Westpac Leading Index Slows to Near-Flat, Signals Cooling Growth Momentum

•February 18, 2026

0

Companies Mentioned

Why It Matters

The near‑flat index signals that tightening monetary policy is beginning to curb Australia’s growth momentum, raising caution for investors and policymakers.

Key Takeaways

- •Leading Index flat at +0.02% in January

- •Consumer sentiment and dwelling approvals drag growth

- •Commodity price gains offset weakness but AUD strength limits impact

- •Westpac projects 2.5% GDP growth for 2026

- •RBA likely to raise rates again in May

Pulse Analysis

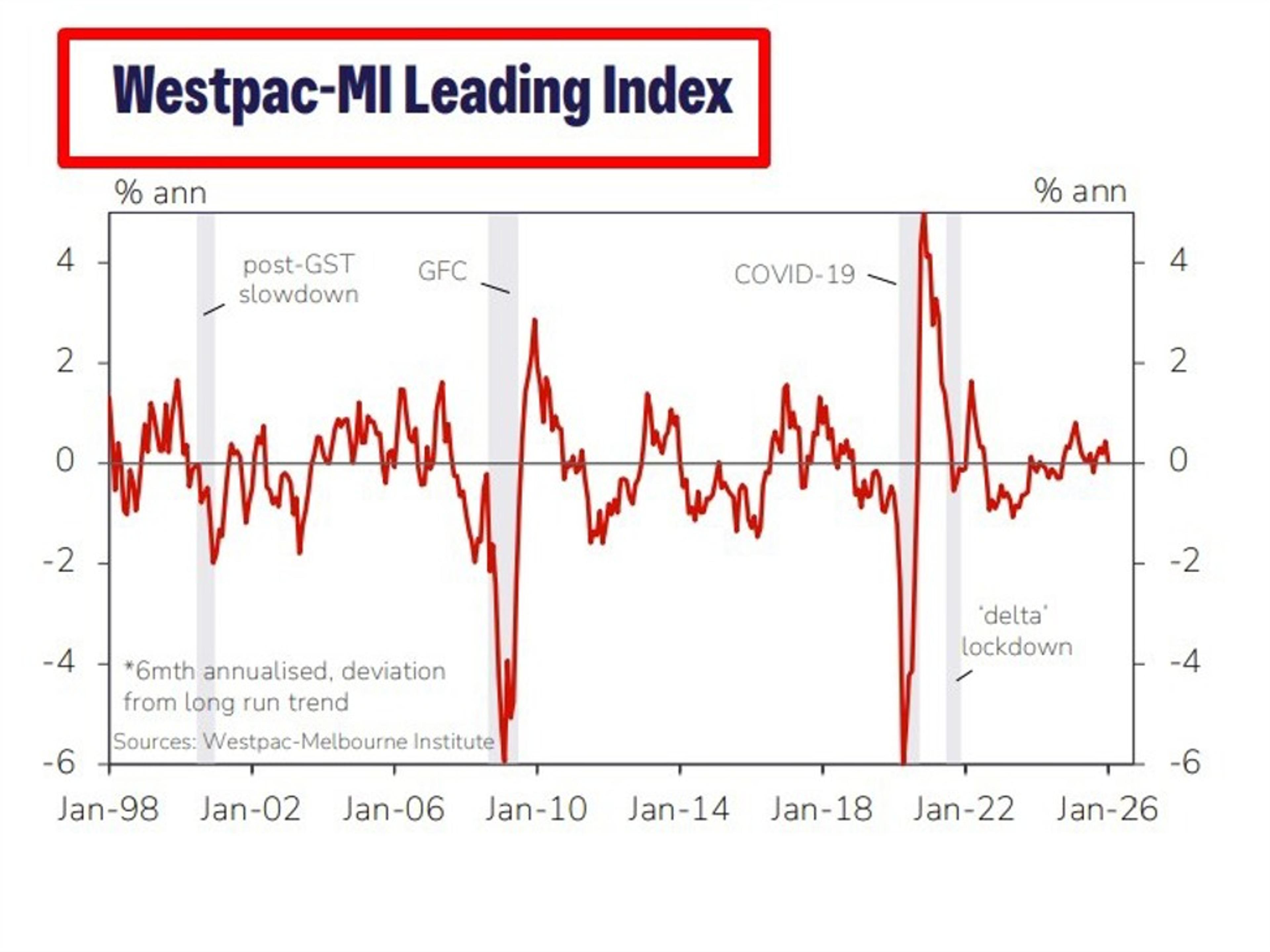

The Westpac‑Melbourne Institute Leading Index is a forward‑looking gauge that tracks activity three to nine months ahead of official GDP releases. A reading of +0.02% suggests Australia’s economy is now moving in line with its long‑run trend, a stark contrast to the modest upside seen at the end of 2025. Analysts watch this metric closely because it often foreshadows shifts in consumer spending, business investment, and monetary policy decisions, making it a bellwether for the broader macro environment.

The latest slowdown is rooted in two domestic weak spots: consumer confidence and housing approvals. Lower sentiment reflects households’ reaction to higher borrowing costs after the Reserve Bank’s February hike, while volatile dwelling approvals signal a cooling property market. Although rising commodity prices added a modest boost, the benefit was partially neutralised by a firmer Australian dollar, which makes export‑linked earnings less competitive. This dynamic underscores the delicate balance between external price shocks and internal demand pressures.

Looking ahead, Westpac’s steadfast 2.5% GDP projection for 2026 suggests it expects the economy to regain footing once the tightening cycle eases. However, the prospect of a further 25‑basis‑point rate increase in May signals that the RBA remains vigilant about inflation. Investors should monitor upcoming CPI data and the AUD’s trajectory, as these factors will shape credit conditions, equity valuations, and the overall risk appetite in the Australian market.

Westpac Leading Index slows to near-flat, signals cooling growth momentum

Westpac’s Leading Index slowed to near-flat in January, signalling growth momentum has slipped back to trend. Consumer and housing weakness offset commodity support, with GDP still seen at 2.5% in 2026.

Summary:

-

Westpac–Melbourne Institute Leading Index slows to +0.02% in January (from +0.44%).

-

Growth momentum shifts from slightly above trend to broadly in line with trend.

-

Consumer sentiment and dwelling approvals the main drags.

-

Commodity price gains cushioned weakness, but AUD strength may dilute support.

-

Westpac still sees 2.5% GDP growth in 2026, with next RBA hike likely in May.

Australia’s growth pulse has flattened at the start of 2026, with the Westpac–Melbourne Institute Leading Index slowing sharply in January, signalling that momentum has slipped back to trend after a modest lift late last year.

The six-month annualised growth rate of the index — which tracks economic activity three to nine months ahead — eased to +0.02% in January from +0.44% in December, effectively stalling. Westpac said the earlier second-half pick-up in 2025 was never especially convincing, and the latest reading suggests that momentum has once again faded.

The weakness was centred on the domestic consumer and housing sectors. The Westpac-MI Consumer Expectations Index shaved 0.16 percentage points off the growth rate over the past six months, while dwelling approvals detracted a further 0.23 points. While approvals have been volatile month to month, softer consumer sentiment appears more entrenched, reflecting shifting interest-rate expectations and the impact of February’s Reserve Bank hike.

Commodity prices provided some offset, contributing 0.36 percentage points over the past half-year. However, Westpac noted that gains in USD-denominated commodity prices were partly diluted by a firmer Australian dollar, with the recent acceleration in AUD strength likely to dampen future readings if sustained.

Despite the softer signal, Westpac continues to forecast GDP growth of 2.5% in 2026, broadly in line with trend. The bank expects the Reserve Bank of Australia to tread cautiously at its March meeting but sees another 25bp rate hike in early May, contingent on a still-elevated quarterly CPI reading due April 29.

For now, the Leading Index suggests the tightening cycle is beginning to weigh, reinforcing expectations of an “on again, off again” growth profile this year.

This article was written by Eamonn Sheridan at investinglive.com.

0

Comments

Want to join the conversation?

Loading comments...