Recommended Weekend Reads

•February 14, 2026

0

Why It Matters

Understanding these trends is crucial for policymakers, investors, and citizens who must navigate a world where traditional alliances are weakening, trade protectionism is costly, and demographic shifts threaten labor supplies. The episode’s timing aligns with the Munich Security Conference and ongoing debates over U.S. leadership, making the analysis especially relevant for anyone tracking the future of international order and economic policy.

Recommended Weekend Reads

### February 13 - 15, 2026

Below are several reports and articles we read this past week that we found particularly interesting. I hope you find them both interesting and useful. Have a great weekend.

The Future of NATO and the Munich Security Conference

NOTE: With the Munich Security Conference taking place this weekend, we wanted to bring focus to several of the key issues being discussed and debated.

-

Trump’s NATO Dilemma – America Can’t Disengage from the Alliance and Also Lead It Sara Bjerg Moller/Foreign Affairs

Amid a sea of disruptions—territorial threats against Denmark, missed alliance meetings by senior U.S. diplomats, and planned personnel reductions at NATO installations—the Trump administration’s second-term approach to NATO is now coming into focus. Rather than openly abandoning the alliance, as some analysts feared, the United States appears to be “quiet quitting”: incrementally stepping away from the alliance it has led for close to eight decades. The White House seems to believe that only if the United States steps back will Europe finally be forced to step up. But it will find that walking away from overseeing NATO’s military machinery is far harder than anticipated. NATO’s command structure was built around U.S. infrastructure and personnel, and no other member of the alliance is currently equipped to replace Washington. If Trump does choose to push ahead with his planned disengagement, the logistics of succession would be the least of the United States’ concerns. No major power has ever voluntarily surrendered control, much less command, of an alliance it built and led. Doing so at a moment of profound geopolitical upheaval would weaken the transatlantic partnership—and leave the United States less secure.

-

Poll: Top NATO allies don’t think the US helps deter enemies anymore Politico EU

As global leaders convene in Germany for the Munich Security Conference, new results from The POLITICO Poll show President Donald Trump’s efforts to rewrite longstanding international relationships — particularly in Europe — are repelling longtime, traditionally loyal partners. The United States’ eroding reputation is raising fresh questions about the stability of the global order that has held for decades, and of the country’s strength on the world stage. Across all countries polled, far more people described the U.S. as an unreliable ally than a reliable one, including half the adults polled in Germany and 57 percent in Canada. In France, too, the share of people who called the U.S. unreliable was more than double the share who said it was reliable.

Perspectives is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

-

Can Germany’s Merz be the savior of Europe? Reuters Commentary

European Union leaders are meeting this week to discuss how to boost the bloc’s competitiveness. While President Donald Trump’s withering description of Europe last month as a “decaying” region was unwelcome, it may be what finally prompts them to take much-needed action. Germany has historically been a brake on EU reform, but Berlin now appears to be on board. Chancellor Friedrich Merz told the World Economic Forum in Davos last month that the EU now had no choice but to urgently pursue former European Central Bank president Mario Draghi’s blueprint for a competitive Europe.

-

Europe’s Next Hegemon: The Perils of German Power Liana Fix/Foreign Affairs

After many delays, Germany’s Zeitenwende—its 2022 promise to become one of Europe’s defense leaders—is finally becoming a reality. In 2025, Germany spent more on defense than any other European country in absolute terms. Its military budget today ranks fourth in the world, just after Russia’s. Annual military spending is expected to reach $189 billion in 2029, more than triple what it was in 2022. Germany is even considering a return to mandatory conscription if its military, the Bundeswehr, cannot attract enough voluntary recruits. Should the country stay the course, it will again be a great military power before 2030.

-

Vladimir Putin is trapped in a war he cannot win but dare not end Peter Dickerson/The Atlantic Council

Putin’s reluctance to accept Trump’s offer makes perfect sense when viewed from the perspective of the Russian ruler’s revisionist worldview and imperial ambitions. Crucially, Putin is well aware that any peace deal based on the current front lines of the war would leave 80 percent of Ukraine beyond Kremlin control and free to integrate into the democratic world. That is exactly what he is fighting to prevent. As the war enters a fifth year, Putin finds himself in an unenviable predicament. He has no obvious pathway to victory, but cannot agree to a compromise peace without acknowledging what would amount to a historic defeat and placing his own political survival in question.

Tariffs, Trade, and Geoeconomics

-

Who Is Paying for the 2025 U.S. Tariffs? Federal Reserve Bank of New York

The Federal Reserve Bank of New York is out with a new analysis that finds ~90% of tariffs’ economic burden was borne by American firms and consumers in the first 8 months of 2025. Between January and November, however, that incidence declined 88 percent as firms reorganized supply chains.

-

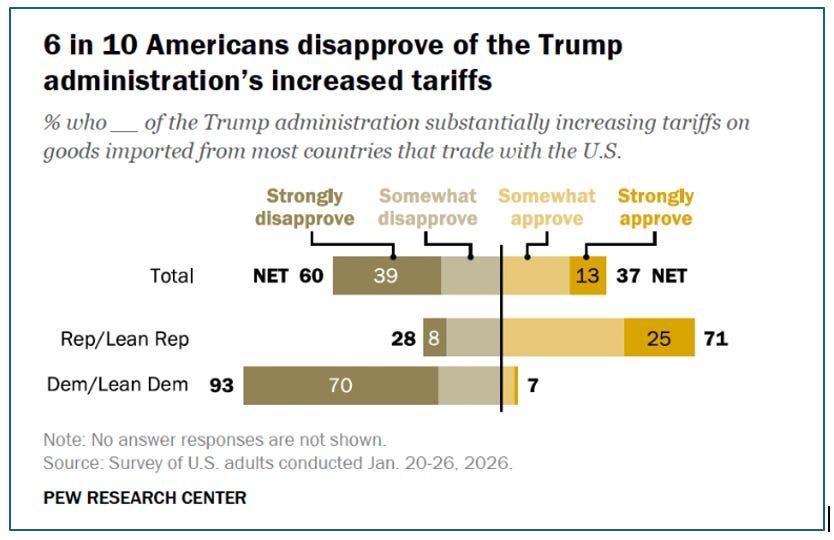

Americans Largely Disapprove of Trump’s Tariff Increases Pew Research Center

By a wide margin, Americans continue to say they disapprove of the Trump Administration substantially increasing tariffs: 60% say, including 39% who say they strongly disapprove. By contrast, 37% say they approve of the increased tariffs, and just 13% strongly approve. Views of the Administration’s tariff increase have been relatively stable since last April, when President Donald Trump unveiled his far-reaching tariff policy.

[

](https://substackcdn.com/image/fetch/$s_!sIKJ!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fb9b15000-e9e4-4e27-8ee1-1f8f9ff08870_834x540.png)

-

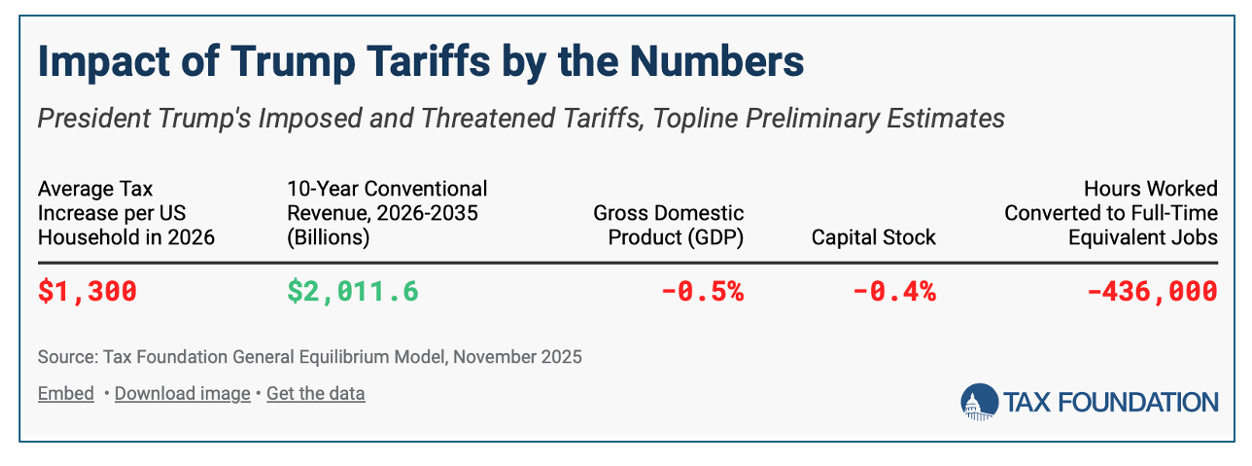

Trump Tariffs: Tracking the Economic Impact of the Trump Trade War The Tax Foundation

President Trump has imposed International Emergency Economic Powers Act (IEEPA) tariffs on US trading partners, including China, Canada, Mexico, and the EU. In addition, he has threatened and imposed Section 232 tariffs on autos, heavy trucks, steel, aluminum, lumber, furniture, semiconductors, pharmaceuticals, and copper, among others. The Trump tariffs amount to an average tax increase per US household of $1,000 in 2025 and $1,300 in 2026. Under the tariffs imposed and scheduled as of February 6, 2026, the weighted average applied tariff rate on all imports rises to 13.5 percent, and the average effective tariff rate, reflecting behavioral responses, rises to 9.9 percent—the highest average rate since 1946. The Trump tariffs are the largest US tax increase as a percent of GDP (0.54 percent for 2026) since 1993. Trump’s imposed tariffs will raise $2.0 trillion in revenue from 2026-2035 on a conventional basis and reduce US GDP by 0.5 percent, all before foreign retaliation. Accounting for negative economic effects, the revenue raised by the tariffs falls to $1.6 trillion over the next decade. We estimate that the tariffs raised $132 billion in net tax revenue in 2025. The Trump tariffs threaten to offset much of the economic benefits of the new tax cuts, while falling short of paying for them.

[

](https://substackcdn.com/image/fetch/$s_!-Y4n!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F096ec4eb-ad21-469a-96b6-05cf90d4b320_1252x466.png)

Demographic Trends and Employment Gaps

-

The Likelihood of Persistently Low Global Fertility Journal of Economic Perspectives

Low fertility is likely to persist as a global phenomenon as pro-natal policies have been insufficient to “adequately challenge conventions, challenge social orders, and challenge what gets society’s attention, power, and investment.”

-

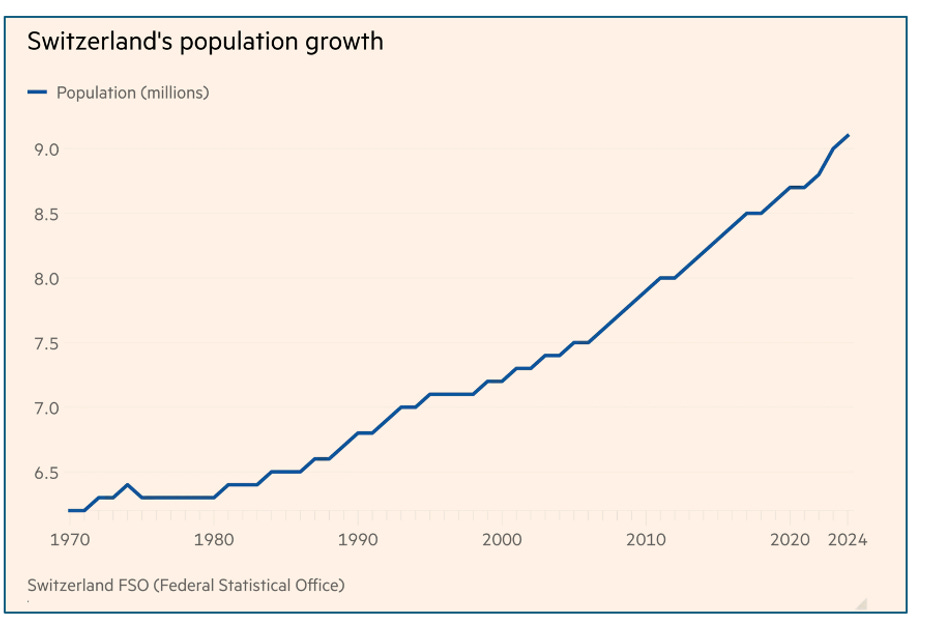

Switzerland To Vote On Plan To Cap Population At 10mn Financial Times

Switzerland will hold a vote on a radical proposal to cap the country’s population at 10mn people, a move that could threaten crucial agreements with the EU and limit companies’ access to skilled foreign workers. The country’s current population is 9.1 million people, and Switzerland has a high level of immigration, as people are drawn by its high wages and quality of life. It has one of the largest proportions of foreign residents in Europe, at 27% according to official figures, and its population has grown by some 25% since 2000, much higher than most neighboring countries.

[

](https://substackcdn.com/image/fetch/$s_!a8Or!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5dbaeafe-66d1-4ef9-9db2-bf1c56c15d93_926x630.png)

- The H-1B Wage Gap, Visa Fees, and Employer Demand George J. Borjas/National Bureau of Economic ResearchAbstract: The H-1B program lets firms hire high-skill foreign workers for a six-year term. The annual number of visas allocated to for-profit firms is capped at 85,000 and there is excess demand for those visas. The analysis merges administrative data, including the I-129 petitions that report the wage offer made to specific H-1B beneficiaries, with the American Community Surveys. On average, H-1B workers earn 16 percent less than comparable natives, suggesting that firms may be willing to pay a one-time fee to obtain the visa. The data are examined using a labor demand model to simulate how a fee alters the hiring decision. Depending on the level of excess demand, the unobserved productivity gains or costs from an H-1B hire, and the rate of job separations, the revenue-maximizing fee is between $118,000 and $264,000, has little or no impact on the number of H-1Bs hired, and generates between $6.2 and $22.4 billion in revenues. The demand for visas remains strong even if firms offshore some of the jobs currently held by H-1Bs. The fee also changes the skill composition of the H-1B workforce, making it more skilled.

0

Comments

Want to join the conversation?

Loading comments...