g7t8i

By Tadas Viskanta

Social•Feb 12, 2026

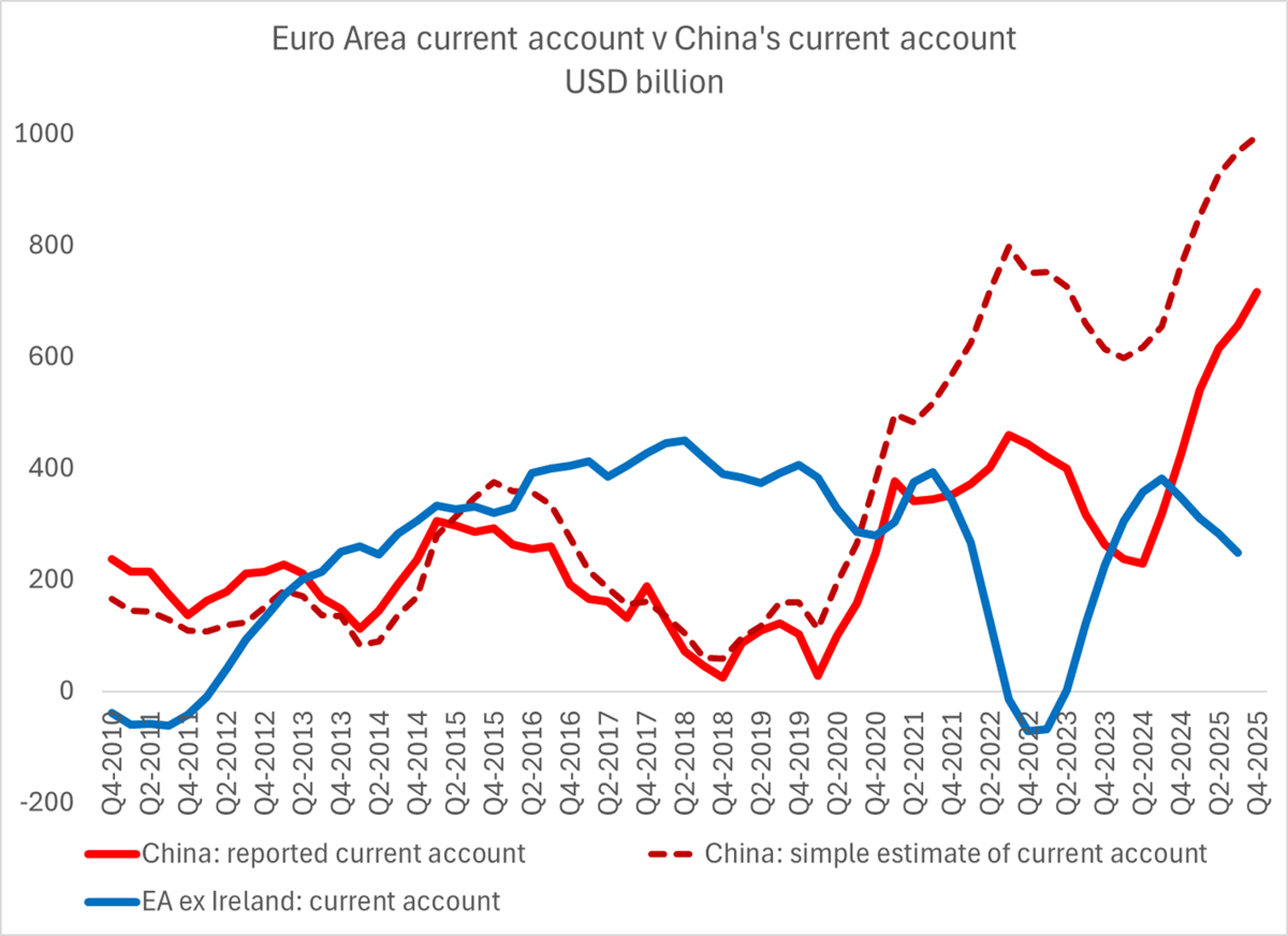

China’s Surplus Outpaces Europe, IMF View Outdated

The IMF's standard way of talking about global trade and payment imbalances tends to view Europe and China similarly -- but that is now out of date. China's reported surplus will top $700b in 2025, the euro area's surplus...

By Brad Setser

Social•Feb 12, 2026

Domestic Sales and Exports Aren't Comparable Economic Metrics

It is ignored because it is misleading to compare in country sales (generated by Chinese production for sale to Chinese buyers) to exports (goods produced in one country for sale in another). Firms and countries are different economic concepts

By Brad Setser

Social•Feb 12, 2026

China Eases Capital Controls as Asset Buildup Accelerates

China usually liberalizes its financial account when the PBOC (now the state banks) are accumulating assets at too rapid a pace, and it wans the dollar risk to be taken by others ... 1/2

By Brad Setser

Social•Feb 12, 2026

East Asia Drives Surging Trade Surplus, Currencies Remain Cheap

Bingo And the global trade surplus (ex pharma) is now primarily in China, Taiwan and Korea ... Important qualification to the now standard argument the dollar has gotten weaker (which is true primarily if the clock starts at the end of 24,...

By Brad Setser

Social•Feb 12, 2026

Excess Wealth vs Limited Cash Fuels Asset Bubbles

Wealth isn’t worth anything unless it can be converted into money to spend. And when there’s a lot of wealth relative to the amount of hard money available — like we’re seeing today — bubbles are created. @nikhilkamathcio https://t.co/iBiRkkv7Ok

By Ray Dalio