Social•Feb 19, 2026

Korean Reforms Spark Value Ups, Awaiting IBKR Access

I initially thought the Korean reforms would be ineffective. But on the ground, I’m seeing many companies come up with highly positive value up plans. And valuations remain a fraction of those in Japan. Once IBKR opens access, the focus will shift to Korea.

By Michael Fritzell

Social•Feb 18, 2026

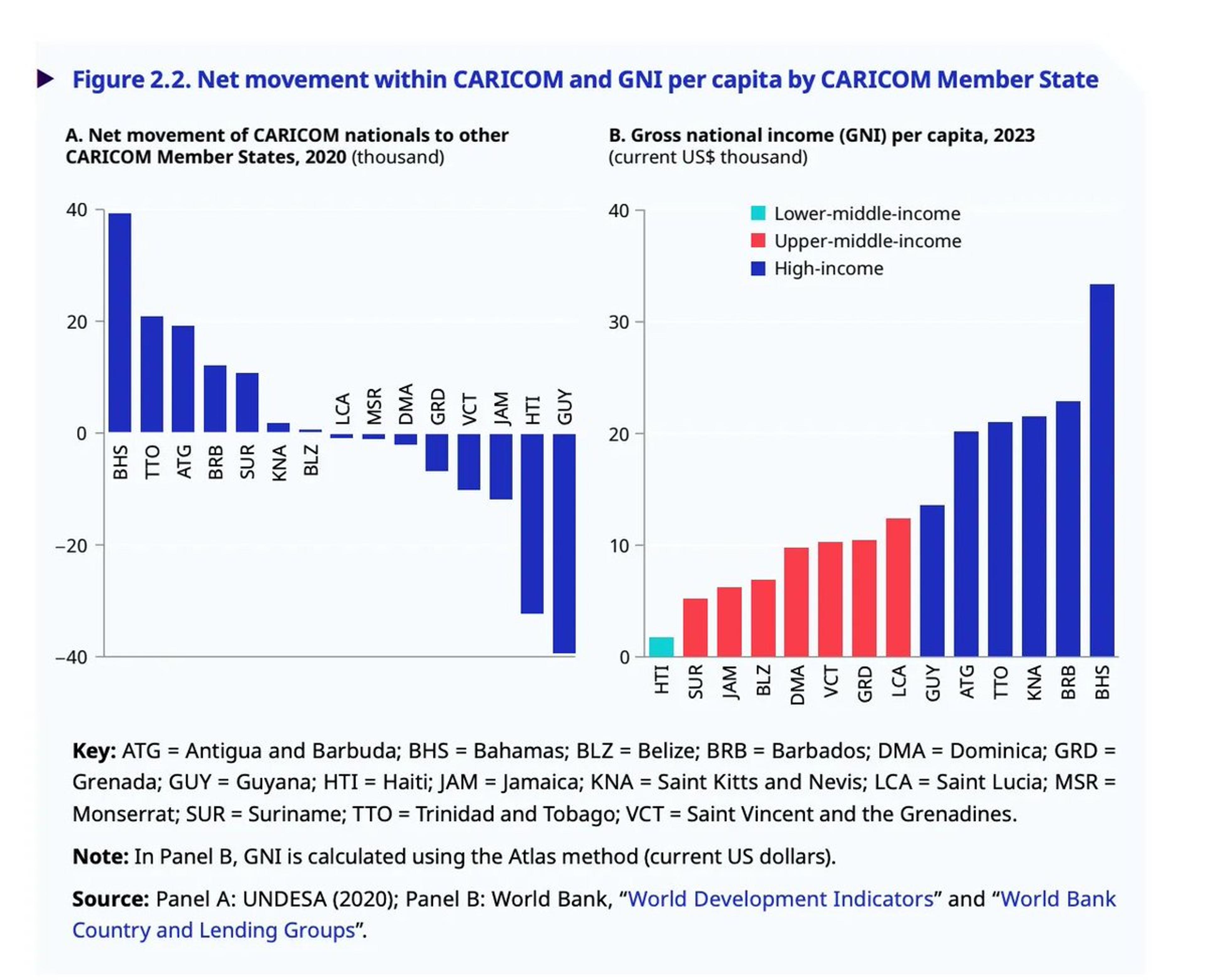

Income Gaps Fuel Migration Across CARICOM Nations

Stark differences in income drive migration within CARICOM (and these are official data). More at today's Chartbook Top Links: https://t.co/DaCnHTI3Wj

By Adam Tooze

Social•Feb 18, 2026

India Navy Seizes Shadow Fleet, Triggering Domino Effect

India's navy has begun seizing shadow fleet tankers in its exclusive economic zone. As I've said in other videos covering the shadow fleet, once the first domino falls...the rest will quickly follow. #crudeoil #crude #india #geopolitics https://t.co/IVVPGp8cQ7

By Peter Zeihan

Social•Feb 18, 2026

IEA Shifts Priorities to Security, Clean Energy, Affordability

IEA executive director Fatih Birol proposes focusing the agency's work in three areas during the next few years: 1) energy security -- "first and foremost" mission 2) new energy uptake (wind, solar, geothermal, nuclear) 3) afordability of energy "IEA 3.0" may well be...

By Javier Blas

Social•Feb 18, 2026

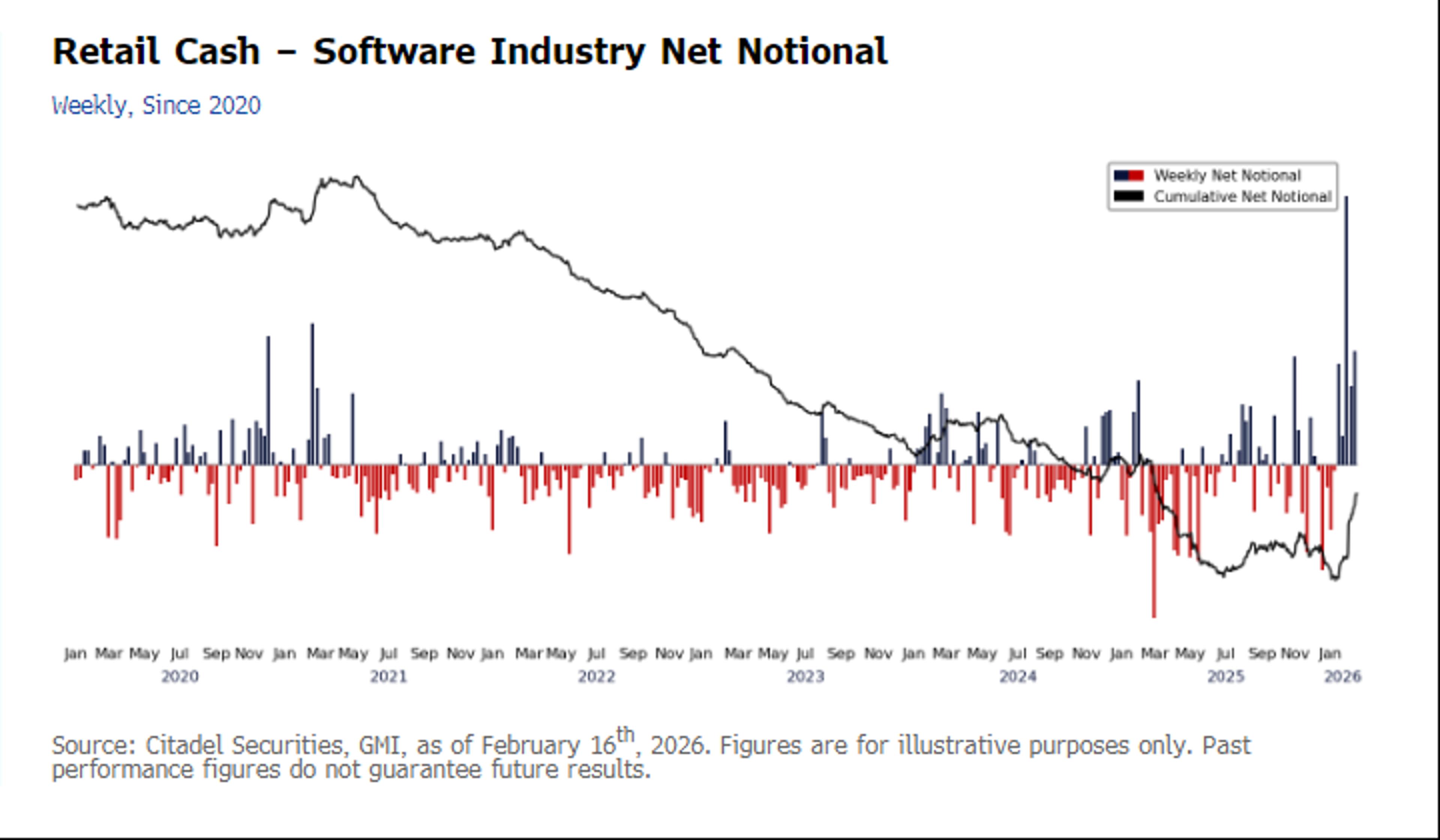

Retail Traders Set Record Demand on Citadel Platform

Citadel on flows, via Bbrg: Retail traders spent a record amount snapping up software shares on Citadel Securities’ platform, according to Scott Rubner, head of equity and equity derivatives strategy at the firm, which began tracking the data in 2017: “Net notional...

By MacroCharts

Social•Feb 18, 2026

China Delays Auto Sales Data, Signaling Weakening Market

The Economist: “Last month the China Association of Automobile Manufacturers, another state-backed trade group, appears to have deferred the publication of its weekly sales data—a sure sign of growing anxiety over weakening numbers.” https://t.co/feytAJBiP2

By Jonathan Cheng

Social•Feb 17, 2026

IEA Paris Meeting Tests Net‑Zero Shift Against US Oil Priorities

For energy policy making, a key week in Paris as @IEA energy officials gather Feb 18-19 for a biennial ministerial meeting. The IEA’s drift toward net-zero advocacy and overtures to China will be tested as US officials push to a return...

By Javier Blas

Social•Feb 17, 2026

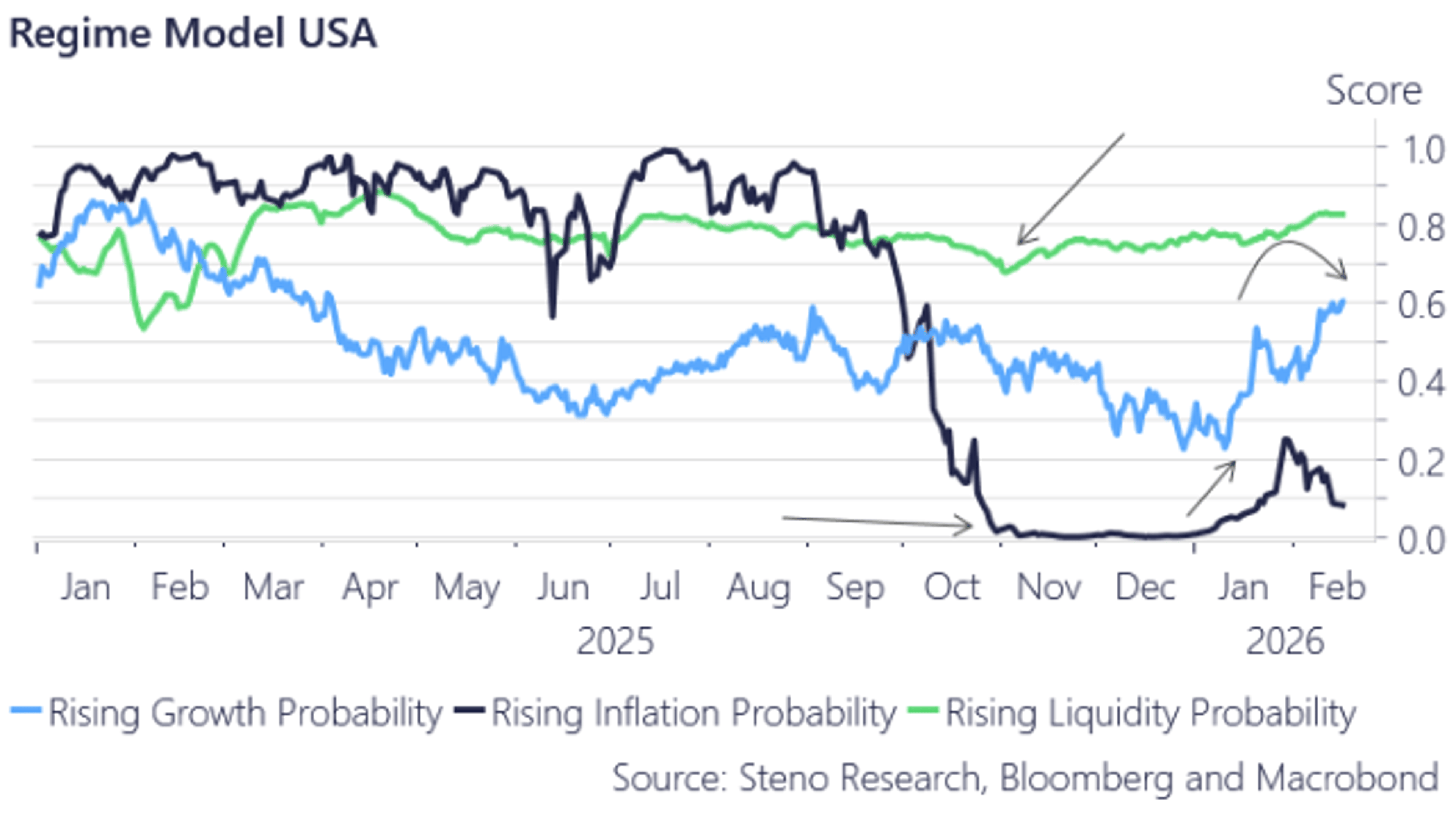

Nowcast IQ Predicts US Growth Despite Market Pessimism

A few of our weekly inputs have come in for US growth. We continue to rebound hard cyclically. EURUSD down, US assets (soon) up, and ISM PMI towards 60 by summer. Our Nowcast IQ is telling a VERY contrarian story to...

By Andreas Steno Larsen

Social•Feb 17, 2026

US‑Iran Oil Talks Conclude Second Round, Third Round Pending

OIL MARKET: The 2nd round of US-Iran talks has concluded, and Iranian media says there would be a 3rd round of negotiations in the “near future” after both sides consult with their respective governments.

By Javier Blas

Social•Feb 17, 2026

Iran and Russia Clash over China Oil Supply Rivalry

The oil ministers of Iran and Russia met today. Contrary to popular belief, Moscow and Tehran are now bitter rivals in the oil market as the size of the black market for crude shrinks. Both compete to supply China. (My earlier @Opinion...

By Javier Blas

Social•Feb 17, 2026

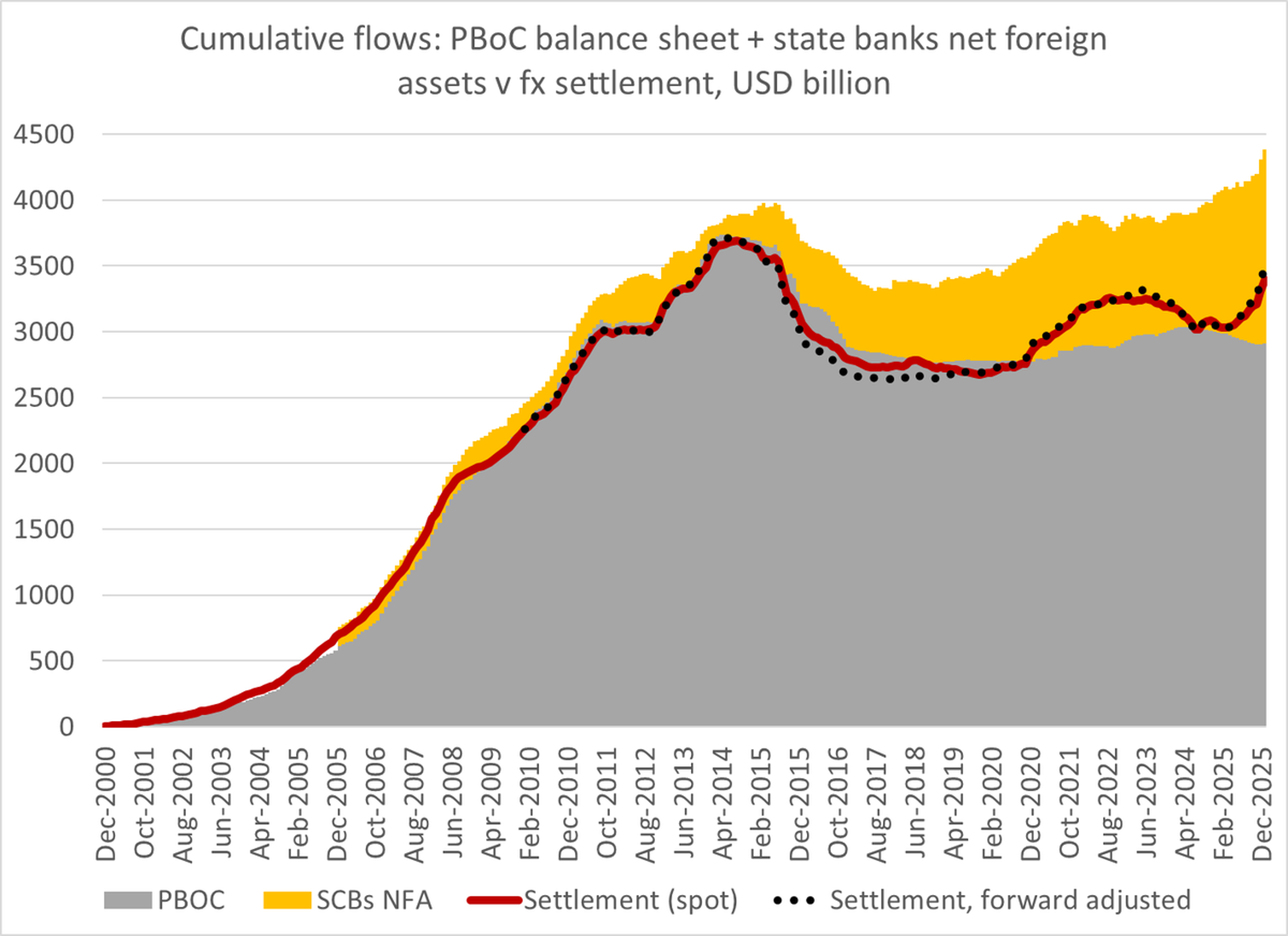

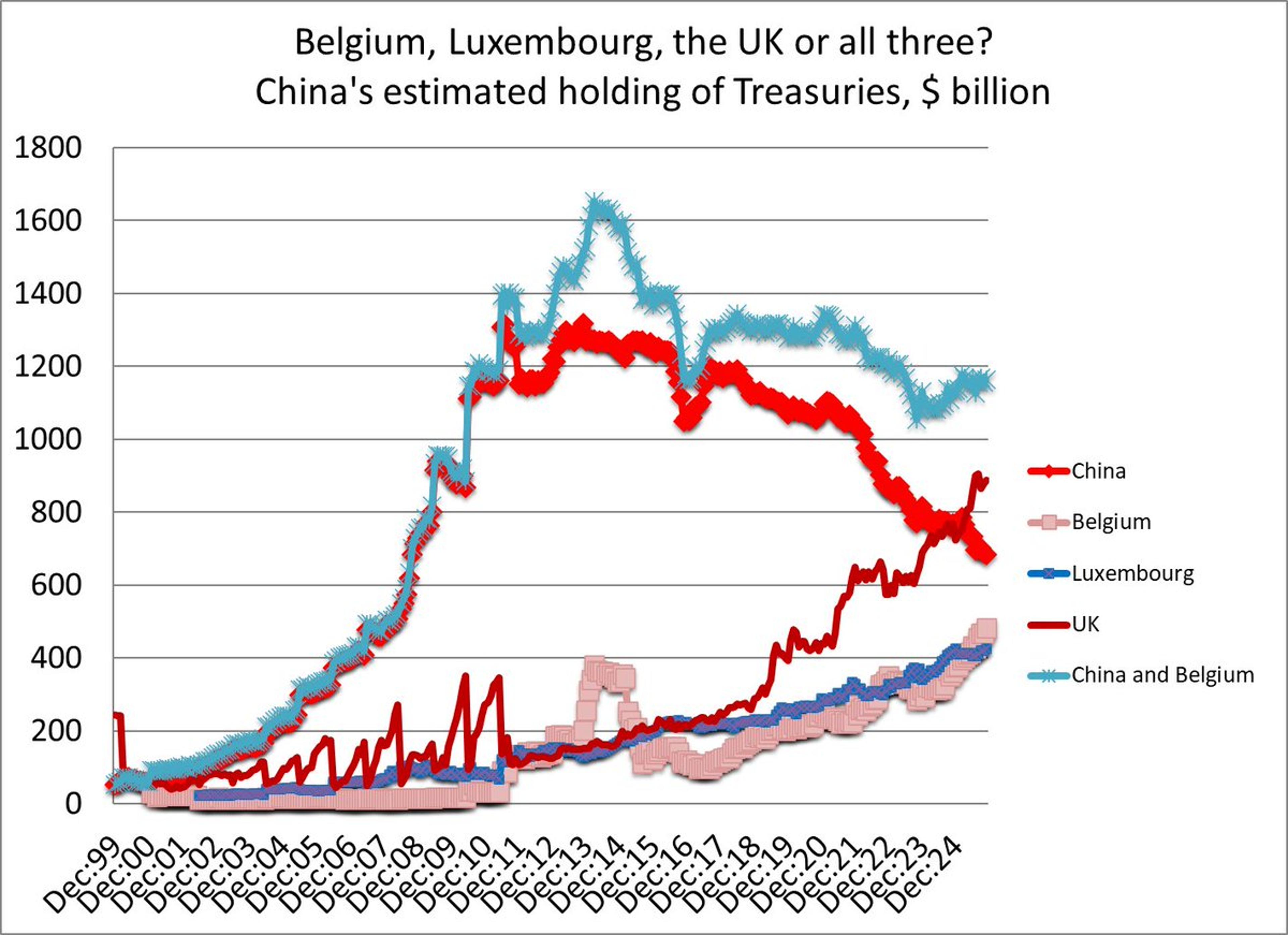

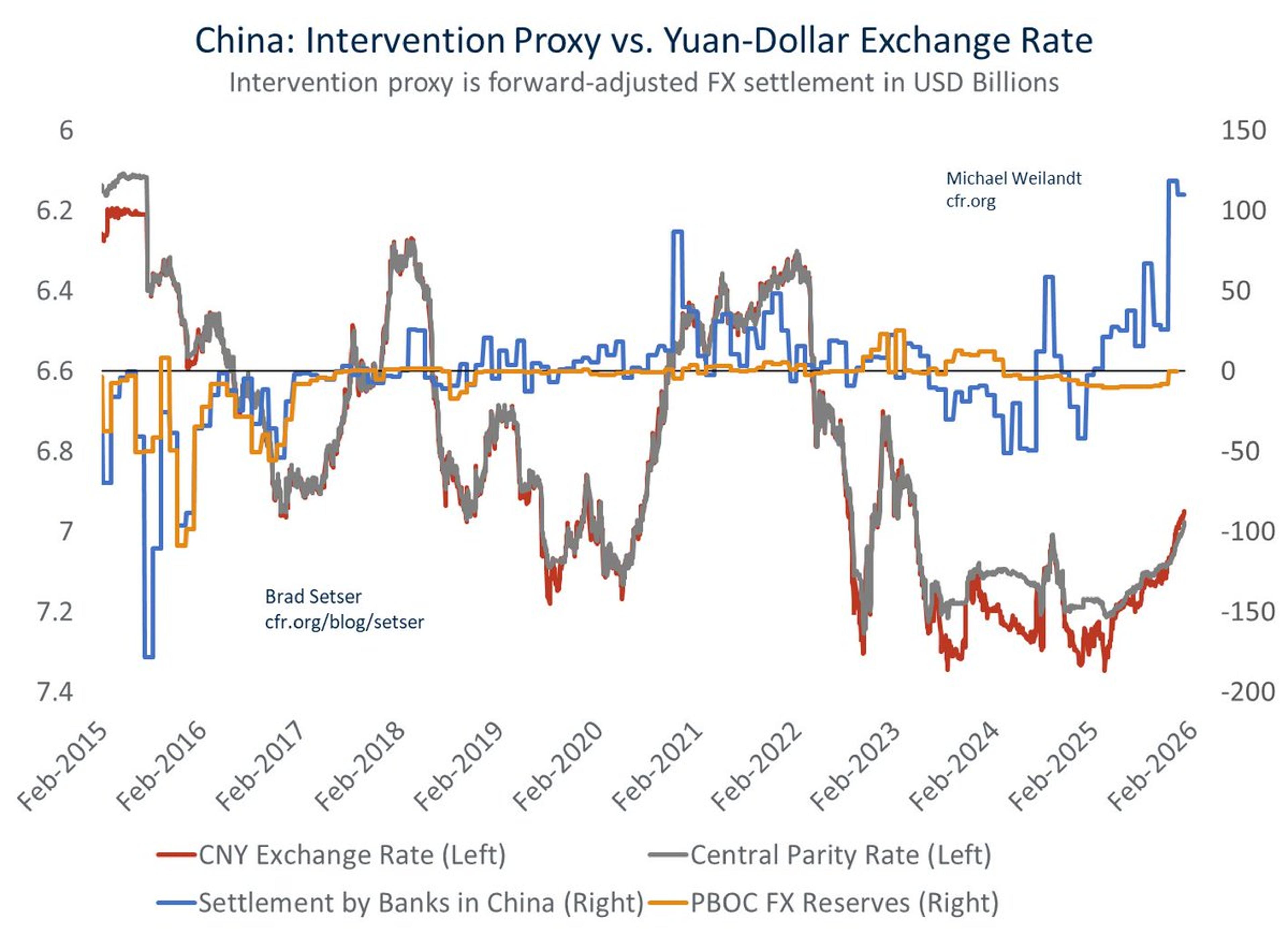

China Shifts Reserves to State Banks, Boosts Returns

Beijing really just outsourced its reserves to its state banks, and shifted out of US custodians High return on investment tho. Tons of folks swallow the fall in reported Treasury holdings hook, line and sinker https://t.co/MKw3EJlSuR

By Brad Setser

Social•Feb 17, 2026

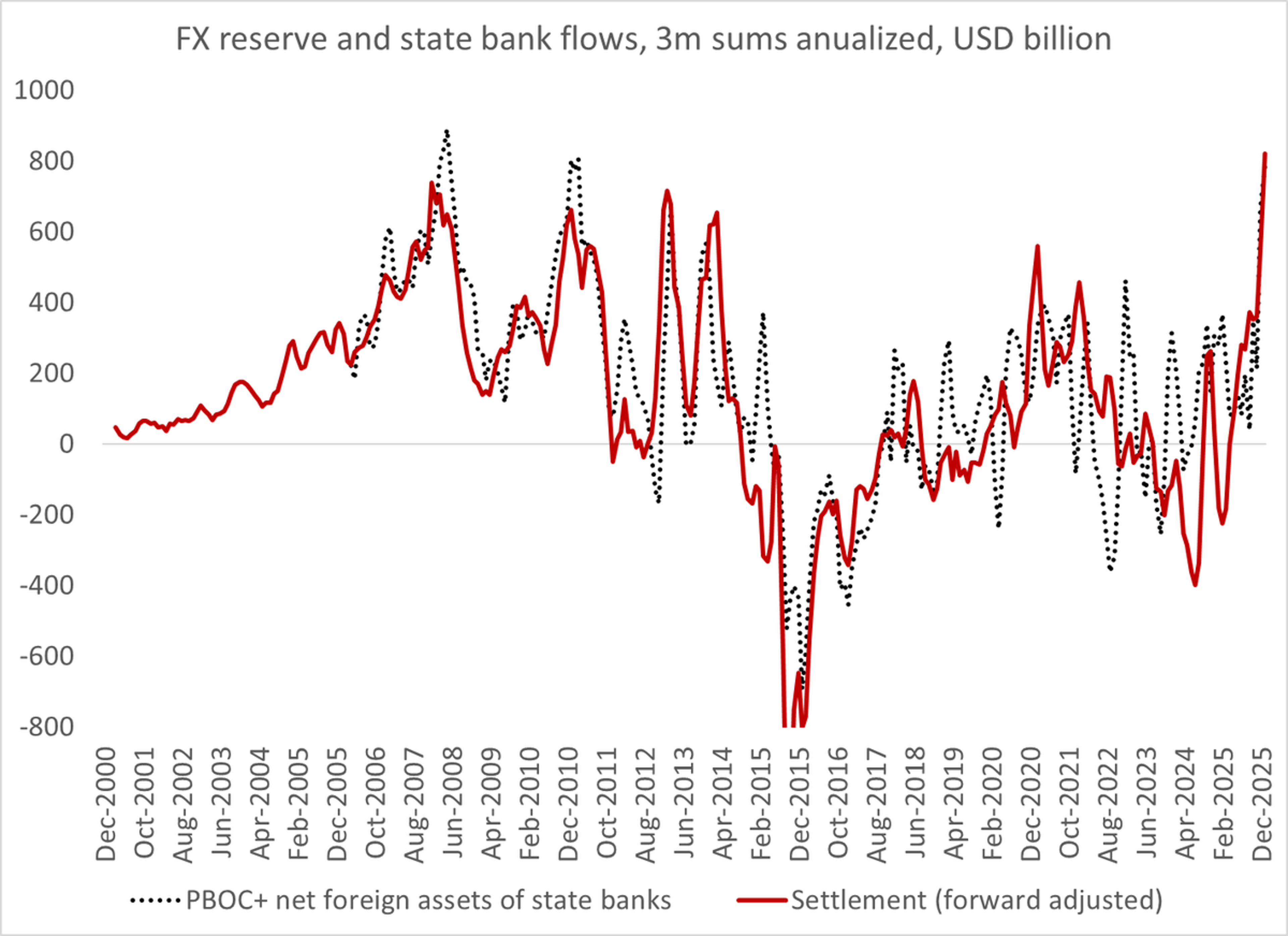

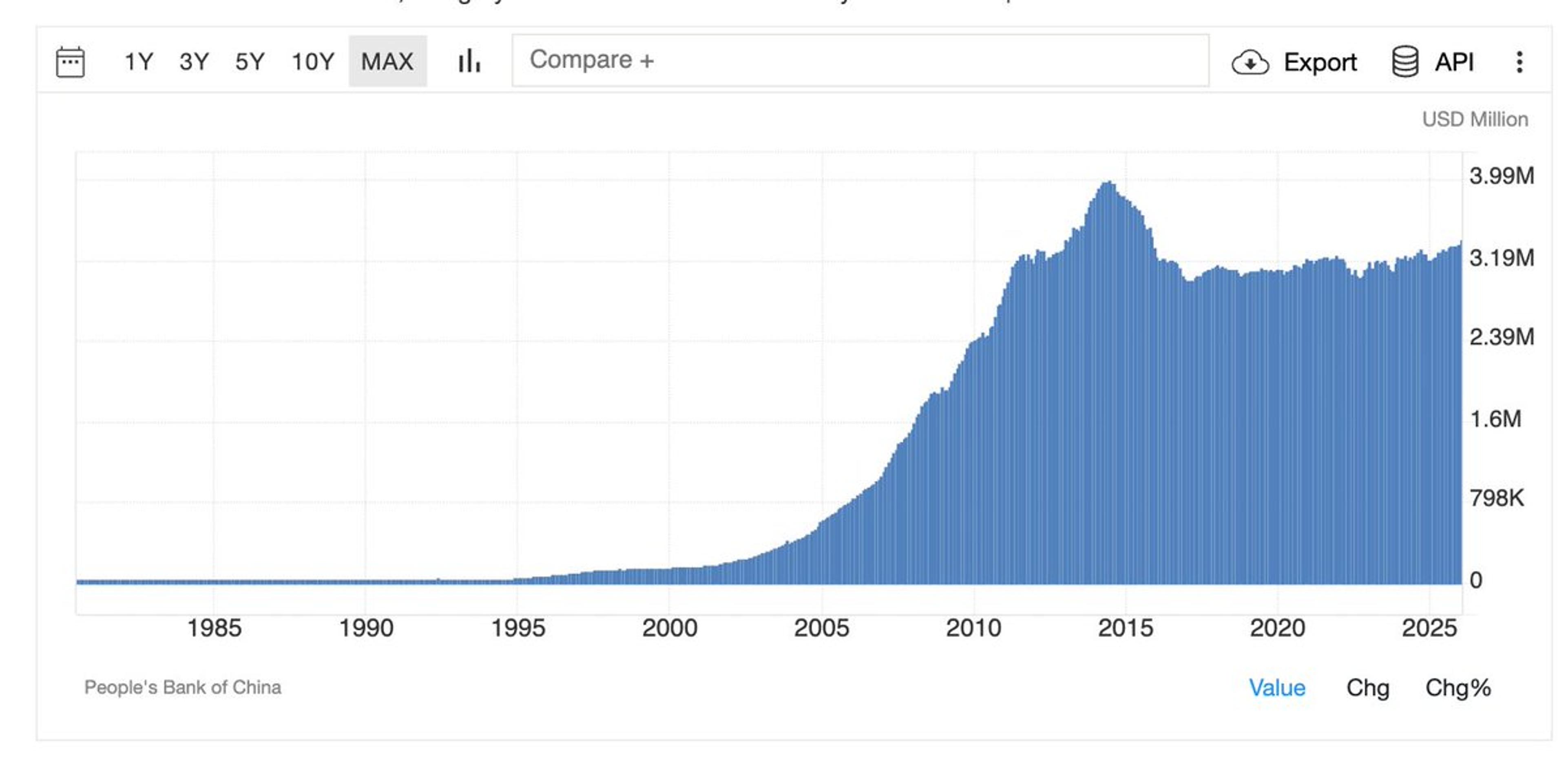

China's Hidden Bank Interventions Hit $800B Annual Record

The annualized measures of Chinese intervention over the last 3ms that capture backdoor intervention by the state banks are at all time highs in dollar terms -- over $200b a quarter/ over $800b annualized https://t.co/7vlh3tf4CX

By Brad Setser

Social•Feb 16, 2026

US Growth Decouples From Jobs, Entering Uncharted Territory

Via the Financial Times: My thoughts on why US "jobless growth" may have entered uncharted territory. The decoupling of US growth from employment looks more persistent—and consequential—than the three previous episodes we've seen over the last 40 years: https://www.ft.com/content/298a38bb-4cc1-44f3-bd62-6aff25d58b94 #economy #jobs #employment #unemployment #growth...

By Mohamed El‑Erian

Social•Feb 15, 2026

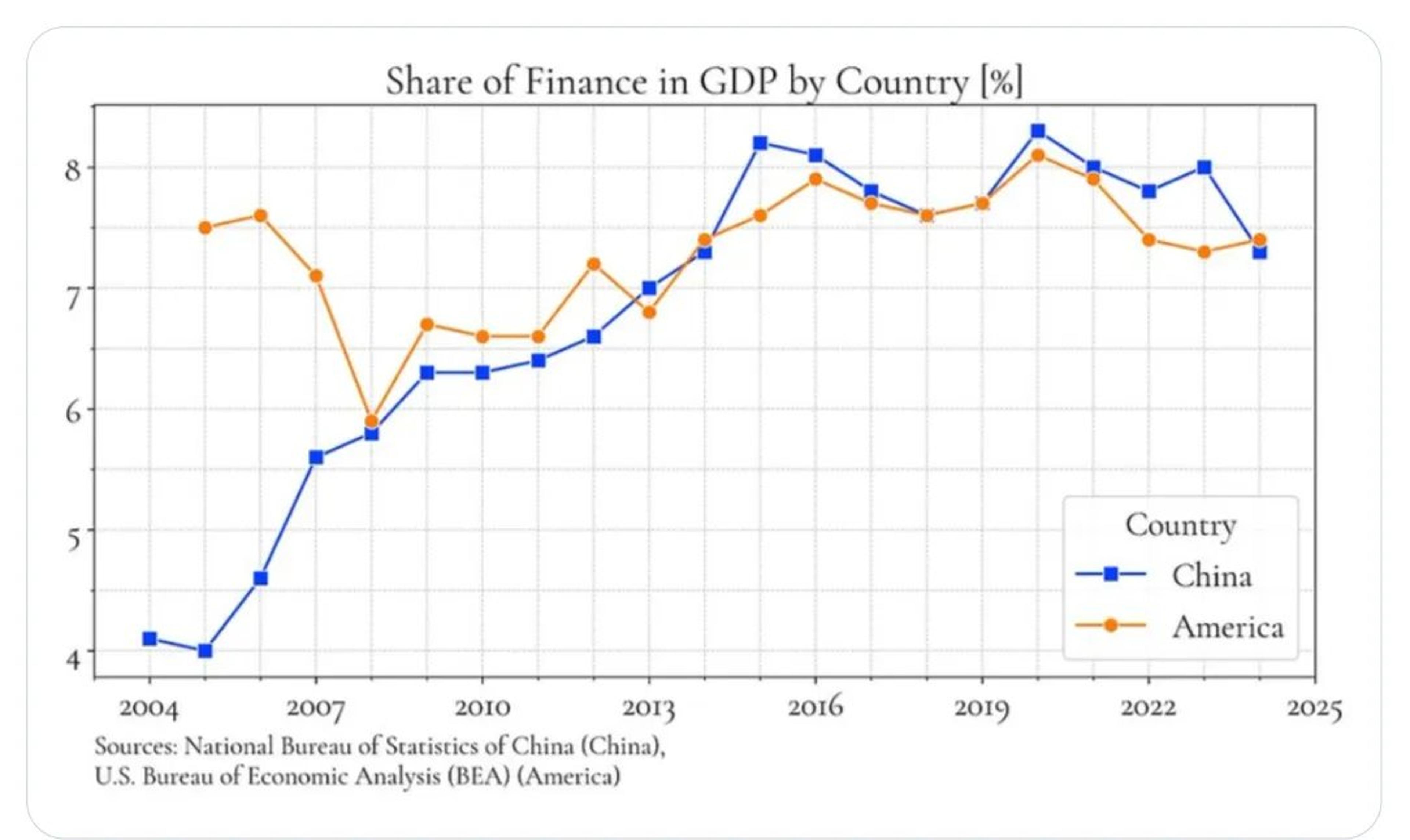

US‑China Gap Lies Beyond Financialization Share of GDP

Whatever the difference between the US and China may be and however you evaluate it, it isn’t in “financialization”, at least not as measured by the share of finance in GDP (h/t twitter account of devarbol for this graph). More...

By Adam Tooze

Social•Feb 15, 2026

TIC Data Misses China’s Treasury Holdings Abroad

My periodic reminder that the US TIC data doesn't measure China's holdings of US Treasuries. It only measures China's holdings of Treasuries in US custodians. The real question is how many Treasuries Chinese entities hold in non US...

By Brad Setser

Social•Feb 15, 2026

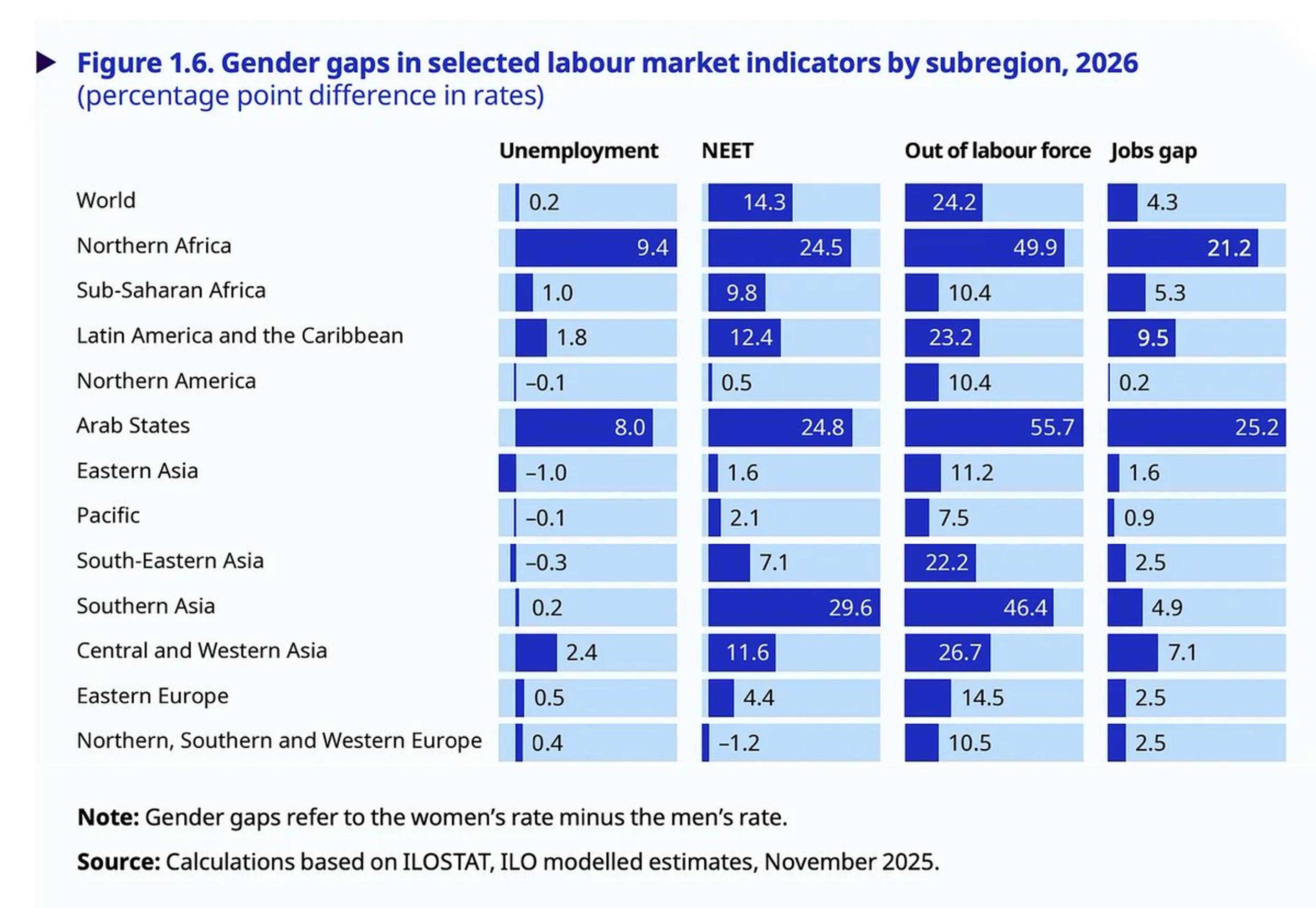

East Asia, Africa Match West; MENA, South Asia Lag

East Asia has labour-market gender gaps comparable to those in Europe and North America. Sub-Saharan Africa is also surprisingly similar (in the formal labour market). MENA and South Asia have massive gender segregation and LatAm and Carib are surprisingly in-between....

By Adam Tooze

Social•Feb 15, 2026

Stockpile Buffers Risk, Not Replaces Chinese Supply

A $12B rare earth stockpile is a step in the right direction, but buying from China on the open market isn’t independence; it’s a piggy bank with a very fragile supply chain. Until we build domestic processing, this is a...

By Peter Zeihan

Social•Feb 15, 2026

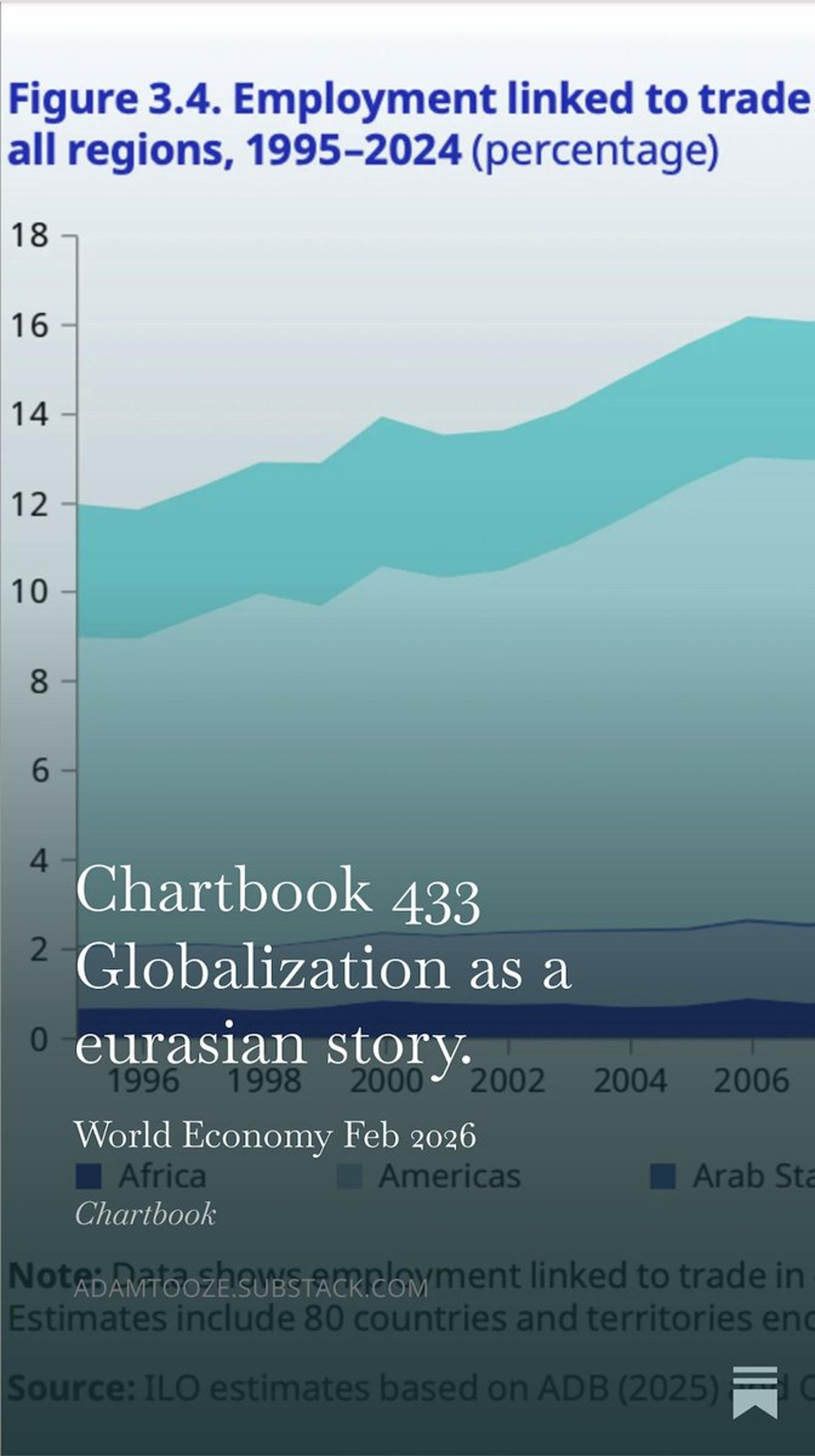

Eurasia Holds 81% of Trade‑Linked Jobs Globally

81 percent of employment worldwide that is linked to trade in goods and services is in Europe and Asia. Globalization is a eurasian story. Chartbook 433 just dropped. Check it out. https://t.co/jq1gYjLP4X https://t.co/I3iRrM8XEN

By Adam Tooze

Social•Feb 15, 2026

Consumption, Not Exports, Powers China's Growth

Why smart people say that exports “contribute” to China’s growth rather than “driving” it: almost all the time, growth in consumption is, in fact, a bigger contributor. More at today's Chartbook Top Links: https://t.co/NNNTMiyj6N

By Adam Tooze

Social•Feb 14, 2026

China's Foreign Exchange Reserves: Key Trends Unveiled

Deep dive into Chinese Foreign Exchange Reserves in today's version of the Chartbook Top Links. https://t.co/Yc09wNGpPK

By Adam Tooze

Social•Feb 14, 2026

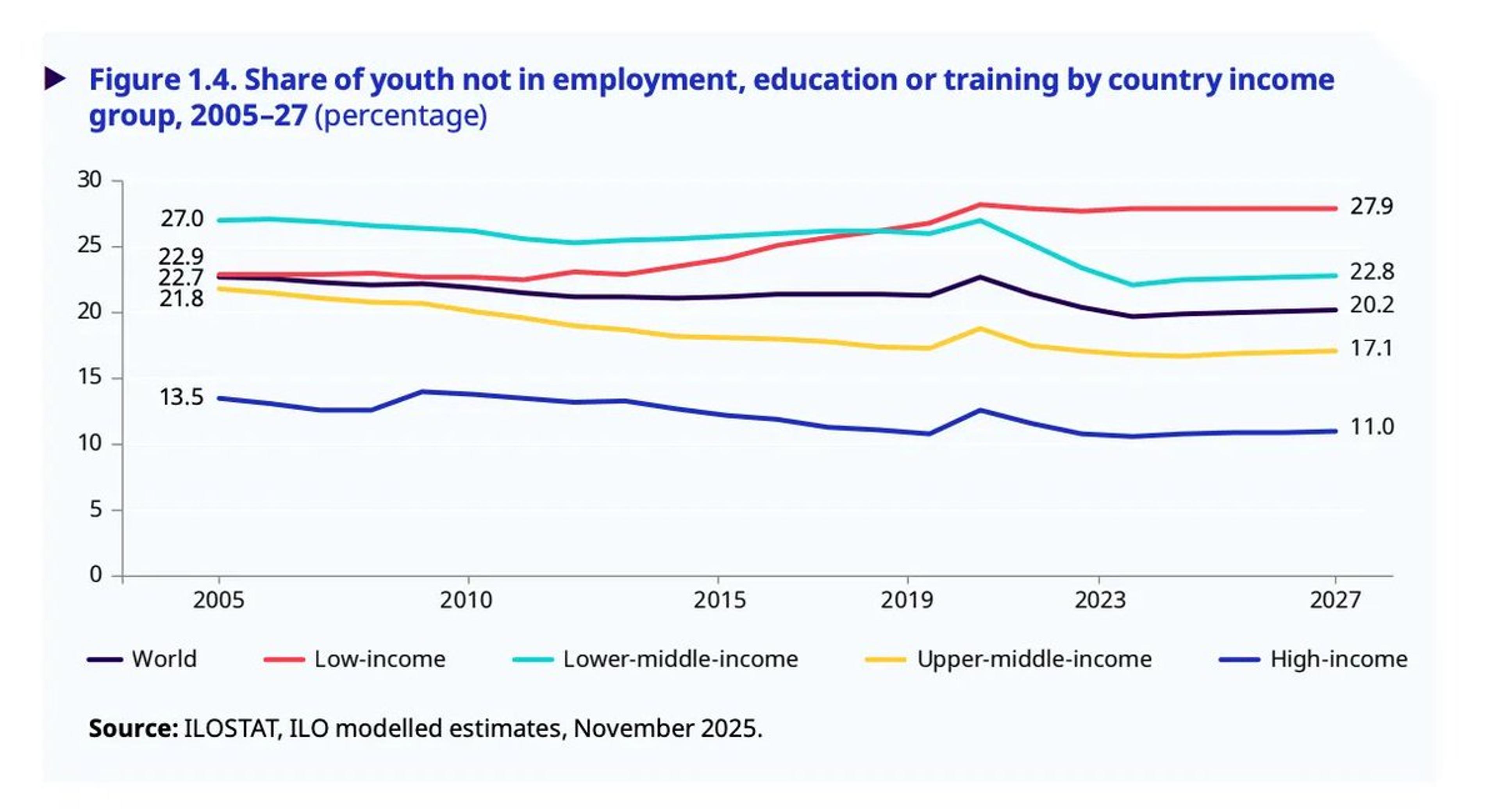

Poor Nations Double Youth Disengagement Compared to Rich Countries

How rich-country advantages compound. More than twice the share of young people in poor countries are not in employment, education or training. This and more insights in today's Chartbook Top Links. https://t.co/pokvStfn3w

By Adam Tooze

Social•Feb 14, 2026

Cognitive Warfare Already Undermining Western Alliances and Institutions

Cognitive warfare isn’t coming—it’s here. Some Western political leaders are being used to weaken alliances, disrupt decision-making, and fragment institutions. Swipe to see the key predictions, and visit davidmurrin.co.uk for the full analysis. #Geopolitics #NationalSecurity #Russia #China #Strategy

By David Murrin

Social•Feb 14, 2026

Iran's Inflation Hits 81.5%, World's Second Highest

#IranWatch🇮🇷: Today, I measure Iran’s inflation at a PUNISHING 81.5%/yr. That's the world's SECOND HIGHEST INFLATION RATE. I remain the only reliable source of inflationary measures in Iran. https://t.co/HcSee4i4O2

By Steve Hanke

Social•Feb 14, 2026

Buy Manappuram on Pullbacks Amid RBI

Macro: PE flows target Indian NBFCs. RBI cleared Bain's up to 41.7% in Manappuram; ₹43.85bn injected. Risk: regulatory scrutiny. Trading insight: buy Manappuram on pullbacks. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 14, 2026

EU Boosts Chinese Imports as Trump Tariffs Bite

During 2025, Chinese exports to the EU jumped by 6.3%. TRUMP'S TARIFFS = EU PIVOTS TOWARDS CHINA. https://t.co/tkz6F9xAsN

By Steve Hanke

Social•Feb 14, 2026

Nifty May Plunge to 19k Amid Global Macro Risks

The Nifty Can Crash to 19000 due to Global Macros - Prepare Now - Hindi ... https://t.co/gKdPPrx6C6 via @YouTube The video discussed the current market setup, IT sector view, which sectors are the weakest. Why we got here and where...

By Rohit Srivastava

Social•Feb 14, 2026

Modi Leveraged Trump Tariff Threat to Advance Free Trade

My take on PM Modi's clever move to reduce India's punishing tariffs and non-tariff barriers: "Modi used the tariff threat from Trump as cover to push for free trade between India and other countries." MODI = SMARTER THAN YOU THINK. https://t.co/aTUbO8em04

By Steve Hanke

Social•Feb 14, 2026

EU Trade Surplus Shrinks as Tariffs and China Pressure

1/5 Reuters: "The EU's trade surplus kept shrinking, data showed on Friday, as tariffs weighed on exports to the U.S. and rising Chinese imports crowded out domestic production, highlighting existential threats to the bloc's economic model." https://t.co/91sJO2nGjP

By Michael Pettis

Social•Feb 14, 2026

Provincial Revenues Forecast 2‑3% Growth, Lagging Economy

1/4 SCMP: "Major provinces are budgeting for 2 to 3 per cent growth this year in general public operating revenue, broadly in line with last year but below broader economic growth targets, Fitch Ratings said in a research note." https://t.co/HwyAPw042O

By Michael Pettis

Social•Feb 14, 2026

China Cracks Down on Hidden Corporate IOU Market

1/3 Very interesting Caixin article on attempts by Chinese regulators to get their arms around "the opaque market for corporate IOUs that has allowed big-name companies to defer payments to suppliers on a massive scale." https://t.co/FIJywKAtIX

By Michael Pettis

Social•Feb 14, 2026

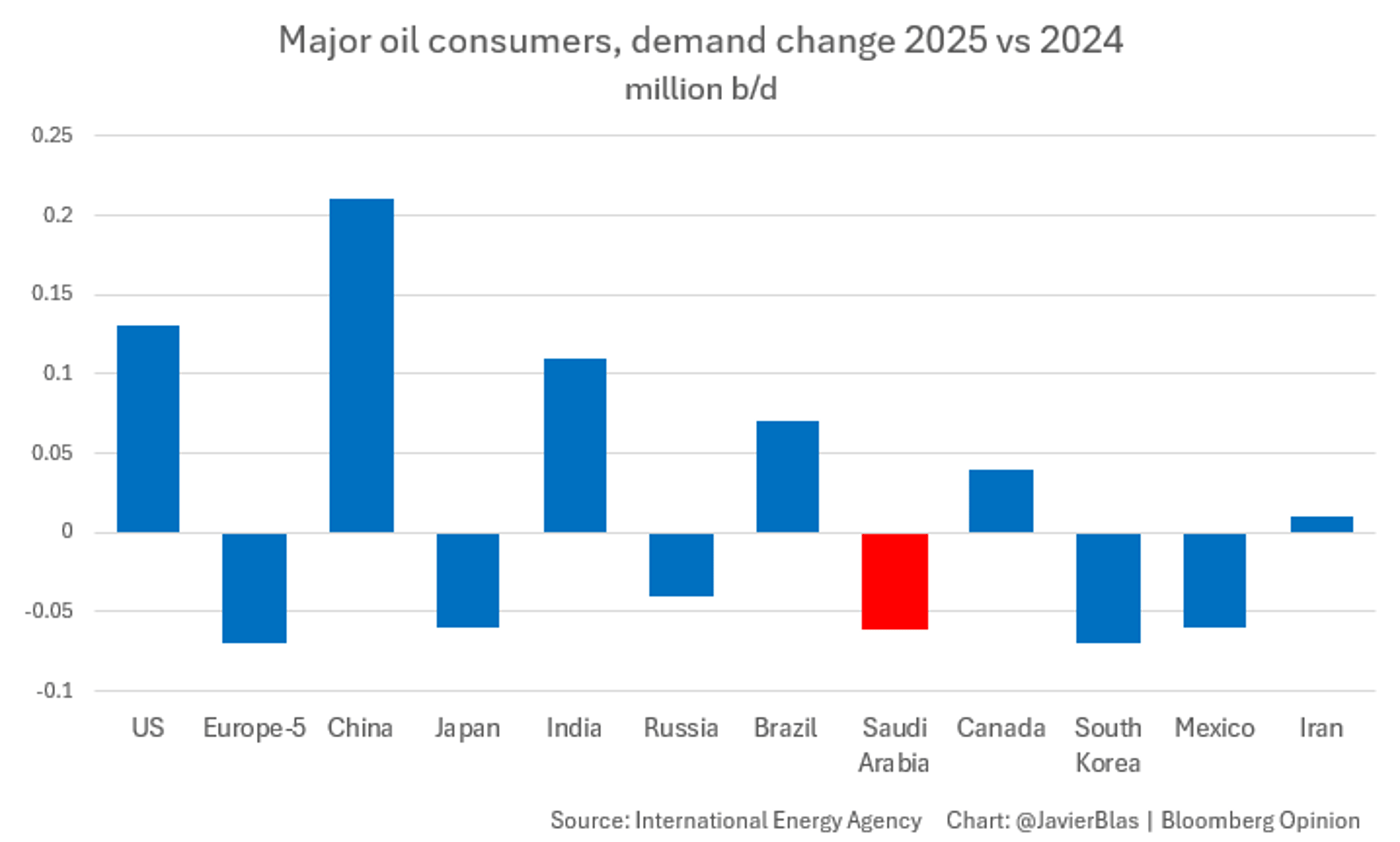

Saudi Arabia’s Oil Demand Plummets as Gas Powers Electricity

CHART OF THE DAY: Among the world's top oil consumers, a curious trend. The 2nd largest consumption drop last year ocurred in Saudi Arabia, where demand fell ~60,000 b/d (only South Korea saw a larger drop). The reason? Gas is...

By Javier Blas

Social•Feb 14, 2026

China's January Financing Jumps 2.4% Year‑over‑year, Beating Forecasts

1/5 According to Caixin, China’s aggregate financing grew slightly faster than expected in January, rising by RMB 7.22 trillion. This was 2.4% more than in January 2025 and 10.4% more than in January 2024. It is equal to 5.1% of annual...

By Michael Pettis

Social•Feb 14, 2026

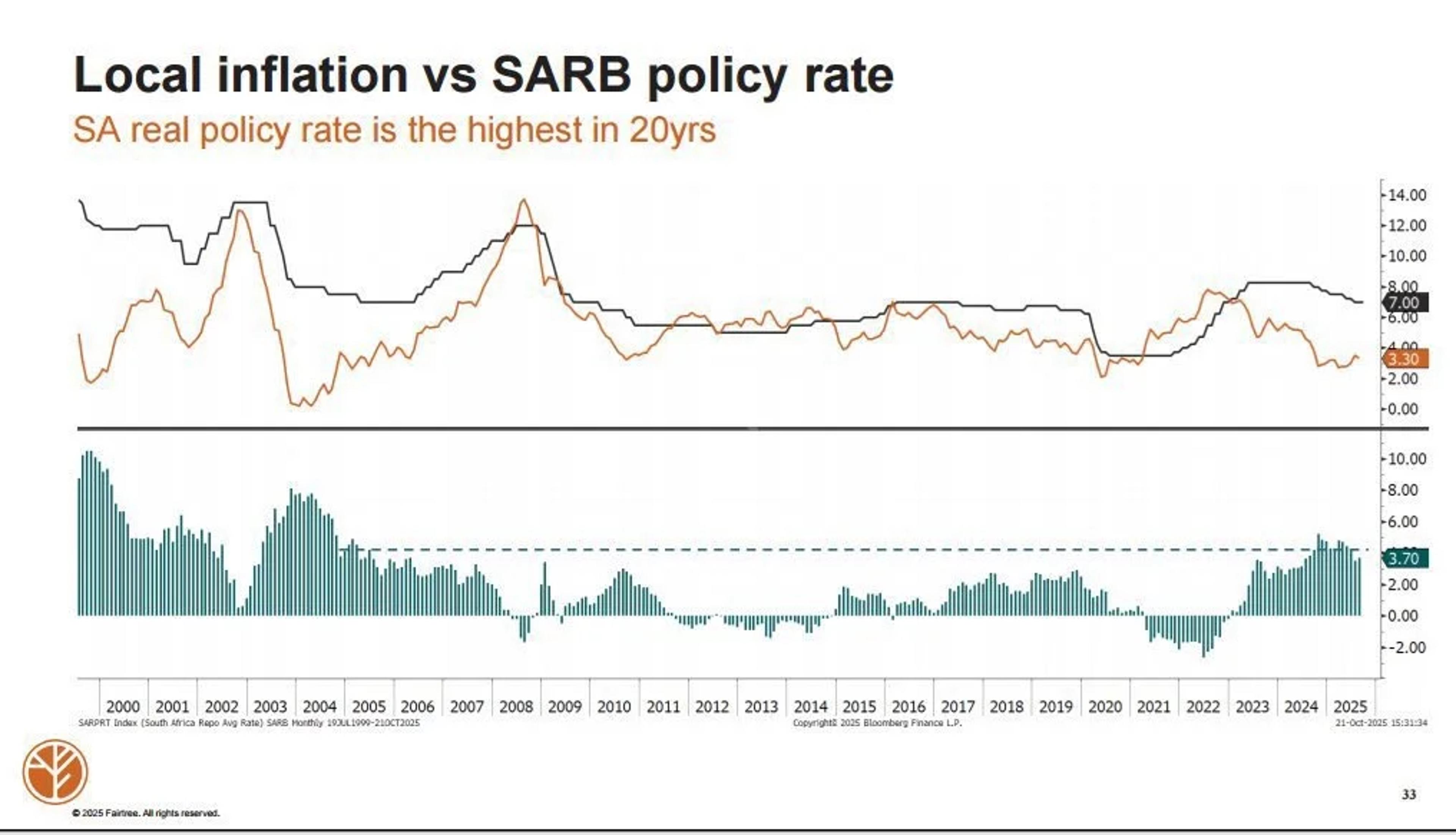

South Africa's Record Real Rates Prompt Slow, Steady Cuts

South African rates are restrictive. The real policy rate is the highest it’s been in 20 years, and they expect growth. They are suffocating the economy with high real rates. However, we can expect more rate cuts throughout the year,...

By Talk Cents

Social•Feb 14, 2026

China's Railway Investment Climbs 5.5% in January

Xinhua: "China's railway sector completed 46.3 billion yuan (about 6.67 billion U.S. dollars) in fixed-asset investment in January, up 5.5 percent year on year." https://t.co/g109GF2REm

By Michael Pettis

Social•Feb 14, 2026

Malaysia Beats Forecast, Yet MSMEs Face Headwinds

Malaysia’s Economic Outlook & Risks Full-year performance exceeds government’s upper ceiling based on 4Q 2025 data Outperformance —► Hawkish BNM bias. Chatter of tougher operating conditions on the ground, especially for micro, small and medium enterprises (MSMEs) including F&B sector are leading many...

By David Chuah

Social•Feb 14, 2026

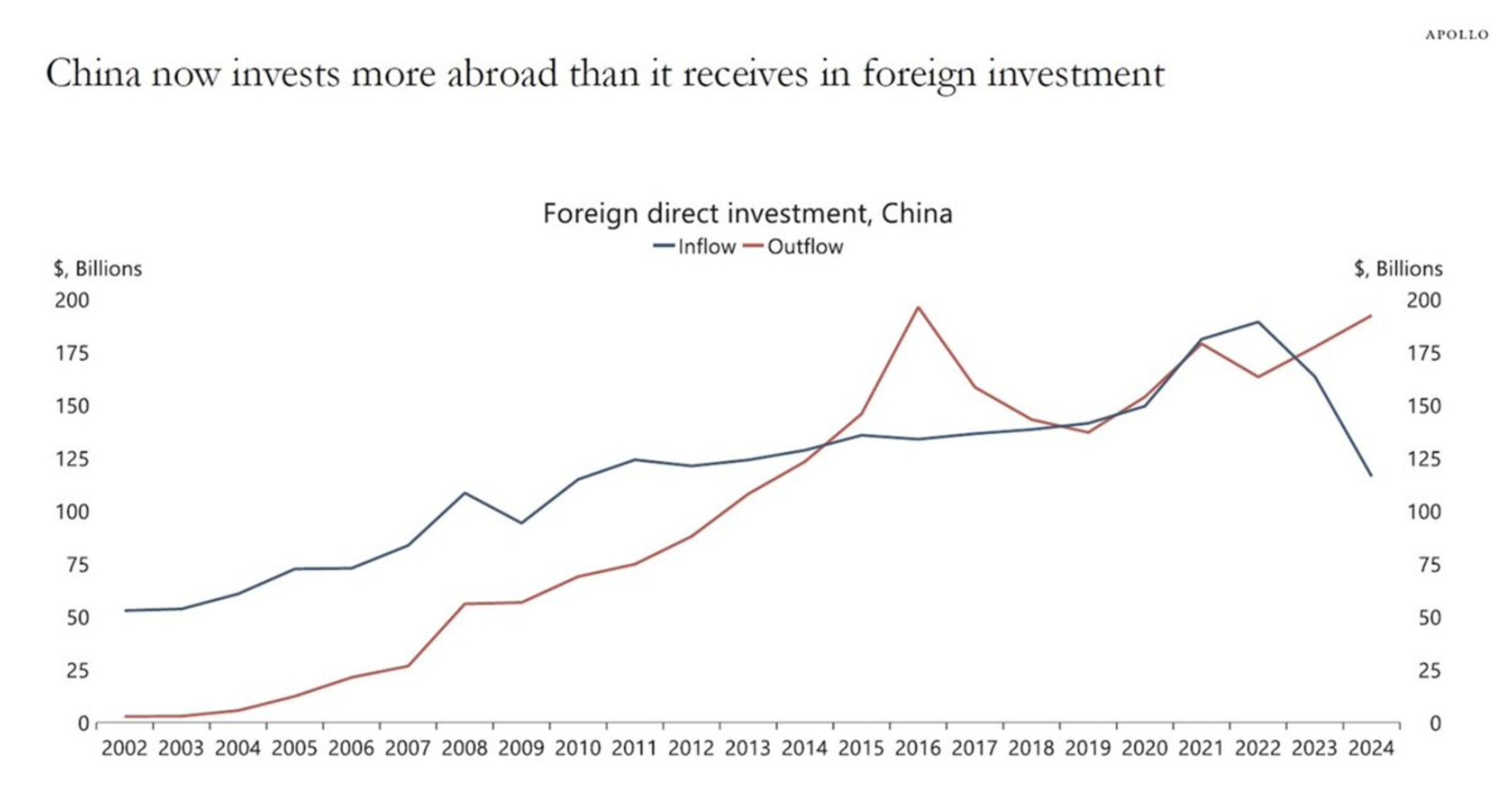

China’s Inbound FDI Collapses as Outbound Investment Soars

For years, the world invested in China. Since 2022, foreign direct investment inflows to China have PLUNGED, while China's foreign investment outflows have SURGED. https://t.co/TCWhEPF7bq

By Steve Hanke

Social•Feb 14, 2026

China EV Sales Dip, Exports Surge 70% Abroad

China EV Sales Drop for First Time Since February 2024—Chinese exports of EVs and hybrids rise 70% in 2025 as automakers shift their focus overseas @ivy_jiahuihuang https://t.co/PdiFmEGPXg https://t.co/PdiFmEGPXg

By Jonathan Cheng

Social•Feb 13, 2026

China’s $1.2 T Surplus Fuels Massive Market Interventions

One by product of China's exploding external surplus (goods surplus of $1.2 trillion, q4 current account surplus annualized is close to $1 trillion) is that it creates the raw material for some massive intervention numbers h/t @Mike_Weilandt for the chart https://t.co/PMvhatfgWh

By Brad Setser

Social•Feb 13, 2026

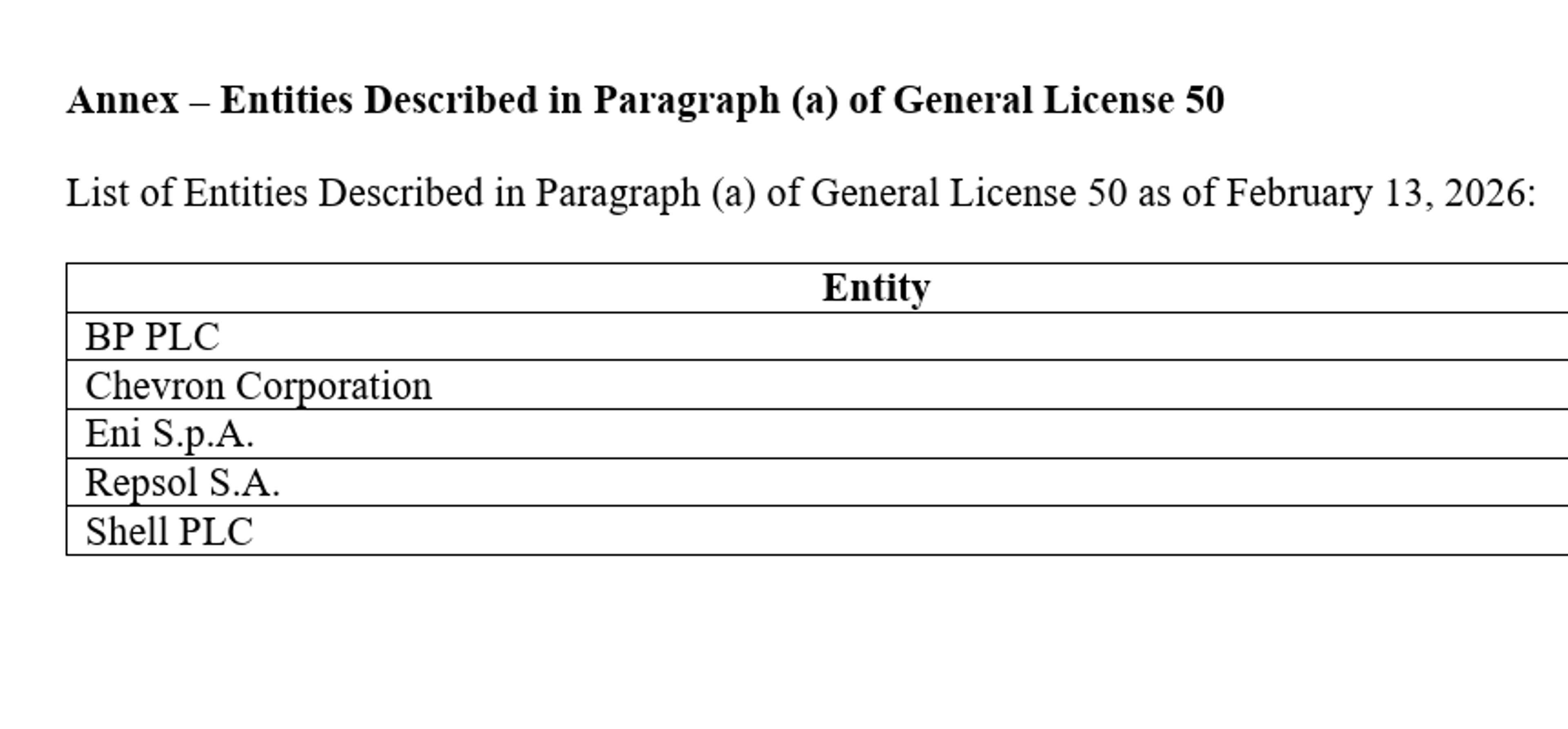

Notable Absentees Among Firms Granted Venezuelan Upstream Access

Can't help but notice who ISN'T on this list of companies who just gained access to invest and operate in Venezuelan upstream. https://t.co/qrLcy4bd48

By Rory Johnston