Markets Don't Care About the Middle East

•February 18, 2026

0

Why It Matters

Understanding the disconnect between geopolitical risk and market reaction helps investors avoid over‑reacting to headlines while still monitoring long‑term structural changes. As the Middle East remains a potential source of both disruption and future economic integration, recognizing when it might truly affect global portfolios is crucial for strategic asset allocation.

Markets Don't Care About the Middle East

[

](https://images.unsplash.com/photo-1679480122411-7d61ea3e07b3?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wzMDAzMzh8MHwxfHNlYXJjaHw1fHxpcmFuJTIwZmxhZ3xlbnwwfHx8fDE3NzEzNjE1ODJ8MA&ixlib=rb-4.1.0&q=80&w=1080)

Photo by engin akyurt on Unsplash

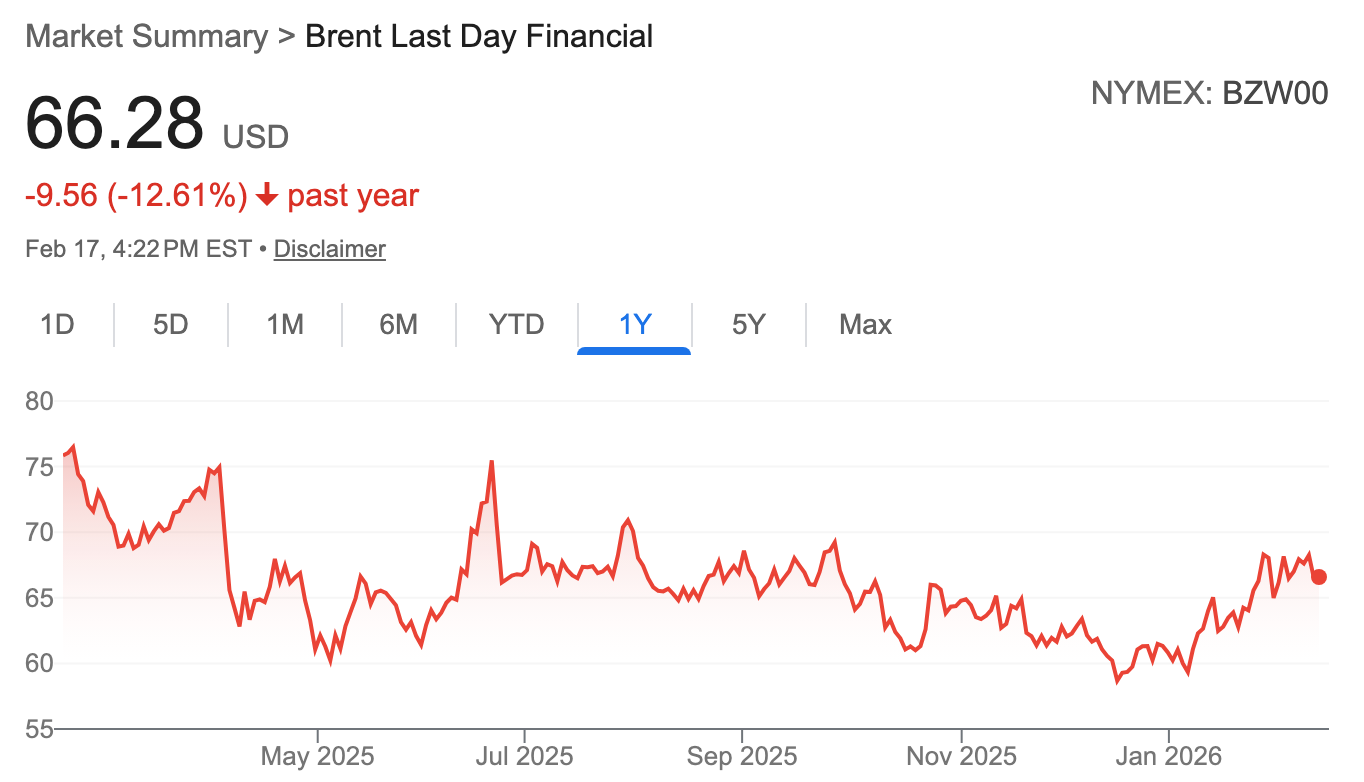

Yesterday’s news brought hints of a possible deal with Iran, but the continuing U.S. threats and naval deployments echo the unmistakable sounds of war. So why is it that oil prices have risen roughly 10% since the start of the year on the prospect of fresh conflict, while the world’s stock markets seem blissfully unaware that this fragile region may be on the verge of falling apart?

While the region matters deeply to anyone with a conscience and an inkling of the suffering that continues to play out, the truth is that the Middle East just doesn’t matter much to global investors. For decades after the 1973 Arab Oil embargo, which drove U.S. inflation above 12% and unemployment over 8%, markets have shivered whenever regional tensions rose.

But oil discoveries in the United States, Canada, Brazil and Nigeria have significantly diversified production. Today, even though the region’s oil producers supply a third of the world’s oil markets, few expect anything that happens here to have much impact on the 3.3% global growth the IMF forecasts this year.

The last significant global oil shock came with Russia’s surprise invasion of Ukraine and the expansive sanctions imposed on the country, which initially drove Brent crude oil above $112 per barrel in June 2022. Europe bore much of the pain through higher prices and a stock market slump. But that didn’t last.

Israeli and U.S. attacks on Iran last June sent oil prices near $70 for a few days, but they quickly dropped back to the mid-60s when it became clear that Iranian retaliation would be limited and Saudi Arabia was not going to get involved.

The recent rise reflects the gathering U.S. naval deployments and increasingly voluble threats from President Donald Trump. But few investors seem to believe in the extreme risks of Saudi Arabia entering the fight or Iran escalating the conflict by blocking the Strait of Hormuz.

So there’s no need to go fiddling with your portfolio as you watch the diplomatic dance unfold. But do keep an eye on the long game. While there’s a big chance of continuing bad news from here, there’s also a small chance for some very good news. If the day should ever come that allows Saudi Arabia and Israel to normalize relations, that’s when global investors will pay close attention once again.

Opening trade and investment between the region’s most advanced economy and its largest pot of money is a story that would have reverberations around the world.

[

](https://substackcdn.com/image/fetch/$s_!AkhJ!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fcdb69b5e-bc5b-410f-817d-e117a23b5505_1364x782.png)

0

Comments

Want to join the conversation?

Loading comments...