New ‘Disney Inspire’ Visa Card Revealed | List of All Benefits + How to Earn Rewards

•February 3, 2026

0

Companies Mentioned

Why It Matters

The card targets affluent Disney fans willing to pay a premium for bundled travel and entertainment credits, potentially boosting Disney’s direct‑to‑consumer revenue and enriching Chase’s premium card portfolio. Its high‑value incentives could shift spend from competing theme‑park and streaming loyalty programs.

Key Takeaways

- •$149 annual fee, higher than existing Disney cards

- •$300 statement credit after $1,000 spend in first 3 months

- •10% cash back on Disney+, Hulu, ESPN+ purchases

- •0% APR for six months on select vacation packages

- •Earn up to 200 Disney Rewards Dollars on resort stays

Pulse Analysis

The Disney Inspire Visa Card arrives as a high‑margin, premium product designed to capture the spending of Disney’s most dedicated fans. Priced at $149 annually, it immediately differentiates itself with a $300 statement credit after a modest $1,000 spend in the first three months, plus a $300 e‑gift card and a $100 annual park‑ticket credit. These upfront incentives are paired with a suite of experiential perks—character photo sessions, cruise‑line savings, and exclusive discounts on merchandise and dining—that reinforce brand loyalty while encouraging card‑linked purchases across Disney’s ecosystem.

Reward earnings are structured to favor Disney‑centric spending. Cardholders receive 10% back in Disney Rewards Dollars on Disney+, Hulu and ESPN+ subscriptions, 3% at gas stations and Disney locations, and 2% at groceries and restaurants, with a baseline 1% on all other purchases. The “Pay Yourself Back” feature lets members convert rewards into statement credits for airline tickets, effectively turning the card into a travel‑funding tool. Compared with the free Disney Visa and the $49‑annual Disney Premier Visa, the Inspire card’s higher fee is offset by its richer credit mix and the 0% promotional APR for six months on select vacation packages.

From a market perspective, the partnership deepens Chase’s foothold in the premium co‑branded card space while giving Disney a direct conduit to monetize its expanding streaming and theme‑park portfolio. By bundling streaming credits with tangible park and cruise benefits, the card blurs the line between digital and physical experiences, a strategy likely to attract high‑spending households seeking a single payment instrument for all Disney interactions. If adoption meets expectations, the Inspire card could set a new benchmark for entertainment‑brand credit cards, prompting competitors to enhance their own loyalty‑linked offerings.

New ‘Disney Inspire’ Visa Card revealed | List of all benefits + how to earn rewards

Disney Inspire Visa Card | List of all benefits + how to earn rewards

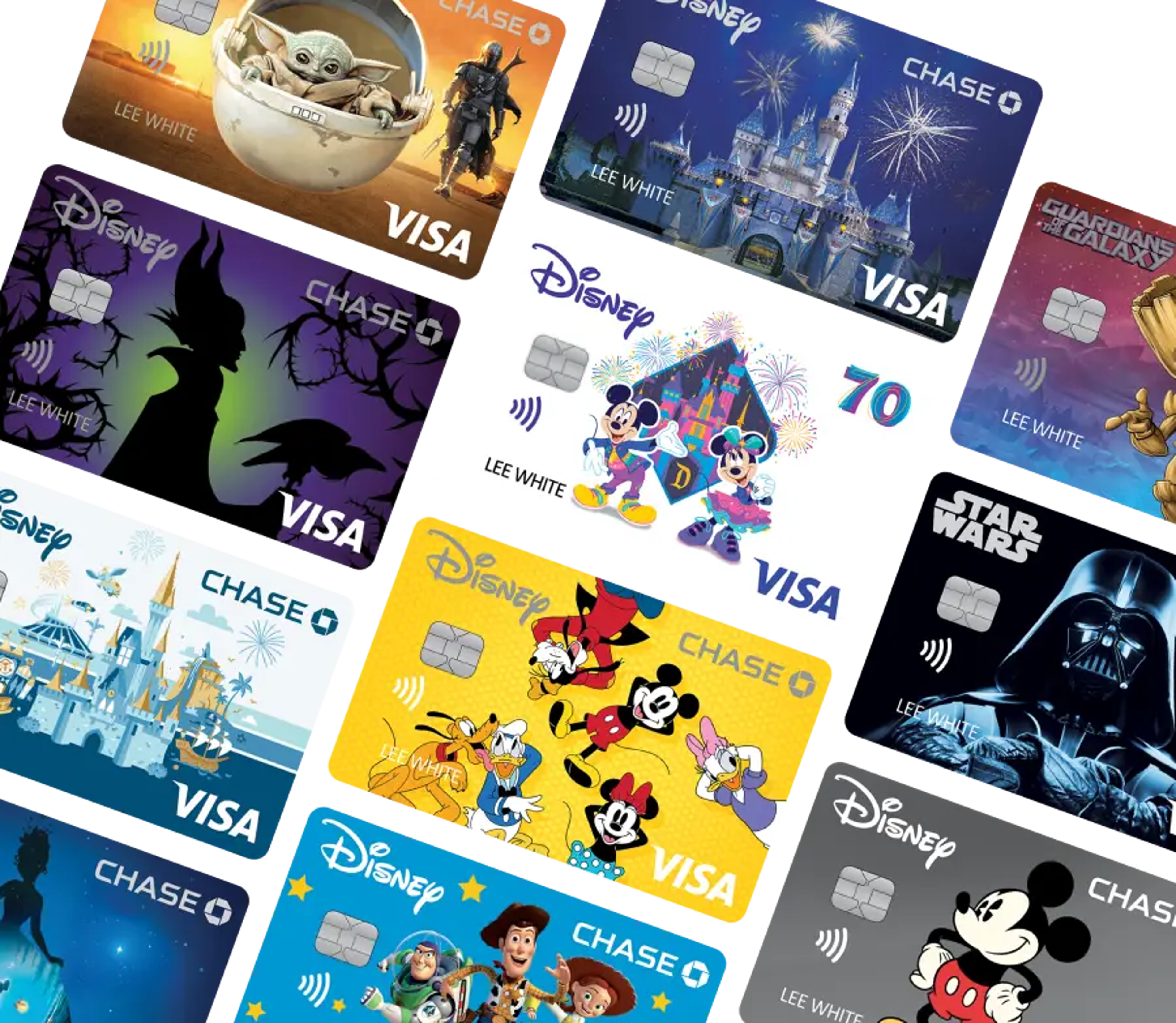

Disney and Chase announced the Disney Inspire Visa Card on Feb. 3, 2026. This new offering rolls out in addition to, not in replacement of, the existing Disney Visa Card and Disney Premier Visa Card.

The Disney Inspire Visa Card requires a $149 annual fee. (This compares to the $0 annual fee for the Disney Visa Card and the $49 annual fee for the Disney Premier Visa Card.)

Disney Inspire Visa Cardholders earn rewards for spending money on Disney products and experiences, and the rewards can in turn be used for more Disney‑related moments, as seen in the lists below.

List of benefits for Disney Inspire Visa Card

The Disney Inspire Visa Card comes with the following benefits:

-

No foreign transaction fees

-

Pay Yourself Back to redeem Disney Rewards Dollars for a statement credit on qualifying Disney and airline purchases

-

Savings aboard Disney Cruise Line for select onboard purchases

-

Cardmember‑exclusive character photo opportunities at Walt Disney World and Disneyland

-

0% promotional APR for 6 months on select Disney vacation packages

-

$300 statement credit (after spending $1,000 on purchases in the first three months from account opening)

-

$300 Disney gift card eGift for new cardmembers upon approval

-

$100 statement credit (after spending $200 per anniversary year on U.S. Disney theme park tickets)

-

200 Disney Rewards Dollars (after spending $2,000 per anniversary year on U.S. Disney Resort stays and Disney Cruise Line bookings)

-

Up to $120 annual credit on Disney+, Hulu, and Plus.ESPN.com purchases

-

10% off select purchases at DisneyStore.com

-

10% off select recreation experiences at Walt Disney World

-

15% off select guided tours at Walt Disney World and Disneyland

-

10% off select dining locations most days at Walt Disney World and Disneyland

-

10% off select merchandise at Walt Disney World and Disneyland

How to earn Disney Rewards Dollars

Using the Disney Inspire Visa Card, cardholders earn the following percentages back in Disney Rewards Dollars from various transactions:

-

1% on all other card purchases

-

2% at grocery stores and restaurants

-

3% at gas stations

-

3% at most U.S. Disney locations

-

10% at DisneyPlus.com, Hulu.com, and Plus.ESPN.com

How to spend Disney Rewards Dollars

Disney Inspire Visa Cardholders can spend their Disney Rewards Dollars on:

-

Airline purchases (using Pay Yourself Back for statement credits)

-

Disney movies at AMC Theatres

-

Purchases at DisneyStore.com

-

Disney Cruise Line onboard activities and shopping

-

Disney Cruise Line packages

-

Dining at Disney theme parks and resorts in the U.S.

-

Shopping at Disney theme parks and resorts in the U.S.

-

Disney hotel stays in the U.S.

-

Disney theme park tickets in the U.S.

Learn more about the Inspire Disney Visa Card and compare to other Disney Visa Card options [here]. For an analysis of its perks, check out [Nerd Wallet’s story] on why it’s the only Disney Visa card they recommend.

0

Comments

Want to join the conversation?

Loading comments...